Top 3 SEHK Growth Stocks With High Insider Ownership

As global markets navigate through a mix of economic signals, the Hong Kong market has shown resilience with the Hang Seng Index gaining 2.14%. Amidst this backdrop, identifying growth companies with high insider ownership can be particularly advantageous for investors seeking stability and potential upside. In today's volatile environment, stocks with strong insider ownership often signal confidence from those who know the company best. Here are three growth stocks listed on SEHK that exemplify this trait.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

Laopu Gold (SEHK:6181) | 36.4% | 34.7% |

Akeso (SEHK:9926) | 20.5% | 55.1% |

Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.7% | 70.6% |

Tian Tu Capital (SEHK:1973) | 34% | 81.4% |

Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 76.4% |

Adicon Holdings (SEHK:9860) | 22.4% | 33.6% |

DPC Dash (SEHK:1405) | 38.2% | 100.5% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 109.2% |

Beijing Airdoc Technology (SEHK:2251) | 28.6% | 93.4% |

Let's dive into some prime choices out of the screener.

BYD

Simply Wall St Growth Rating: ★★★★☆☆

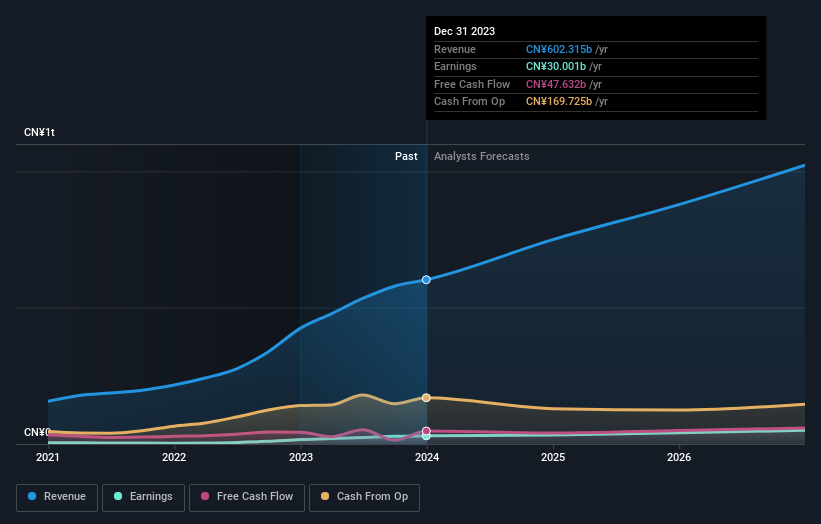

Overview: BYD Company Limited, with a market cap of HK$760.70 billion, operates in the automobiles and batteries business across China, Hong Kong, Macau, Taiwan, and internationally.

Operations: Revenue segments (in millions of CN¥): Automobiles and Related Products and Other Products: ¥507.52 billion, Mobile Handset Components, Assembly Service and Other Products: ¥154.49 billion

Insider Ownership: 30.1%

BYD has demonstrated strong growth, with earnings increasing by 36.2% over the past year and revenue forecast to grow at 13.8% annually, outpacing the Hong Kong market's average. Insider ownership remains high, reflecting confidence in its future prospects. Recent achievements include a strategic partnership with Uber and significant production milestones such as the inauguration of a new plant in Thailand and reaching 8 million new energy vehicles produced.

Delve into the full analysis future growth report here for a deeper understanding of BYD.

Our expertly prepared valuation report BYD implies its share price may be too high.

Meituan

Simply Wall St Growth Rating: ★★★★☆☆

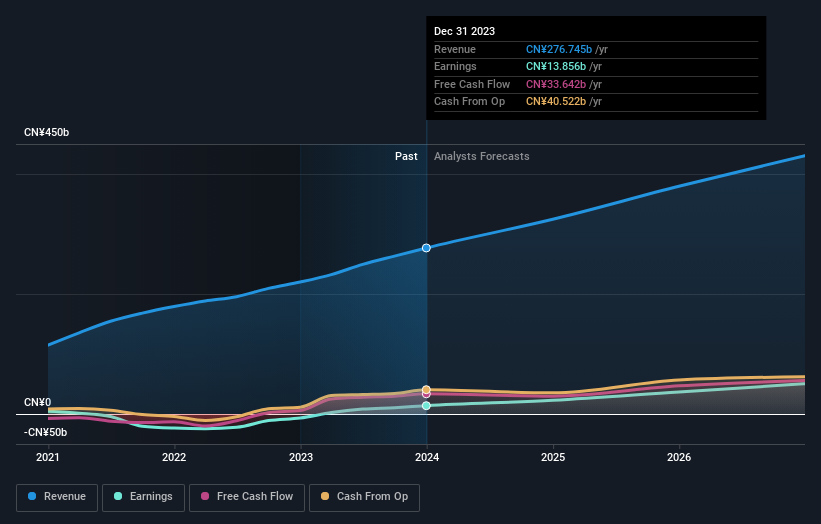

Overview: Meituan operates as a technology retail company in the People’s Republic of China with a market cap of HK$718.84 billion.

Operations: The company's revenue segments consist of CN¥228.13 billion from Core Local Commerce and CN¥77.56 billion from New Initiatives.

Insider Ownership: 11.6%

Meituan has shown impressive growth, with earnings surging 175.5% over the past year and revenue forecasted to grow at 12.9% annually, outpacing the Hong Kong market's average. Recent half-year results reported sales of CNY 155.53 billion and net income of CNY 16.72 billion, both significantly higher than the previous year. Insider ownership remains high, indicating confidence in its robust growth prospects, further supported by a substantial share repurchase program worth US$1 billion announced recently.

Take a closer look at Meituan's potential here in our earnings growth report.

Our valuation report unveils the possibility Meituan's shares may be trading at a discount.

Akeso

Simply Wall St Growth Rating: ★★★★★★

Overview: Akeso, Inc. is a biopharmaceutical company that researches, develops, manufactures, and commercializes antibody drugs with a market cap of HK$43.55 billion.

Operations: The company generates CN¥1.87 billion from the research, development, production, and sale of biopharmaceutical products.

Insider Ownership: 20.5%

Akeso, Inc., a growth company with high insider ownership in Hong Kong, has faced recent revenue and net income declines. However, the company is advancing its innovative PD-1/VEGF bispecific antibody ivonescimab, which has shown significant clinical value and received priority review for new indications. Despite financial setbacks, Akeso's strong pipeline and substantial insider ownership suggest confidence in its long-term growth potential.

Taking Advantage

Click this link to deep-dive into the 49 companies within our Fast Growing SEHK Companies With High Insider Ownership screener.

Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1211 SEHK:3690 and SEHK:9926.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]