It’s time to dump FAANG investing in the trash

Make 2019 the year where investing in the catchy acronym FAANG is a thing of the past.

Why? Simple, because it’s a necessity as the Federal Reserve embarks deeper into its interest rate tightening cycle and each component enters the next phase of its lifecycle.

The origin of FAANG (short for tech stalwarts Facebook, Apple, Amazon, Netflix and Alphabet/Google) could be hotly debated, but its underlying premise cannot. It’s a ridiculous byproduct of the post Great Recession bull market where tech stocks more often than not have gone up in value in unison. So why not group the most powerful tech companies in the world together and watch them roar ahead with each passing, somewhat predictable trading session?

Saying FAANG on business news TV and creating indexes and ETFs pegged to it has been cool as hell — it’s the ultimate indication of aggressive trading in an algorithmic world.

Unfortunately, acronym investing has always been borderline dumb. And investors were reminded of that in 2018 as many of the FAANG stocks were clobbered starting in the fall and continuing into year end.

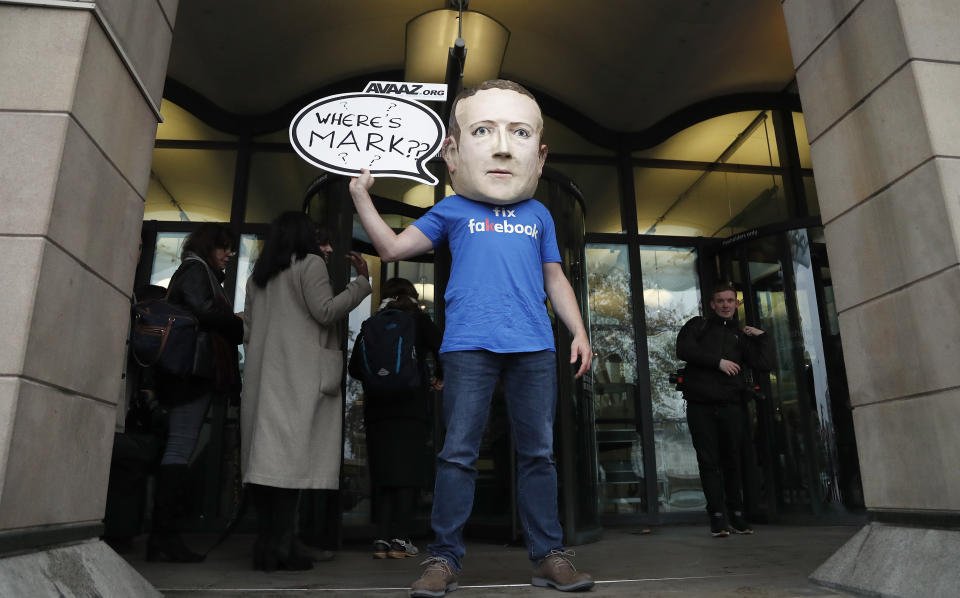

Reality check: The average FAANG stock gained a meager 3% in 2018, which is akin to a down year for the once smoking hot group. Each stock tanked in the last six months of 2018 as investors questioned growth outlooks. FAANG’s first component, Facebook, had the worst year as it plunged 28% as it dealt with multiple PR crises.

What happened to FAANG is a two part process. First, hedge funds unwinded their overcrowded FAANG positions and dumped cash into health care and god knows what else with liquidity being sucked from the financial system. Remember, the magic behind the bullish FAANG trade was low interest rates and docile, predictable markets. The slowing momentum led to fund managers and retail investors, who were also too bullish on FAANG, to begin reassessing each tech giant’s business models and outlooks.

What does Facebook truly have in common with Netflix? Very little other than you need an internet connection to use both services. Alphabet doesn’t have retail stores, but Amazon has 475 Whole Foods and one location with no cashiers in its Seattle backyard. Apple doesn’t have self-driving cars, Alphabet has Waymo.

Not all FAANG components are created equally despite the hype on TV the last several years.

The bottom line: Bank of America Merrill Lynch told Yahoo Finance it has been shorting FAANG stocks for the past six months. The bank doesn’t seem too keen on them entering 2019, either.

“[FAANG] could be a bullish trade at some point in 2019 once the Big Low in risk assets occurs in the first quarter — but that requires low interest rates to combine with no recession in 2019,” a source at Bank of America said. “Yes, acronym investing always comes to a grisly end.”

With interest rates on the rise, leveraging up to maximize one’s returns will cost more. The era-low interest rates and momentum was the fuel to the fire of FAANG. Growth rates for the group have also started to slow and wildly diverge.

FAANG has died. Time to move on.

Brian Sozzi is an editor-at-large at Yahoo Finance. Follow him on Twitter @BrianSozzi

Read Yahoo Finance’s Exclusives:

Hasbro CEO: We will return to growth in 2019

Macy’s CEO: Mobile shopping is surging

Procter & Gamble CEO: We aren’t splitting up the company

Coca-Cola CEO: Why we aren’t getting into the alcohol business