Top 10 Growth Stocks in Biotech

In this article, we will discuss the Top 10 Growth Stocks in Biotech. You can skip our industry overview and go directly to the Top 5 Growth Stocks in Biotech.

The biotech industry encompasses a wide range of fields, including genetic engineering, biomanufacturing, bioinformatics, and synthetic biology. It has the potential to transform many aspects of our lives, from healthcare to food production to environmental sustainability. The rising investments in the sector are a testament to the growth potential of biotechnology. According to an EY Report, 68% of publicly traded biotech companies in the US and Europe increased their Research and Development spending in 2021, collectively investing $43 billion to develop the next generation of therapies and drugs.

The biotechnology sector is a subset of the healthcare sector, which represents 20.3% of the S&P Pure Growth Index, ranking second only to the Energy sector. Two biopharmaceuticals firms, Regeneron Pharmaceuticals, Inc. (NASDAQ:REGN) and Vertex Pharmaceuticals Incorporated (NASDAQ:VRTX), are among the top 10 firms in the index as per weightage.

The biotechnology sector came into the limelight in 2020 after the COVID-19 pandemic, as all eyes were set on biotech companies and their development of COVID-19 vaccines. The industry delivered on its promise with the development of MRNA-based vaccines. Several biotech stocks soared to new highs. For example, BioNTech SE’s (NASDAQ:BNTX) stock was trading in the $20s at the start of 2020, but by the end of the year, the stock was trading at over $100.

The biotech sector is highly regulated, and the success of companies hinges on the outcome of clinical trials for potential blockbuster drugs and subsequent approval by the Food and Drug Administration. Roche Holding AG (OTC:RHHBY) experienced its most significant stock price decline in over two years in May 2022 due to the failure of the second phase 3 trial for its new immunotherapy, tiragolumab.

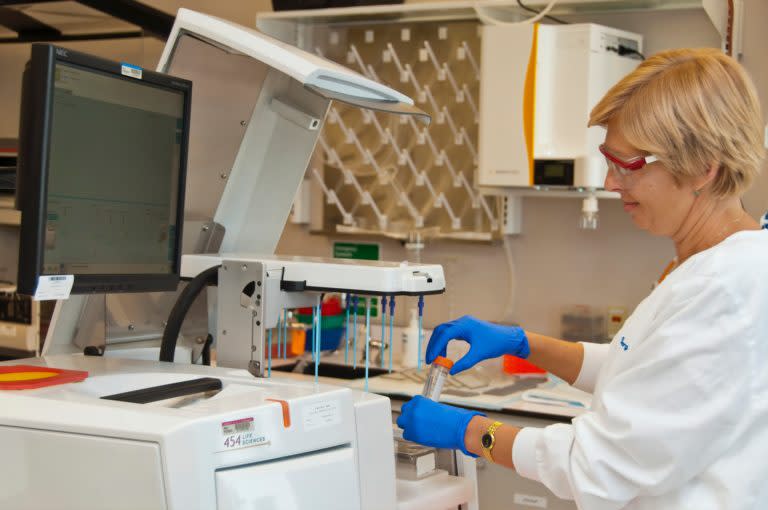

Photo by National Cancer Institute on Unsplash

The biotech industry experienced a challenging year in 2022, as evidenced by the Nasdaq Biotech Index closing at 4,213.13, reflecting a 12% decrease from its closing value in 2021. The sector grappled with a challenging macro environment. However, the biotech industry has shown signs of recovery after a difficult year, with the XBI biotech index rebounding in the latter half of 2022. The positive momentum has been driven by favorable drug launches and clinical readouts.

Looking forward, a more permissive regulatory environment in areas like rare disease or gene therapy, to which many small-cap companies are tied, should also spur overall sentiment. However, weaker companies may face restructuring and dilution, limiting overall index performance. To read more about Biotech startups and their potential use cases, you can head on to 12 Most Profitable Biotech Stocks Today.

Our Methodology

For this article we used stock screeners to identify high growth biotech stocks. We screened profitable biotech stocks on a net income TTM basis and revenue growth of at least 50% over the past four quarters. The list is ranked in ascending order of the YoY revenue growth metric.

Top 10 Growth Stocks in Biotech

10. Recursion Pharmaceuticals, Inc. (NASDAQ:RXRX)

Revenue Growth YOY: 291.46%

Recursion Pharmaceuticals, Inc. (NASDAQ:RXRX) is a biotechnology company based in the United States. The company engages in drug discovery through experimental biology by integrating technological innovations across biology, chemistry, data science, engineering, and automation. Recursion Pharmaceuticals, Inc. (NASDAQ:RXRX) is currently developing various products for several oncological disorders as well as rare and other diseases like Cerebral Cavernous Malformation and Clostridioides difficile Colitis.

On February 27, 2023, Recursion Pharmaceuticals, Inc. (NASDAQ:RXRX) announced its fourth quarter 2022 results. The company reported a revenue of $13.68 million, missing market expectations by $10.32 million. The Normalized EPS stood at $0.30, missing market estimates by $0.06.

In addition to Recursion Pharmaceuticals, Inc. (NASDAQ:RXRX), Orchard Therapeutics plc (NASDAQ:ORTX), Rhythm Pharmaceuticals, Inc. (NASDAQ:RYTM), and Ascendis Pharma A/S (NASDAQ:ASND) are included in our list of top 10 growth stocks in biotech.

As per Insider Monkey’s database, 13 hedge funds held stakes worth $194 million in Recursion Pharmaceuticals, Inc. (NASDAQ:RXRX) in Q4 2022, compared to 15 funds in the prior quarter with stakes worth $243 million.

