This big contradiction has everyone in the stock market at odds

The stock market (^GSPC) continues to make new all-time highs. The popular explanation behind this move is President Donald Trump’s promise of tax cuts and deregulation, which would more than offset the negatives coming from protectionist trade rhetoric.

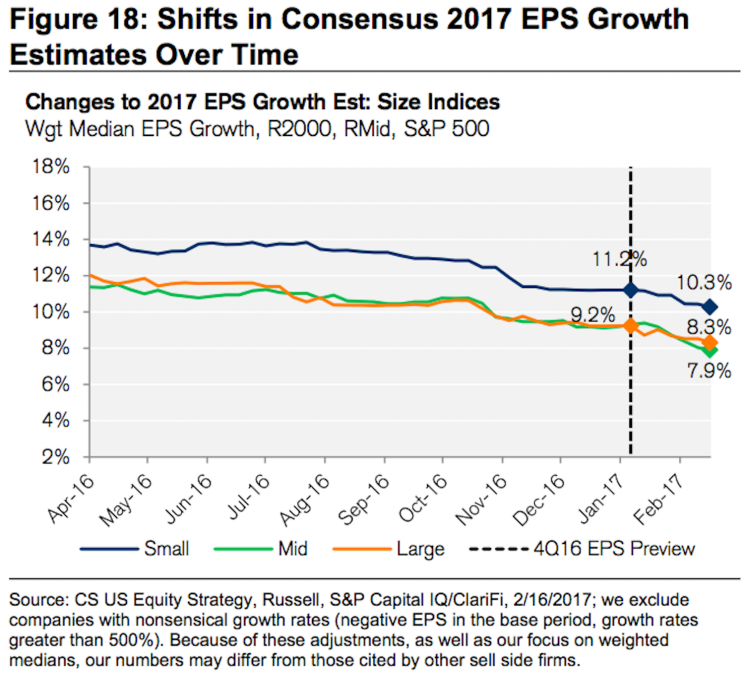

However, Wall Street’s stock market analysts haven’t yet revised up their 2017 earnings forecasts for this bullish policy outlook. In fact, analysts have actually been reducing their forecasts for earnings since the election of Trump.

This contradiction between rising stock prices fueled by Trump optimism and deteriorating expectations for earnings exacerbated by Trump skepticism have pushed stock market valuations to frightening levels.

So, what’s happening?

Everyone except the stock market analysts are bullish

Goldman Sachs analysts recently reviewed the first quarter earnings announcements and analyst calls of S&P 500 companies, and they identified four major trends in sentiment: 1) “Managements are optimistic about potential corporate tax reform, but are concerned about the controversial border-adjusted tax;” 2) “Hopes for widespread deregulation and improved regulatory clarity are increasing confidence among some management teams;” 3) “Managers of industrial firms are enthusiastic about potential infrastructure spending and a possible end to the defense sequester;” and 4) “Management views are mixed on whether President Trump’s trade proposals will be constructive or will lead to damaging retaliation from US trade partners.”

Those first three positive trends appear to be overwhelming the one negative trend. And it’s reflected by an elevated level of optimism among managements, literally.

“[T]he word ‘optimistic’ has been used on a record 51% of the calls this quarter, the highest in our data history (since 2003),” Bank of America Merrill Lynch’s Savita Subramanian said.

All of this optimism about the future has driven stock prices higher, which would make sense as stocks are a discounting mechanism.

So, why are analysts holding back?

The fact is none of Trump’s business-friendly policies have actually been signed into law. Furthermore, anything that does get enacted is unlikely to have a material impact for a little while.

“The new US Administration and Republican majority in Congress have very audacious plans on reforming US taxation, but the likelihood that much of this will pass by midyear seems low to us,” JPMorgan’s Jan Loeys said on Friday. “Deregulation similarly will take quite some time before it has a real impact. Hence, while creating upside, we do not think these will show up soon in the data or earnings.”

“We are approaching the point of maximum optimism regarding policy initiatives,” Goldman Sachs’ David Kostin said. “Our US Economics team expects a tax reform package may not pass until late 2017 or early 2018. Even so, the tailwind to corporate earnings from tax reform will be constrained by the unwillingness of certain Congressional Republicans to significantly expand the federal budget deficit.”

It’s also worth noting that analysts have a long history of initially being too bullish about earnings growth forecasts.

“Positive revisions to aggregate S&P 500 EPS estimates are rare – during the last 33 years, consensus EPS estimates have been revised upward from their starting point just six times,” Kostin observed.

And so, history repeats as analysts cut their forecasts for earnings across the board.

“It is not unusual for estimates to move lower for a given year during the first calendar quarter,” Credit Suisse’s Lori Calvasina said. “But if this trend persists, it is likely to present a challenge for equity markets given extremely high valuations and expectations for upward revisions this year.”

Indeed, valuation as measured by the forward price/earnings ratio is already so high that you could say “at this stage, chasing the rally is akin to picking up nickels in front of a steam roller.”

“The current forward 12-month P/E ratio of 17.6 is now above the four most recent historical averages: 5-year (15.2), 10-year (14.4), 15-year (15.2), and 20-year (17.2),” FactSet’s John Butters observed on Friday. “In fact, this week marked the first time the forward 12-month P/E has been equal to (or above) 17.6 since June 23, 2004. On that date, the closing price of the S&P 500 was 1144.06 and the forward 12-month EPS estimate was $65.14.”

But there is a camp of analysts out there who aren’t reading too much into these elevated valuations because they are confident that Trump’s policy promises will eventually be folded into earnings expectations.

Wall Street’s optimists look ahead

“Positive caveat: the expected earnings trajectory highlighted above is exclusive of fiscal stimulus via some combination of tax cuts, regulatory reform and infrastructure spending,” Schwab’s Liz Ann Sonders said on Thursday. “Anything on those fronts which get implemented this year would likely lead analysts to ratchet up their earnings expectations for 2017.”

It certainly helps when the the big risks out there are well-known. When risks are overemphasized, the bulls argue that it’s time to be bullish.

“We remain constructive on global equities and do not expect any meaningful correction,” JPMorgan’s Loeys said. “US politics and the upcoming French presidential election remain the major risks. But we don’t think markets have priced in much upside on deregulation and tax cuts, with consensus earnings forecasts in the US having dropped post Nov 8 instead of being upgraded, which suggests a potential reprice higher.”

Sure, doubt abounds in this environment of increased uncertainty. However, you could characterize the markets this way during many points in history, which all proved to be long-term buying opportunities.

“[T]here is a very good chance that the year of surprises that 2016 represented will likely roll over into 2017,” BMO Capital’s Brian Belski said in a Feb. 7 note to clients. “After all, investors have been climbing the wall of worry for eight years and counting. Doubt, fear, and rushes to judgement have been trying to diagnose the end of the bull market since it began. Sound familiar to something else? In other words, chances are the same type of wall of worry applies to a Trump administration as well, perhaps figuratively and literally.”

–

Sam Ro is managing editor at Yahoo Finance.

Read more: