Three Solid German Dividend Stocks With Yields Starting At 3.7%

As global markets respond to shifting economic indicators, Germany's DAX index has shown resilience, gaining 1.48% recently, buoyed by favorable reactions to international inflation trends. In this context, identifying robust dividend stocks becomes crucial for investors seeking steady returns in a landscape marked by fluctuating interest rates and economic policies.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Allianz (XTRA:ALV) | 5.24% | ★★★★★★ |

OVB Holding (XTRA:O4B) | 4.69% | ★★★★★☆ |

INDUS Holding (XTRA:INH) | 5.08% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 8.34% | ★★★★★☆ |

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 6.99% | ★★★★★☆ |

Südzucker (XTRA:SZU) | 6.83% | ★★★★★☆ |

MLP (XTRA:MLP) | 5.36% | ★★★★★☆ |

Deutsche Telekom (XTRA:DTE) | 3.23% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.24% | ★★★★★☆ |

FRoSTA (DB:NLM) | 3.10% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top German Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

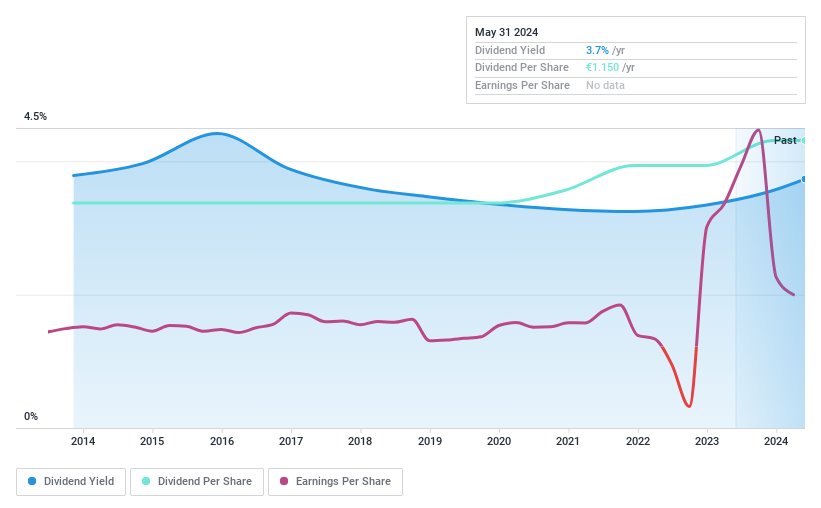

MVV Energie

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MVV Energie AG operates primarily in Germany, offering a range of services including electricity, heat, gas, water, and waste treatment and disposal, with a market capitalization of approximately €2.02 billion.

Operations: MVV Energie AG generates revenue through its New Energies segment at €959.74 million, Customer Solutions at €7.54 billion, and Generation and Infrastructure at €1.75 billion.

Dividend Yield: 3.8%

MVV Energie's recent earnings show a downturn, with sales dropping to €1.996 billion and net income falling to €69.37 million in Q2 2024, significantly lower than the previous year. Despite this, the company has maintained stable dividends over the past decade, though current dividend payments are not well supported by free cash flow or earnings, indicating potential sustainability issues. Trading slightly below fair value and with a modest dividend yield of 3.76%, its appeal to dividend investors is limited by these financial challenges and a low profit margin of 3.8%.

Click to explore a detailed breakdown of our findings in MVV Energie's dividend report.

Our valuation report here indicates MVV Energie may be undervalued.

