A three-phase recession will be 'unlike anything we have seen in modern history': Morning Brief

Thursday, May 21, 2020

Get the Morning Brief sent directly to your inbox every Monday to Friday by 6:30 a.m. ET.

It’s a long road ahead for the U.S. economy

As of Wednesday, all 50 states had begun to loosen coronavirus-related restrictions in some form or fashion. But the road ahead for the U.S. economy coming out of this pandemic induced recession is a long one.

Read more: What is a recession? Here are the basics

And according to economists at Bank of America Global Research, things will be even more challenging than initially thought.

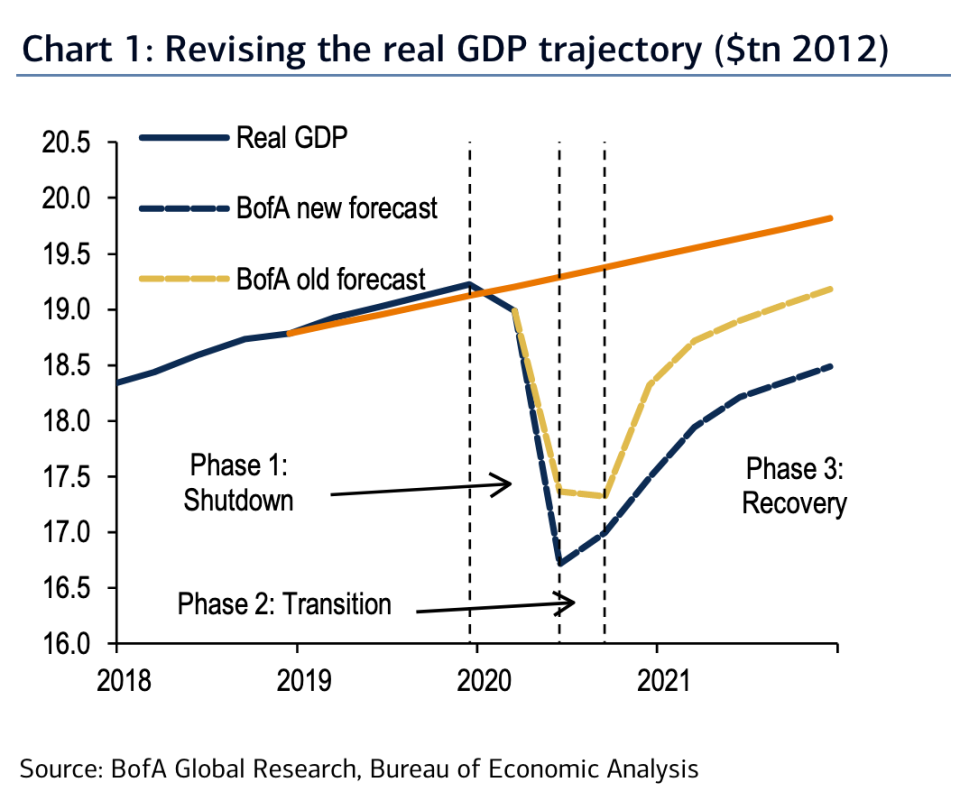

“The damage to the economy from this historic shock has been hard to grasp,” the firm wrote in a note to clients published Wednesday. “Indeed, we now believe we have understated the extent of the decline and are revising down the path of GDP.”

The firm now sees the recession playing out in three phases: lockdown, transition, and recovery.

First, the good news — during the transition phase, the bounce we’re going to see in economic activity after a springtime collapse is now expected to be stronger than previously forecast. We are currently in this phase.

“An earlier reopening means an earlier bounce in activity,” BofA said. “We are revising up 3Q GDP growth to +7% qoq saar vs. -1% qoq saar previously. The gain is entirely driven by a snap higher in consumer spending; we still expect a meaningful decline in investment.”

