Three Undervalued Small Caps In Hong Kong With Insider Buying

In recent weeks, the Hong Kong market has experienced a notable uptick, with the Hang Seng Index climbing 10.2% amid optimism about Beijing's support measures despite ongoing global tensions. This environment presents potential opportunities for investors interested in small-cap stocks, particularly those that may be undervalued and have seen insider buying activity—an indicator often associated with confidence in a company's future prospects.

Top 10 Undervalued Small Caps With Insider Buying In Hong Kong

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Edianyun | NA | 0.6x | 41.15% | ★★★★★☆ |

Vesync | 7.4x | 1.1x | -6.75% | ★★★★☆☆ |

Lion Rock Group | 5.4x | 0.4x | 49.97% | ★★★★☆☆ |

Ferretti | 10.7x | 0.7x | 48.00% | ★★★★☆☆ |

Gemdale Properties and Investment | NA | 0.3x | 40.37% | ★★★★☆☆ |

China Lesso Group Holdings | 6.1x | 0.4x | -538.85% | ★★★☆☆☆ |

Skyworth Group | 6.0x | 0.1x | -319.64% | ★★★☆☆☆ |

Lee & Man Paper Manufacturing | 7.4x | 0.4x | -51.58% | ★★★☆☆☆ |

Guangdong Kanghua Healthcare Group | 13.8x | 0.3x | 5.36% | ★★★☆☆☆ |

Emperor International Holdings | NA | 0.9x | 21.61% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

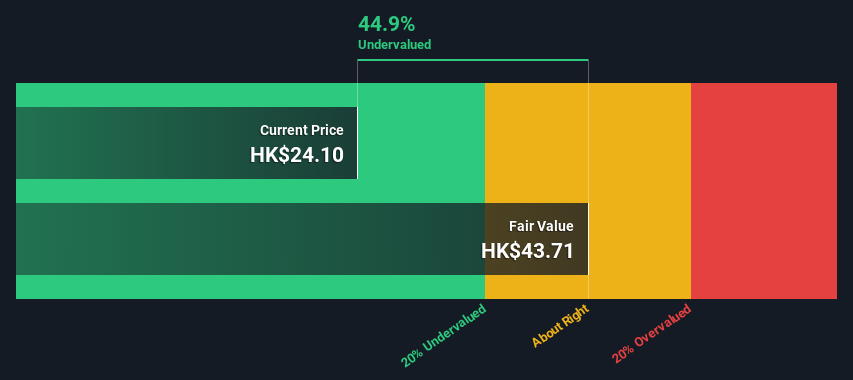

Vesync

Simply Wall St Value Rating: ★★★★☆☆

Overview: Vesync is a company that specializes in the design, manufacture, and sale of small home appliances and tools, with a market capitalization of approximately HK$2.67 billion.

Operations: The primary revenue stream comes from the Appliance & Tool segment, generating $604.75 million. The gross profit margin has shown an upward trend, reaching 48.46% as of the latest period. Operating expenses include significant allocations to sales and marketing and general and administrative expenses, totaling $180.14 million recently.

PE: 7.4x

Vesync, a Hong Kong-based company, has shown promising growth potential with earnings forecasted to rise by 6.61% annually. Despite relying entirely on external borrowing for funding, which carries higher risk, the company's recent inclusion in the S&P Global BMI Index signals positive market recognition. Notably, insider confidence is evident as Zhaojun Chen acquired 200,000 shares valued at approximately HK$828,979 in September 2024. Vesync reported a significant increase in net income to US$44.86 million for the first half of 2024 from US$32.62 million last year and declared a dividend increase payable on October 22nd.

Navigate through the intricacies of Vesync with our comprehensive valuation report here.

Understand Vesync's track record by examining our Past report.

Skyworth Group

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Skyworth Group is a diversified company engaged in the smart household appliances, smart systems technology, modern services, and new energy sectors, with operations generating revenue across these segments.

Operations: Skyworth Group's revenue streams are primarily derived from its Smart Household Appliances Business and New Energy Business, contributing CN¥32.51 billion and CN¥20.21 billion, respectively. The company has experienced fluctuations in its gross profit margin, which was 14.36% as of June 2024. Operating expenses include significant allocations towards sales and marketing as well as research and development activities.

PE: 6.0x

Skyworth Group, a notable player among Hong Kong's smaller companies, recently reported a mixed financial performance for the first half of 2024. Sales increased to ¥265 million from ¥252 million year-on-year, while revenue dipped to ¥30.15 billion from ¥32.3 billion. Net income rose to ¥384 million compared to the previous year's ¥302 million, indicating potential profitability improvements despite revenue challenges. Insider confidence is evident with Chi Shi purchasing 2,188,000 shares in July 2024 for approximately CNY6.3 million, reflecting significant insider belief in future prospects. Skyworth's strategic expansion into Russia highlights its commitment to technological innovation and market growth amidst financial restructuring challenges due to reliance on external borrowing rather than customer deposits or operating cash flow coverage of debt obligations.

Ferretti

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ferretti is a company focused on the design, construction, and marketing of yachts and recreational boats with a market capitalization of approximately €1.93 billion.

Operations: The company generates revenue primarily from the design, construction, and marketing of yachts and recreational boats. Over recent periods, its gross profit margin has shown a trend of fluctuation, with the latest figure at 36.04%. Operating expenses are significant but have been managed to support net income growth.

PE: 10.7x

Ferretti, a small company in Hong Kong, has shown significant insider confidence with recent share purchases. The company's earnings are set to grow by 12.8% annually, despite relying entirely on external borrowing for funding. Recent changes in leadership include the appointment of Mr. Jiang Kui as Chairman and Mr. Qinggui Hao as Joint Company Secretary, indicating strategic restructuring. Ferretti's half-year sales reached €695 million, up from €628 million last year, reflecting strong operational performance amidst these transitions.

Delve into the full analysis valuation report here for a deeper understanding of Ferretti.

Gain insights into Ferretti's historical performance by reviewing our past performance report.

Turning Ideas Into Actions

Access the full spectrum of 10 Undervalued SEHK Small Caps With Insider Buying by clicking on this link.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:2148 SEHK:751 and SEHK:9638.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]