Exclusive: These airlines are most at risk of COVID-19-related default

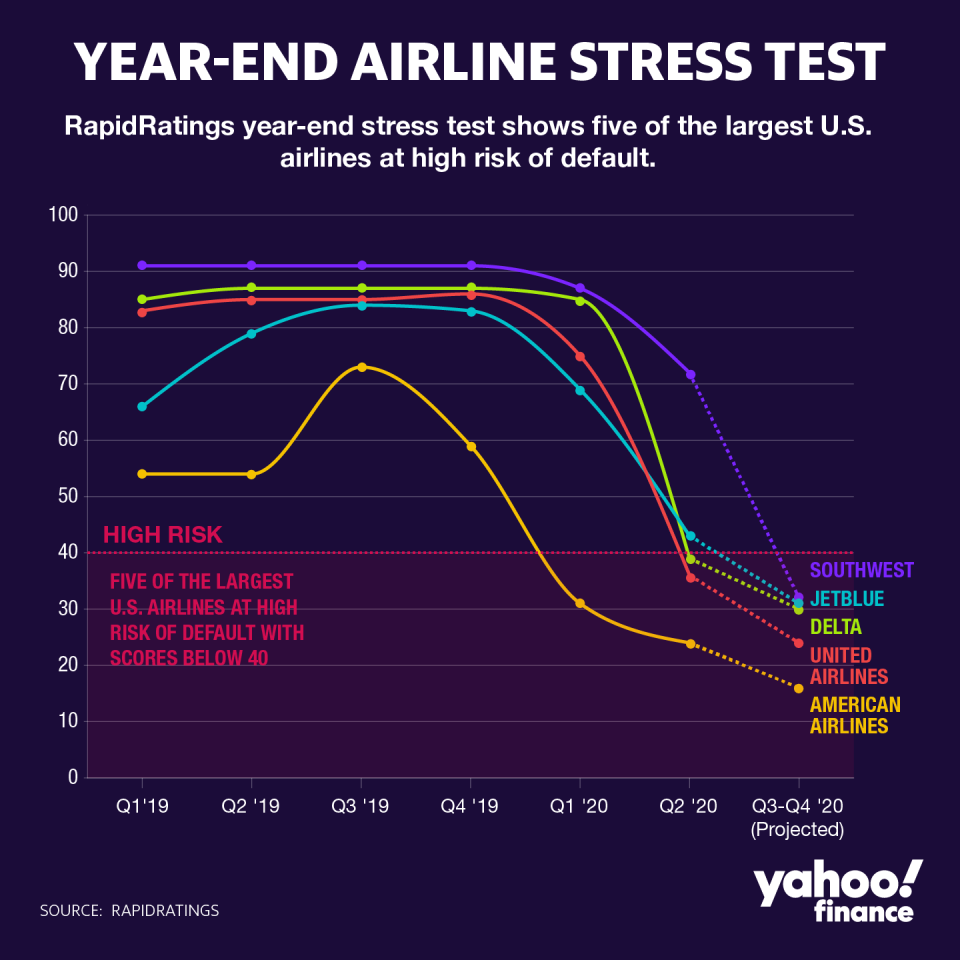

The latest stress test on U.S. airlines shows five of the largest carriers — American Airlines (AAL), United Airlines (UAL) , Delta Air Lines (DAL), Southwest (LUV) and JetBlue (JBLU) — will be at high risk of default by the end of the year as the coronavirus pandemic decimates their industry.

“The airlines can’t recover independently. The future of the airlines is linked to factors out of their control,” RapidRatings CEO James Gellert told Yahoo Finance’s On The Move.

RapidRatings conducts risk assessments and stress tests for major global firms like McDonald’s (MCD) and Unilever (UL), to determine if a company can withstand financial shocks like the COVID-19 crisis.

A key score is the Financial Health Rating, or FHR, which measures a company’s likelihood of default using factors like liquidity and earnings performance to determine a firm’s sustainability.

Gellert says, “Over the last 20 years 90% of companies that have failed have been rated 40 and below” and the results of RapidRatings’ most recent year-end stress test sound an ominous warning for the airlines.

“All the major airlines in the U.S. are falling well into that 40 and below area, with American falling the most to 16,” Gellert warned.

“So it doesn't mean a company will absolutely fail,” Gellert said. “There are a lot of things that go into the decision to file for bankruptcy or being forced into bankruptcy. But companies in this sector in this risk zone are very high risk and all institutional investors and other companies that work with them buying and selling to them need to be paying really close attention.”

Airlines race to recover

Delta and United reported third quarter earnings this week and CEOs from both carriers said the spring of 2021 will be a crucial turning point.

“Even though the negative impact of COVID-19 will persist in the near term, we are now focused on positioning the airline for a strong recovery that will allow United to bring our furloughed employees back to work and emerge as the global leader in aviation,” United CEO Scott Kirby told investors.

Delta CEO Ed Bastian says his airline is on the road to recovery. Bastian predicts Delta will be cash burn neutral by next spring. “We have been encouraged as more customers travel and we are seeing a path of progressive improvement in our revenues, financial results and daily cash burn,” which fell to $24 million the the last quarter.

Gellert says deep liquidity will be the key to each airline’s survival. “Liquidity buys time, time is essential and if you run out of time you don’t make it.”

During the past six months all of the airlines leveraged assets like airplanes and their lucrative frequent flyer programs to bolster liquidity. They each borrowed billions of dollars and added billions more to their debt.

Delta reported it has $21.6 billion in liquidity and United said it has $19.4 billion. A recent note from Raymond James analyst Savanthi Syth said American Airlines has $12.7 billion in liquidity and Southwest has $15.4 billion. American and Southwest report their earnings October 22 and are expected to update their financials.

But Gellert says even with billions in liquidity, the airlines need passenger traffic to come back or they face a grim future. “It is a waiting game as to whether the recovery in traffic comes before liquidity runs out,” he said.

Adam Shapiro is co-anchor of Yahoo Finance’s On the Move.

Delta posts staggering Q3 loss as coronavirus hits demand, layoffs mount

Mass layoffs and smaller airlines loom after COVID-19, even with more aid

Tens of thousands to lose jobs without airline stimulus from Congress

International travel could take until 2024 to recover from COVID-19

Southwest CEO: Bookings 'have recently stalled' because of coronavirus spike

'The corporate tax rate — I’m actually OK at 28%': Gary Cohn

J&J exec: Our coronavirus vaccine is aiming for a 70% success rate in trials

Risk firm: 'American is most at risk' of coronavirus default among US airlines

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, LinkedIn, YouTube, and reddit