Top 3 High Growth Tech Stocks in Canada

The market has been flat in the last week but is up 13% over the past year, with earnings forecast to grow by 15% annually. In this environment, high growth tech stocks that demonstrate strong innovation and scalability potential are particularly attractive for investors seeking significant returns.

Top 10 High Growth Tech Companies In Canada

Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

Docebo | 14.74% | 34.09% | ★★★★★☆ |

Constellation Software | 16.17% | 23.55% | ★★★★★☆ |

HIVE Digital Technologies | 54.20% | 100.27% | ★★★★★☆ |

Wishpond Technologies | 12.72% | 113.87% | ★★★★☆☆ |

GameSquare Holdings | 38.08% | 86.64% | ★★★★★☆ |

Medicenna Therapeutics | 62.37% | 57.20% | ★★★★★☆ |

Sabio Holdings | 12.97% | 122.50% | ★★★★☆☆ |

BlackBerry | 20.61% | 76.74% | ★★★★★☆ |

Cineplex | 8.05% | 179.27% | ★★★★☆☆ |

Alpha Cognition | 62.98% | 69.54% | ★★★★★☆ |

Click here to see the full list of 22 stocks from our TSX High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Cineplex

Simply Wall St Growth Rating: ★★★★☆☆

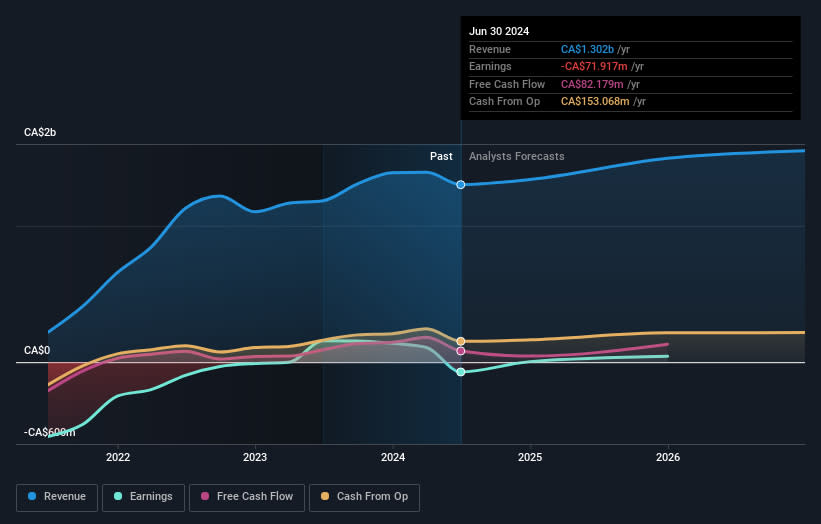

Overview: Cineplex Inc., along with its subsidiaries, operates as an entertainment and media company in Canada and internationally, with a market cap of CA$697.34 million.

Operations: Cineplex Inc. generates revenue primarily from three segments: Media (CA$120.16 million), Location-Based Entertainment (CA$132.08 million), and Film Entertainment and Content (CA$1.05 billion). The company operates in Canada and internationally, focusing on providing diverse entertainment experiences through its various business units.

Cineplex, a significant player in the Canadian entertainment sector, is forecasted to grow its revenue by 8.1% annually, outpacing the broader market's 6.9%. Despite reporting a net loss of CAD 21.44 million for Q2 2024 compared to a net income of CAD 176.55 million the previous year, earnings are expected to surge by an impressive 179.27% per year moving forward. The company has also initiated a share repurchase program aiming to buy back up to 6.32 million shares by August 2025, reflecting confidence in its future prospects despite current challenges.

Navigate through the intricacies of Cineplex with our comprehensive health report here.

Gain insights into Cineplex's past trends and performance with our Past report.

Computer Modelling Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Computer Modelling Group Ltd. is a software and consulting technology company specializing in the development and licensing of reservoir simulation and seismic interpretation software, with a market cap of CA$1.04 billion.

Operations: The company generates revenue primarily through the development and licensing of reservoir simulation and seismic interpretation software, amounting to CA$90.29 million. The business also includes related consulting services as part of its operations.

Computer Modelling Group (CMG) is making significant strides in the tech sector, particularly with its carbon capture and storage (CCS) solutions. The company recently reported Q1 2024 sales of CAD 30.52 million, up from CAD 20.75 million a year ago, though net income dropped to CAD 3.96 million from CAD 6.9 million. CMG's earnings are forecasted to grow at an impressive rate of 24.6% annually, surpassing the Canadian market's average of 15.4%. Notably, their R&D expenses reflect a strong commitment to innovation; for instance, their collaboration with Kongsberg Digital on CO2LINK integrates advanced simulation technologies crucial for CCS projects like Trudvang in the Norwegian North Sea.

Constellation Software

Simply Wall St Growth Rating: ★★★★★☆

Overview: Constellation Software Inc., along with its subsidiaries, acquires, develops, and manages vertical market software businesses across Canada, the United States, Europe, and internationally; it has a market cap of CA$93.26 billion.

Operations: Constellation Software Inc. generates revenue primarily from its software and programming segment, amounting to $9.27 billion. The company's operations involve acquiring, building, and managing vertical market software businesses globally.

Constellation Software's earnings are forecasted to grow at 23.6% annually, outpacing the Canadian market's average of 15.4%. Recent Q2 2024 results show revenue increased to $2.47 billion from $2.04 billion a year ago, with net income rising to $177 million from $103 million. The company's R&D expenses underscore its commitment to innovation, contributing significantly to its growth trajectory and competitive edge in the software sector. Constellation's strategic expansion through Omegro enhances its global footprint across diverse software applications, serving over 15,000 customers worldwide.

Make It Happen

Unlock more gems! Our TSX High Growth Tech and AI Stocks screener has unearthed 19 more companies for you to explore.Click here to unveil our expertly curated list of 22 TSX High Growth Tech and AI Stocks.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:CGX TSX:CMG and TSX:CSU.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Yahoo Finance

Yahoo Finance