Top 3 Growth Companies With High Insider Ownership On The Indian Exchange

Over the past 7 days, the Indian market has risen 1.6%, contributing to an impressive 44% increase over the last 12 months, with earnings forecasted to grow by 17% annually. In such a robust environment, growth companies with high insider ownership often stand out as promising investments due to their potential for strong performance and alignment of interests between company leaders and shareholders.

Top 10 Growth Companies With High Insider Ownership In India

Name | Insider Ownership | Earnings Growth |

Archean Chemical Industries (NSEI:ACI) | 22.9% | 33.7% |

Kirloskar Pneumatic (BSE:505283) | 30.3% | 30.1% |

Dixon Technologies (India) (NSEI:DIXON) | 24.6% | 31.2% |

Jupiter Wagons (NSEI:JWL) | 10.8% | 27.4% |

Happiest Minds Technologies (NSEI:HAPPSTMNDS) | 32.5% | 22.2% |

Paisalo Digital (BSE:532900) | 16.3% | 24.8% |

Apollo Hospitals Enterprise (NSEI:APOLLOHOSP) | 10.4% | 32.3% |

KEI Industries (BSE:517569) | 18.7% | 22.4% |

Pricol (NSEI:PRICOLLTD) | 25.5% | 24% |

Aether Industries (NSEI:AETHER) | 31.1% | 45.9% |

Let's explore several standout options from the results in the screener.

Astral

Simply Wall St Growth Rating: ★★★★★☆

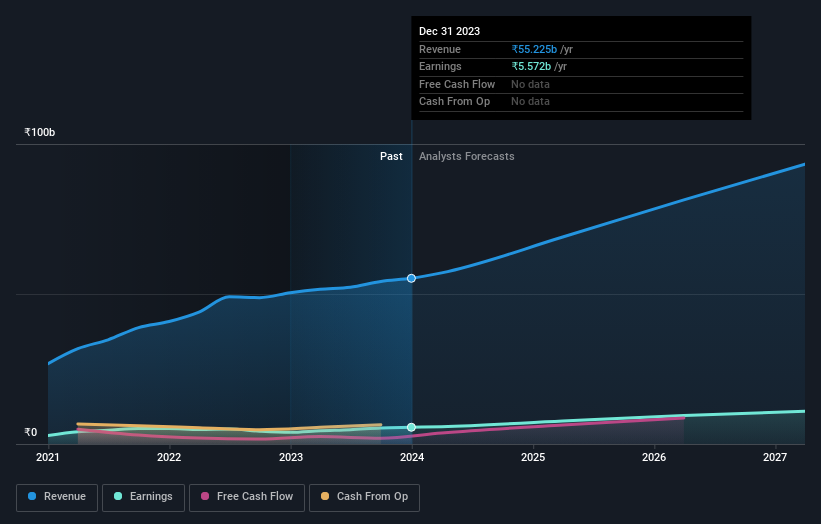

Overview: Astral Limited, along with its subsidiaries, manufactures and markets pipes, water tanks, adhesives, and sealants in India and internationally with a market cap of ?539.55 billion.

Operations: Astral's revenue segments include Plumbing, which generated ?42.17 billion, and Paints and Adhesives, contributing ?15.25 billion.

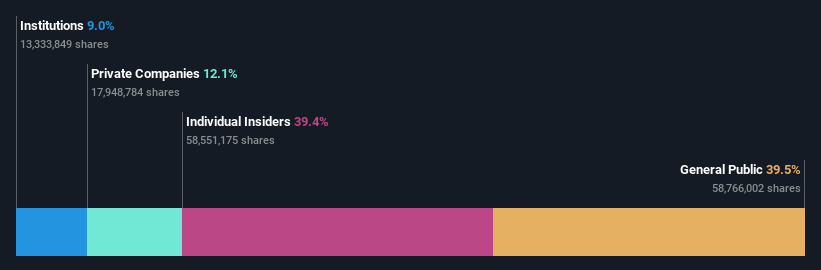

Insider Ownership: 39.4%

Revenue Growth Forecast: 17.3% p.a.