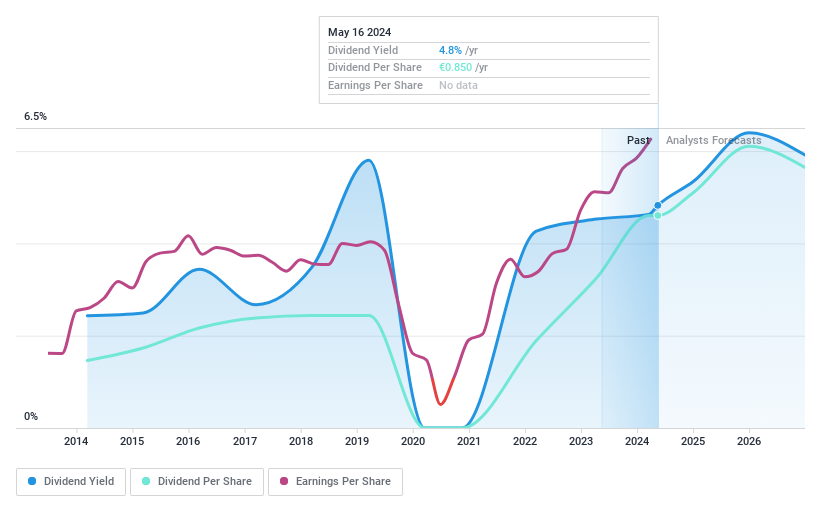

SAF-Holland

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SAF-Holland SE is a company that manufactures and supplies chassis-related assemblies and components for trailers, trucks, semi-trailers, and buses, with a market capitalization of approximately €0.88 billion.

Operations: SAF-Holland SE generates its revenue primarily from three geographical segments: €951.75 million from Europe, the Middle East, and Africa (EMEA), €898.79 million from the Americas, and €280.64 million from Asia/Pacific including China and India.

Dividend Yield: 4.4%

SAF-Holland SE demonstrated a robust first quarter in 2024, with sales increasing to €505.43 million and net income rising to €26.23 million. Despite a historical volatility in dividend payments, recent dividends are well-supported by both earnings and cash flows, with payout ratios of 44.6% and 31.6% respectively. However, its dividend yield of 4.36% remains slightly below the top quartile for German dividend stocks, indicating potential room for improvement in shareholder returns.

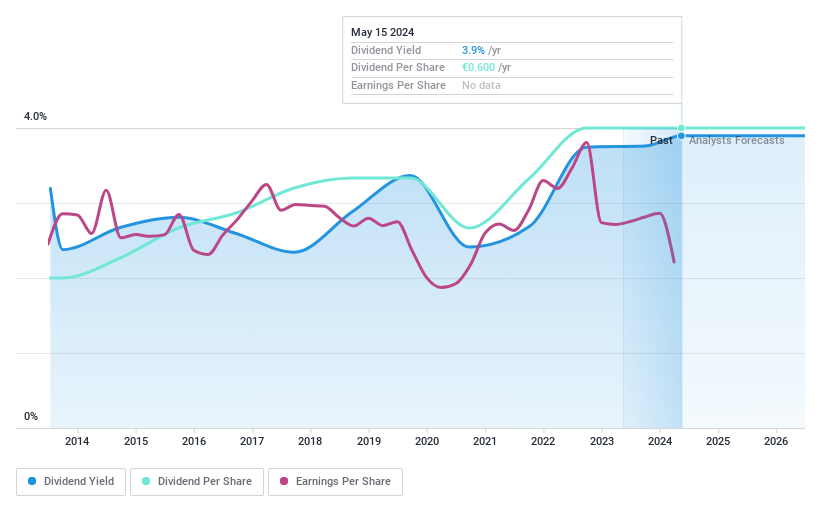

Schloss Wachenheim

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Schloss Wachenheim AG is a company that produces and distributes sparkling and semi-sparkling wines across Europe and internationally, with a market capitalization of approximately €121.97 million.

Operations: Schloss Wachenheim AG generates €441.16 million in revenue from its alcoholic beverages segment.

Dividend Yield: 3.9%

Schloss Wachenheim AG's recent financial performance shows mixed results, with a notable increase in sales to €337.91 million over nine months but a decline in net income to €6.15 million from the previous year's €8.29 million. Despite this, the company maintains a stable dividend history over the past decade, although its current dividend yield of 3.9% is below the top quartile for German stocks at 4.67%. Dividend sustainability is questionable as it is not well covered by free cash flows, reflecting a cash payout ratio of 113.1%.

Unlock comprehensive insights into our analysis of Schloss Wachenheim stock in this dividend report.

Make It Happen

Click here to access our complete index of 28 Top German Dividend Stocks.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:MVV1XTRA:SFQ and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Yahoo Finance

Yahoo Finance