Top 3 Dividend Stocks To Watch On Euronext Paris

As the European Central Bank's recent interest rate cut has buoyed France's CAC 40 Index by 1.54%, investors are increasingly looking at dividend stocks as a stable source of income amid market fluctuations. In this context, selecting dividend stocks with strong fundamentals and consistent payout histories can be an effective strategy for navigating the current economic landscape.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Vicat (ENXTPA:VCT) | 6.21% | ★★★★★★ |

Rubis (ENXTPA:RUI) | 8.48% | ★★★★★★ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.75% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 4.42% | ★★★★★☆ |

VIEL & Cie société anonyme (ENXTPA:VIL) | 3.62% | ★★★★★☆ |

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA) | 5.89% | ★★★★★☆ |

Samse (ENXTPA:SAMS) | 6.92% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 7.94% | ★★★★★☆ |

Trigano (ENXTPA:TRI) | 3.55% | ★★★★☆☆ |

Rexel (ENXTPA:RXL) | 4.79% | ★★★★☆☆ |

Click here to see the full list of 36 stocks from our Top Euronext Paris Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

ABC arbitrage

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ABC arbitrage SA, with a market cap of €268.20 million, develops arbitrage strategies for liquid assets globally through its subsidiaries.

Operations: ABC arbitrage SA generates €39.81 million in revenue from its arbitrage trading activities.

Dividend Yield: 9.8%

ABC arbitrage offers a high dividend yield of 9.76%, placing it in the top 25% of dividend payers in France. However, its dividend payments have been volatile over the past decade and are not well covered by free cash flows, with a cash payout ratio of 131%. Despite trading at 51.1% below its estimated fair value and a low payout ratio of 32.6%, the sustainability and reliability of its dividends remain concerns for investors.

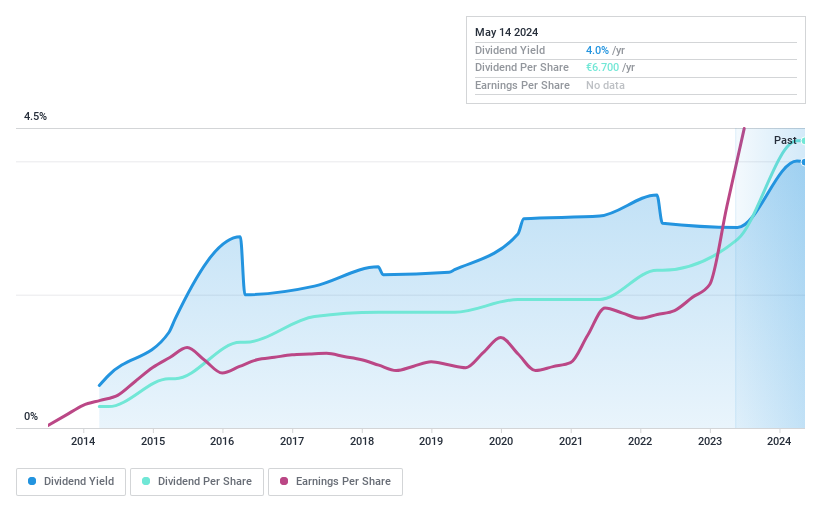

Exacompta Clairefontaine

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Exacompta Clairefontaine S.A. produces, finishes, and formats papers in France, Europe, and internationally with a market cap of €159.54 million.

Operations: Exacompta Clairefontaine S.A. generates revenue from two main segments: Paper (€368.58 million) and Processing (€613.23 million).

Dividend Yield: 4.8%

Exacompta Clairefontaine's dividend payments are well-covered by earnings (payout ratio: 17.6%) and cash flows (cash payout ratio: 10.3%). The company offers a reliable dividend yield of 4.75%, though it is lower than the top 25% of French dividend payers. Dividends have been stable and growing over the past decade, supported by significant earnings growth of 59.4% in the past year, despite recent share price volatility.

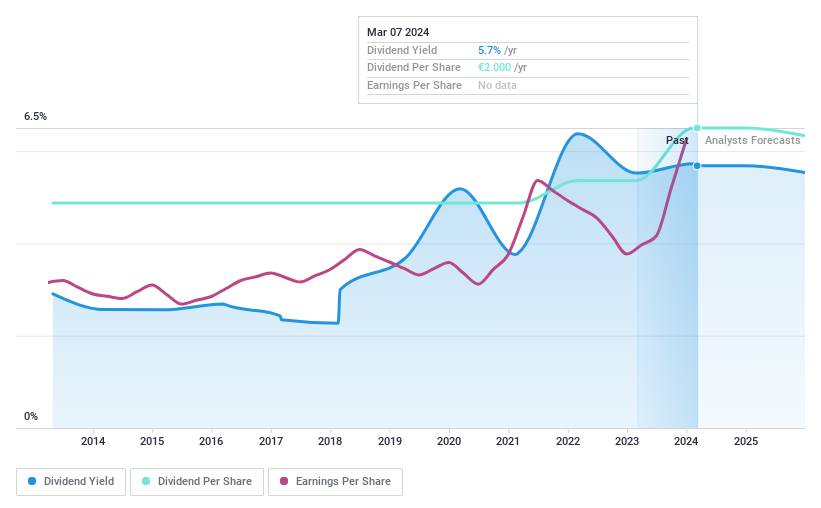

Vicat

Simply Wall St Dividend Rating: ★★★★★★

Overview: Vicat S.A., with a market cap of €1.43 billion, operates through its subsidiaries in the production and sale of cement, ready-mixed concrete, and aggregates for the construction industry.

Operations: Vicat S.A. generates revenue through three primary segments: Cement (€2.52 billion), Concrete & Aggregates (€1.55 billion), and Other Products and Services (€459.99 million).

Dividend Yield: 6.2%

Vicat S.A.'s dividend yield of 6.21% places it in the top 25% of French dividend payers. The company has a history of reliable and growing dividends over the past decade, with stable payouts supported by earnings coverage (payout ratio: 33.4%) and cash flows (cash payout ratio: 45.7%). Recent H1 2024 earnings showed sales at €1.94 billion and net income at €103.54 million, indicating steady financial performance despite high debt levels.

Unlock comprehensive insights into our analysis of Vicat stock in this dividend report.

Our expertly prepared valuation report Vicat implies its share price may be lower than expected.

Next Steps

Explore the 36 names from our Top Euronext Paris Dividend Stocks screener here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:ABCA ENXTPA:ALEXA and ENXTPA:VCT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]