Here is what Lux Capital has to say about Recursion Pharmaceuticals, Inc. (NASDAQ:RXRX) in its Q2 2022 investor letter:

As we discussed before describing “Extensionalism”, one of our theses has been the growing convergence between the biological and technological, the organic and inorganic, man and machine. Lux has made investments in the digitization, technological capture and amplification of each of the human senses. Consider vision and speech: we have technology that can rapidly recognize and label objects from pixels (companies that span defense, biotechnology, manufacturing and transportation like, Recursion (NASDAQ:RXRX), and others that can rapidly generate videos, images, and even more complex language from simple inputs.

9. Lineage Cell Therapeutics, Inc. (NYSE:LCTX)

Revenue Growth YOY: 295.58%

Lineage Cell Therapeutics, Inc. (NYSE:LCTX) is an American clinical-stage biotechnology corporation. The company develops cell-based therapies by creating specific cell types from pluripotent stem cells (PSCs) to cure severe illnesses, including cancer and degenerative disorders. The product pipeline of Lineage Cell Therapeutics, Inc. (NYSE:LCTX) consists of OpRegen, OPC1, ANP1, PNC1, and VAC2, which are focused on therapeutic areas of ophthalmology, neurology, demyelination, and immuno-oncology.

According to Insider Monkey’s database, 10 hedge funds held stakes worth $44 million in Lineage Cell Therapeutics, Inc. (NYSE:LCTX) in Q4 2022, compared to 9 funds in the prior quarter with stakes worth $43 million.

8. Crinetics Pharmaceuticals, Inc. (NASDAQ:CRNX)

Revenue Growth YOY: 339.42%

Crinetics Pharmaceuticals, Inc. (NASDAQ:CRNX) is a clinical-stage pharmaceutical corporation based in the United States. The company primarily focuses on developing therapeutics for patients with rare endocrine disorders and related tumors. Paltusotine is the company’s lead product candidate, which is being developed to treat acromegaly, a rare condition in which the body produces unusual amounts of growth hormones. Crinetics Pharmaceuticals, Inc. (NASDAQ:CRNX) is also developing products for several other diseases, such as hyperparathyroidism, obesity, and diabetes.

As per Insider Monkey’s database, 23 hedge funds held stakes worth $485 million in Crinetics Pharmaceuticals, Inc. (NASDAQ:CRNX) in Q4 2022, compared to 19 funds in the prior quarter with stakes worth $479 million.

7. Ardelyx, Inc. (NASDAQ:ARDX)

Revenue Growth YOY: 416.57%

Ardelyx, Inc. (NASDAQ:ARDX) is an American biopharmaceutical company. The company engages in the development and sale of medicinal drugs to treat cardiorenal and gastrointestinal disorders. IBSRELA? (tenapanor) is the first approved product of Ardelyx, Inc. (NASDAQ:ARDX), and it is used to treat irritable bowel syndrome with constipation (IBS-C). The product pipeline of the company comprises Tenapor, which is under development to treat hyperphosphatemia, RDX013 for the treatment of hyperkalemia, and RDX020 for metabolic acidosis.

On March 3, 2023, Laura Chico, an analyst at Wedbush, increased the price target of Ardelyx, Inc. (NASDAQ:ARDX) to $6 from $3 and upgraded the rating on the company’s shares to Outperform from Neutral. According to the analyst, the company’s product IBSRELA? (tenapanor) is slowly advancing towards targets, while the regulatory route of XPHOZAH? (tenapanor) is beginning to become more visible.

As per Insider Monkey’s database, 13 hedge funds held stakes worth $59 million in Ardelyx, Inc. (NASDAQ:ARDX) in Q4 2022, compared to 19 funds in the prior quarter with stakes worth $42 million.

6. Immunocore Holdings plc (NASDAQ:IMCR)

Revenue Growth YOY: 441.99%

Headquartered in the United Kingdom, Immunocore Holdings plc (NASDAQ:IMCR) is a multinational commercial-stage biotechnology corporation. The company develops immunotherapies for unmet needs in infection, cancer, and autoimmune disorders. Immunocore Holdings plc (NASDAQ:IMCR) has developed KIMMTRAK, an anti-cancer medication for the treatment of adult patients with metastatic uveal melanoma. The company also has several other products in the pipeline, such as IMC-I109V for the treatment of hepatitis B virus (HBV) and IMC-M113V2 for human immunodeficiency virus (HIV).

On March 1, 2023, Immunocore Holdings plc (NASDAQ:IMCR) announced its fourth quarter 2022 results. The company reported a revenue of $57.76 million, surpassing wall street estimates by $4.08 million. The Normalized EPS stood at $0.65, falling short of market expectations by $0.69.

According to Insider Monkey’s database, 19 hedge funds held stakes worth $603 million in Immunocore Holdings plc (NASDAQ:IMCR) in Q4 2022, compared to 19 funds in the prior quarter with stakes worth $518 million.

Last month Immunocore Holdings plc (NASDAQ:IMCR) presented safety and activity data on IMC-M113V, a bispecific soluble TCR therapy for treating people living with HIV. The data, presented at the Conference on Retroviruses and Opportunistic Infection, showed that all three dose levels of IMC-M113V were well-tolerated, with no significant adverse events, changes in hematology or chemistry, cytokine release syndrome, or neurotoxicity.

Click to continue reading and see Top 5 Growth Stocks in Biotech.

Suggested Articles:

Disclosure: None. Top 10 Growth Stocks in Biotech is originally published on Insider Monkey.