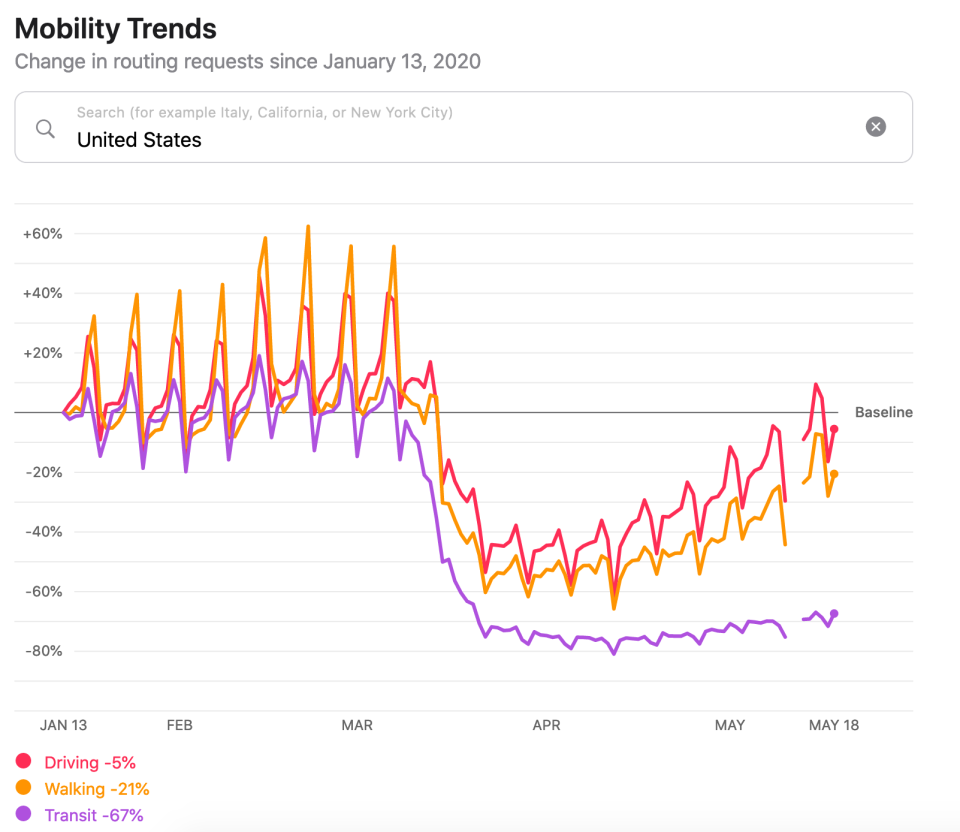

And data such as Apple’s mobility trends report which shows driving across the U.S. just a few percentage points below baseline suggests consumers are ready to leave the house and more businesses are allowed to re-open.

Earnings reports from companies including Target (TGT) and Walmart (WMT) this week have indicated that stimulus provided to consumers through the CARES Act is making its way to some retailers and helping steady the consumer.

But in Bank of America’s view, the impact from the lockdown phase that hit the economy hardest in March and April and the return to pre-COVID levels of GDP will be larger drags on the economy than previously expected.

In the second quarter, BofA now expects GDP to decline at an annualized rate of 40%, up from its prior estimate of a 30% annualized drop in activity. The firm now expects a peak-to-trough GDP drop of 13% — up from its prior forecast for a 10% drop in GDP — which far exceeds the 4% decline seen at the nadir of the financial crisis.

Driving this sharper-than-forecast initial decline is a massive retrenchment in consumer spending and investment, with BofA calling for a 46% annualized drop in consumption and a 35% annualized drop in investment during the second quarter. Of second quarter GDP data, BofA says plainly: “It will be ugly.”

Looking out over the next 18 months, BofA sees a soft labor market, disinflation, and a lack of investment conspiring to keep growth below pre-COVID levels into 2022.

“An earlier reopening has prompted health experts to increase estimates for the number of COVID cases, which will slow the recovery,” the firm writes. “We have also become increasingly concerned about solvency issues and a sticky-high unemployment rate. We now think it will take until the end of 2022, or later, to return to the pre-COVID level of GDP.”

As we noted on Wednesday, investors right now are more focused on potential treatments for the virus than the more well-known economic fallout. And indeed, almost no one is betting on a V-shaped recovery.

So while this work suggests the summer months and the initial rebound following the spring’s economic catastrophe could look encouraging, all signs point to a long, slow, and painful economic road ahead in America.

By Myles Udland, reporter and co-anchor of The Final Round. Follow him at @MylesUdland

What to watch today

Economy

8:30 a.m. ET: Philadelphia Fed Business Outlook, May (-41.0% expected, -56.6 in April)

8:30 a.m. ET: Initial Jobless Claims, week ending May 16 (2.4 million expected, 2.98 million prior); Continuing Claims, week ending May 9 (22.83 million prior)

9:45 a.m. ET: Bloomberg Economic Expectations, May (29.0 in April)

9:45 a.m. ET: Bloomberg Consumer Comfort, week ending May 17 (35.8 prior)

9:45 a.m. ET: Markit US Manufacturing PMI, May preliminary (38.0 expected, 36.1 prior)

9:45 a.m. ET: Markit US Services PMI, May preliminary (32.0 expected, 26.7 prior)

9:45 a.m. ET: Markit US Composite PMI, May preliminary (27.0 prior)

10 a.m. ET: Leading Index, April (-5.7% expected, -6.7% in March)

10 a.m. ET: Existing Home Sales, April (4.30 million expected, 5.27 million in March); Existing Home Sales month-on-month, April (-18.4% expected, -8.5% in March)

Earnings

Pre-market

6:30 a.m. ET: Hormel (HRL) is expected to report earnings of 44 per share on $2.38 billion in revenue

6:45 a.m. ET: BJ’s Wholesale (BJ) is expected to report earnings of 35 cents per share on $3.25 billion in revenue

7 a.m. ET: Best Buy (BBY) is expected to report earnings of 41 cents per share on $8.34 billion in revenue

8 a.m. ET: TJX Companies (TJX) is expected to report a loss of 19 cents per share on $5.78 billion in revenue

Post-market

4:05 p.m. ET: e.l.f. Beauty (ELF) is expected to report a loss of 1 cent per share on $66.81 million in revenue

4:20 p.m. ET: NVIDIA (NVDA) is expected to report earnings of $1.68 per share on $2.99 billion in revenue

4 p.m. ET: Ross Stores (ROST) is expected to report a loss of 1 cent per share on $2.45 billion in revenue

Top News

AstraZeneca to supply potential COVID-19 vaccine in September [Yahoo Finance UK]

UK economy keeps shrinking fast as lockdown hammers firms [Yahoo Finance UK]

Senate moves to delist Chinese companies from US stock exchanges [Yahoo Finance]

Ford shuts two U.S. assembly plants due to COVID-19 infections [Reuters]

YAHOO FINANCE HIGHLIGHTS

How Biden wallops Trump

Facebook and Amazon's new rivalry is heating up

Probability of US restaurants defaulting soars amid COVID-19 pandemic: Report

—

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.

Find live stock market quotes and the latest business and finance news

For tutorials and information on investing and trading stocks, check out Cashay