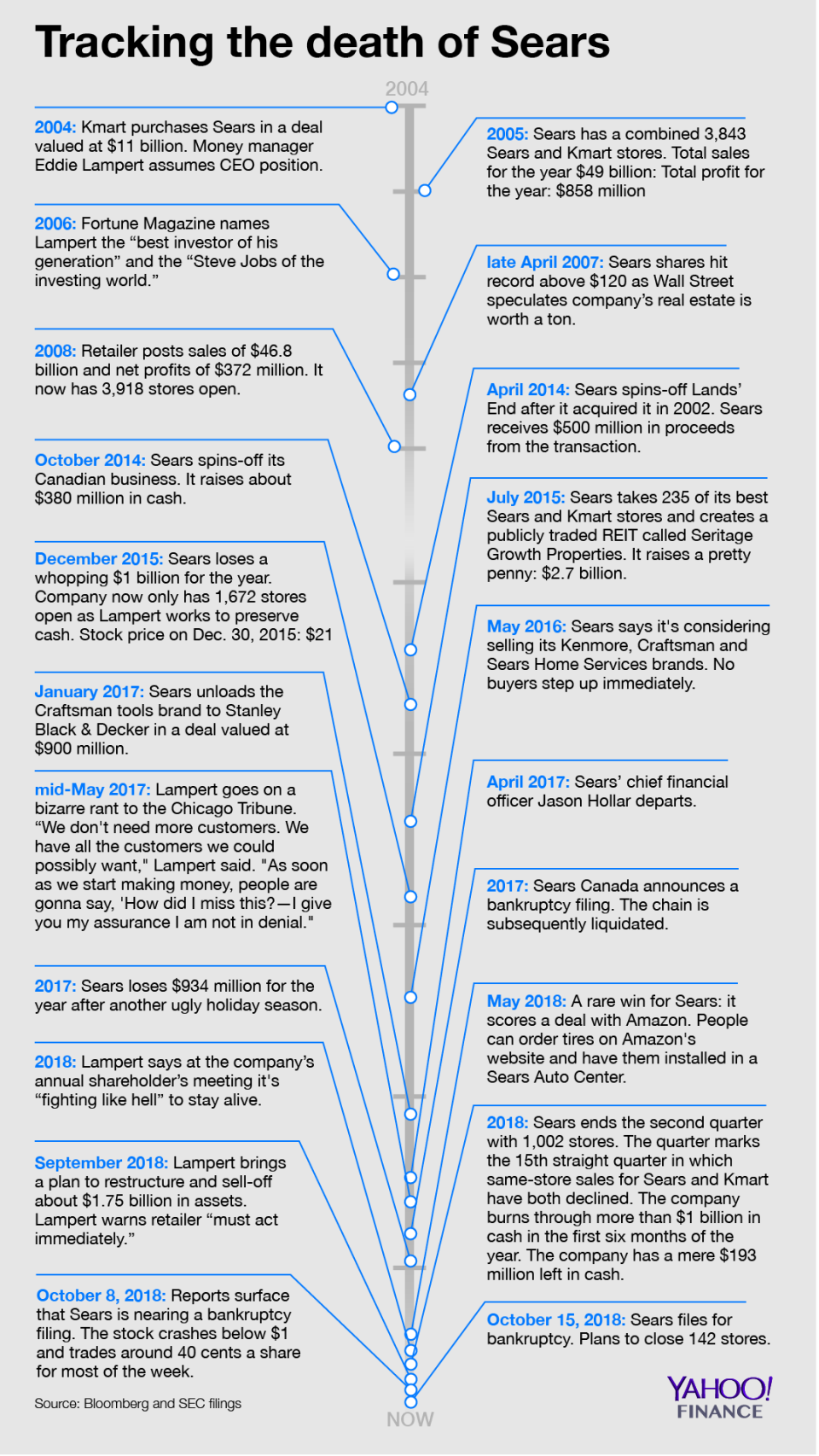

Timeline: How bankrupt Sears dug its own grave

Break out the headstone for the once-healthy retailer known as Sears Roebuck & Company.

The 125-year old former retail icon filed for Chapter 11 bankruptcy protection early Monday, crippled from years of losses and mounting debt. Sears (SHLD) plans to close about 142 money-losing stores by year-end. The company operates about 700 Sears and Kmart stores.

Sears lined up $1.875 billion in bankruptcy financing to extinguish its existing loans and keep the lights on at the chain through the holiday season. CEO Eddie Lampert will step down, but remain as chairman. Lampert’s investment company, ESL Investments, plans to make a stalking horse bid for 400 profitable Sears and Kmart locations in the hopes of running them as a going concern.

Sears’ 173-page bankruptcy filing reads as a case study of how mismanagement could ruin a one-time dominant company. While Sears touts its long history of surviving challenging times in the document, it’s likely the retailer will cease to exist amid numerous mistakes by Lampert over the past 14 years.

Here’s a look back at the road to ruin for Sears.

Brian Sozzi is an editor-at-large at Yahoo Finance. Follow him on Twitter @BrianSozzi

Read more:

Sears bankruptcy could make these 5 big companies multimillion-dollar losers

How Sears plans to save 400 stores from dying

Sears bankruptcy isn’t surprising when looking at these numbers

Philip Morris International tries risky move of making cigarettes extinct