Top 3 Growth Stocks With High Insider Ownership And Up To 40% Earnings Growth

As global markets continue to recover from recent sell-offs, investors are increasingly optimistic about achieving a "soft landing" for the economy. With growth stocks outperforming value shares and positive earnings reports boosting sentiment, now is an opportune time to explore companies that combine robust growth potential with high insider ownership. In this favorable market environment, stocks that exhibit strong earnings growth and significant insider investment can offer compelling opportunities. Here are three such growth companies that stand out for their impressive financial performance and substantial insider stakes.

Top 10 Growth Companies With High Insider Ownership

Name | Insider Ownership | Earnings Growth |

Lavvi Empreendimentos Imobiliários (BOVESPA:LAVV3) | 11.9% | 21.2% |

Atlas Energy Solutions (NYSE:AESI) | 29.1% | 42.6% |

Gaming Innovation Group (OB:GIG) | 26.7% | 37.4% |

On Holding (NYSE:ONON) | 28.4% | 24.7% |

KebNi (OM:KEBNI B) | 37.8% | 86.1% |

Calliditas Therapeutics (OM:CALTX) | 12.7% | 51.9% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.4% | 60.9% |

Adocia (ENXTPA:ADOC) | 11.9% | 63% |

Vow (OB:VOW) | 31.7% | 97.7% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 74.9% |

Let's explore several standout options from the results in the screener.

Alsea. de

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alsea, S.A.B. de C.V. operates restaurants in Latin America and Europe with a market cap of MX$46.55 billion.

Operations: Alsea's revenue segments include its restaurant operations across Latin America and Europe.

Insider Ownership: 38.4%

Earnings Growth Forecast: 24.8% p.a.

Alsea, S.A.B. de C.V. is forecast to see significant annual earnings growth of 24.8%, outpacing the MX market's 10.7%. Despite its below-industry-average P/E ratio of 18.3x and strong revenue growth expectations (9.1% per year), recent financial results show a decline in net income from MXN 499.74 million to MXN 140.08 million year-over-year for Q2, highlighting potential risks despite positive analyst sentiment forecasting a stock price rise of 38.3%.

Click to explore a detailed breakdown of our findings in Alsea. de's earnings growth report.

Our expertly prepared valuation report Alsea. de implies its share price may be lower than expected.

Kossan Rubber Industries Bhd

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kossan Rubber Industries Bhd, an investment holding company with a market cap of MYR5.23 billion, manufactures and sells latex disposable gloves in Malaysia and internationally.

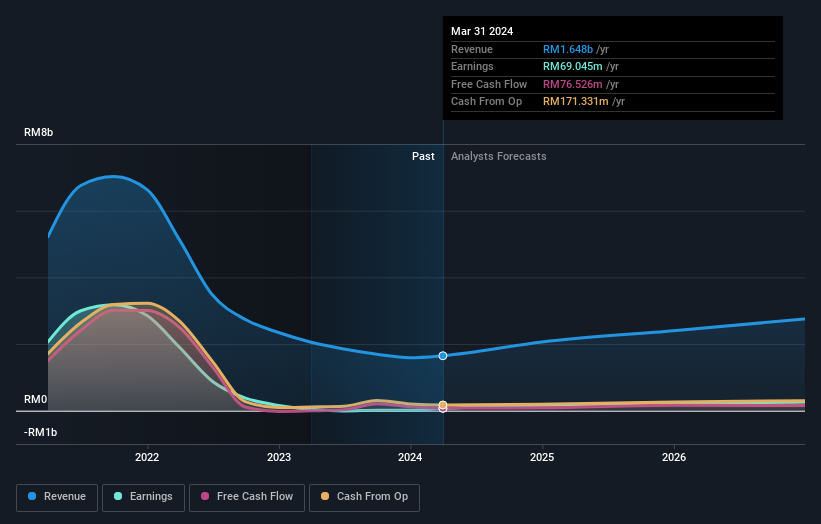

Operations: The company's revenue segments include Gloves (MYR1.35 billion), Clean-Room (MYR102.09 million), and Technical Rubber (MYR197.38 million).

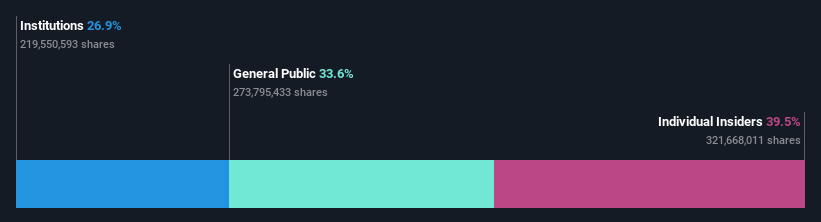

Insider Ownership: 14.2%

Earnings Growth Forecast: 37.5% p.a.

Kossan Rubber Industries Bhd reported strong Q1 2024 results with sales of MYR 451.63 million and net income of MYR 31.45 million, reversing a prior net loss. Earnings grew by 61.6% over the past year and are forecast to grow significantly at 37.52% annually, outpacing the Malaysian market's growth rate of 12.1%. Despite these positives, its return on equity is expected to be low at 5.3%, and its dividend yield of 1.93% is not well covered by earnings or free cash flows.

Hims & Hers Health

Simply Wall St Growth Rating: ★★★★★★

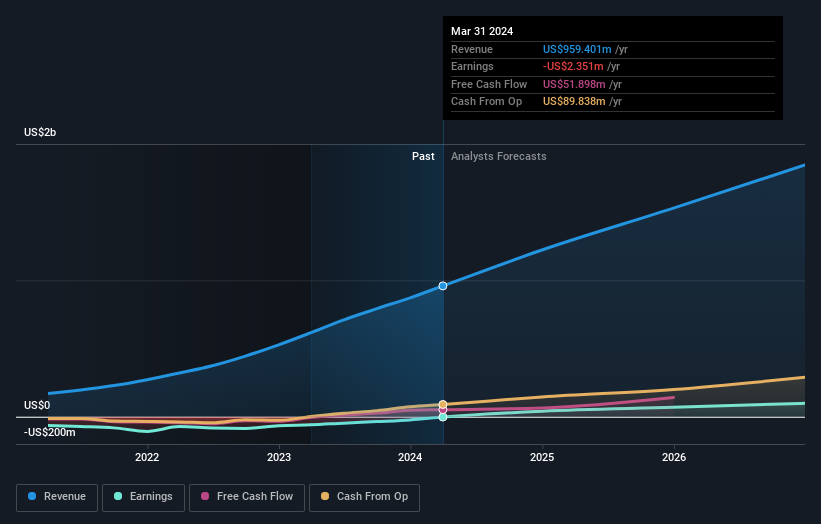

Overview: Hims & Hers Health, Inc. operates a telehealth platform connecting consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally, with a market cap of $3.38 billion.

Operations: The company's revenue segments include $1.07 billion from online retailers.

Insider Ownership: 13.7%

Earnings Growth Forecast: 40.9% p.a.

Hims & Hers Health has shown substantial insider buying over the past three months, reflecting confidence in its growth prospects. The company became profitable this year and reported significant revenue growth, with Q2 2024 sales reaching US$315.65 million compared to US$207.91 million a year ago. Analysts forecast HIMS's revenue to grow at 22.6% annually, outpacing the US market's average of 8.8%. Despite recent shareholder dilution and share price volatility, its earnings are expected to grow significantly at 40.91% per year.

Seize The Opportunity

Explore the 1499 names from our Fast Growing Companies With High Insider Ownership screener here.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include BMV:ALSEA * KLSE:KOSSAN and NYSE:HIMS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]