Astral Limited demonstrates strong growth potential with high insider ownership. The company forecasts significant earnings growth of 23.5% per year, outpacing the Indian market's 17.3%. Recent developments include the commissioning of a new Hyderabad plant and consolidation of adhesive manufacturing operations to more efficient locations in Rania and Dahej. Despite modest revenue growth (17.3% annually), Astral's first-quarter earnings showed stable performance with sales at ?13,836 million and net income at ?1,204 million.

Happiest Minds Technologies

Simply Wall St Growth Rating: ★★★★★★

Overview: Happiest Minds Technologies Limited offers IT solutions and services across various countries, including India, the United States, Canada, and several others, with a market cap of ?123.60 billion.

Operations: The company's revenue segments include Infrastructure Management & Security Services (IMSS) at ?3.02 billion and a segment adjustment of ?13.69 million.

Insider Ownership: 32.5%

Revenue Growth Forecast: 22.1% p.a.

Happiest Minds Technologies showcases robust growth potential with high insider ownership. The company’s earnings are forecast to grow 22.22% annually, significantly outpacing the Indian market's 17.3%. Recent board appointments of Mittu Sridhara and Rajiv Shah aim to bolster its strategic direction. Despite a dip in net income for Q1 FY2025 (?510.3 million), revenue grew to ?4,892.6 million from ?4,045.3 million year-over-year, highlighting strong operational performance amidst expansion efforts and innovative service offerings like Watch360.

One97 Communications

Simply Wall St Growth Rating: ★★★★☆☆

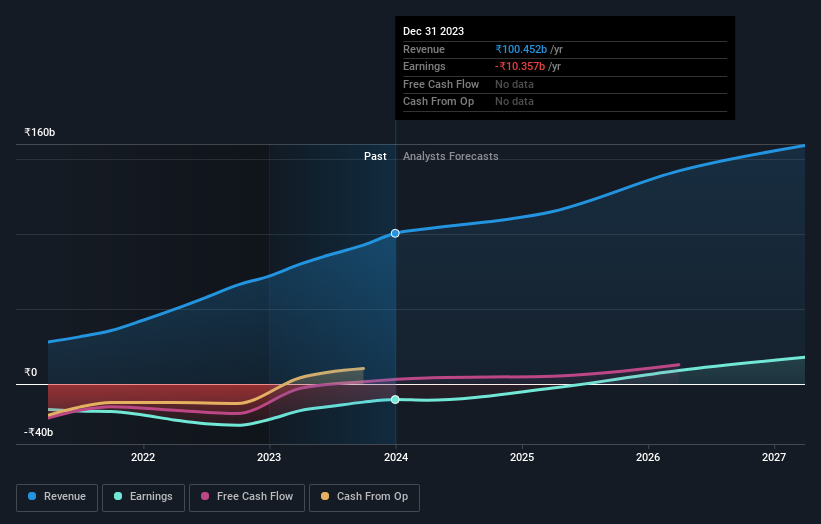

Overview: One97 Communications Limited offers payment, commerce and cloud, and financial services to consumers and merchants in India with a market cap of ?448.93 billion.

Operations: The company's revenue segments include data processing, which generated ?91.38 billion.

Insider Ownership: 20.7%

Revenue Growth Forecast: 12.1% p.a.

One97 Communications, with significant insider ownership, is poised for robust growth. The company recently divested its entertainment ticketing business to Zomato for ?20.48 billion, strengthening its focus on core payments and financial services. Despite a net loss of ?8.39 billion in Q1 FY2025, strategic partnerships like the one with FlixBus and new product launches such as Paytm Health Saathi highlight its commitment to diversifying revenue streams and enhancing service offerings.

Take a closer look at One97 Communications' potential here in our earnings growth report.

Our valuation report here indicates One97 Communications may be overvalued.

Summing It All Up

Access the full spectrum of 93 Fast Growing Indian Companies With High Insider Ownership by clicking on this link.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NSEI:ASTRAL NSEI:HAPPSTMNDS and NSEI:PAYTM.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]