Top 3 SGX Dividend Stocks To Consider In August 2024

The Singapore market has been navigating a complex landscape, influenced by global economic shifts and recent cybersecurity developments. In this environment, dividend stocks can offer stability and consistent returns, making them an attractive option for investors seeking reliable income streams.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

BRC Asia (SGX:BEC) | 7.44% | ★★★★★☆ |

UOB-Kay Hian Holdings (SGX:U10) | 6.72% | ★★★★★☆ |

China Sunsine Chemical Holdings (SGX:QES) | 6.61% | ★★★★★☆ |

Oversea-Chinese Banking (SGX:O39) | 6.36% | ★★★★★☆ |

UOL Group (SGX:U14) | 3.77% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 6.58% | ★★★★★☆ |

Civmec (SGX:P9D) | 5.36% | ★★★★★☆ |

Singapore Exchange (SGX:S68) | 3.61% | ★★★★★☆ |

Singapore Airlines (SGX:C6L) | 8.16% | ★★★★★☆ |

YHI International (SGX:BPF) | 6.77% | ★★★★★☆ |

Click here to see the full list of 18 stocks from our Top SGX Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

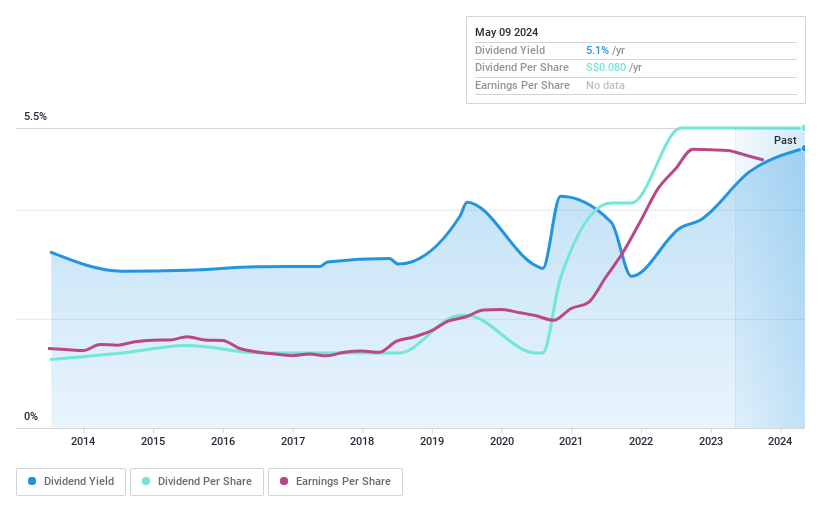

Hour Glass

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Hour Glass Limited is an investment holding company that operates in the retailing and distribution of watches, jewelry, and other luxury products across several countries including Singapore, Hong Kong, Japan, Australia, New Zealand, Malaysia, Thailand, and Vietnam with a market cap of SGD972.16 million.

Operations: The Hour Glass Limited generates SGD1.13 billion from its retailing and distribution of watches, jewelry, and other luxury products.

Dividend Yield: 5.3%

Hour Glass has a mixed dividend profile, with payments increasing over the past decade but exhibiting volatility. The company's dividends are well-covered by both earnings (payout ratio: 33.5%) and cash flows (cash payout ratio: 46.2%). Recent board changes and a share buyback program may impact future payouts, but the current final dividend of SGD 0.06 per share remains stable for now, subject to shareholder approval at the upcoming AGM on July 29, 2024.

Delve into the full analysis dividend report here for a deeper understanding of Hour Glass.

Our valuation report here indicates Hour Glass may be undervalued.

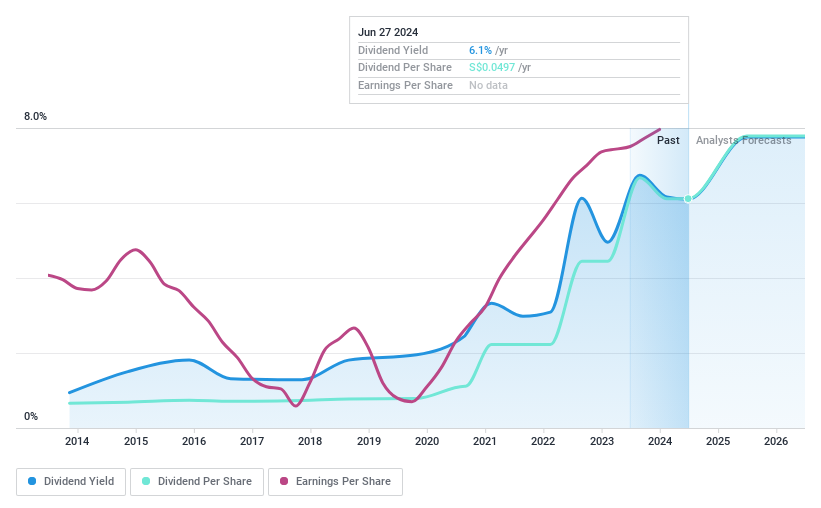

Civmec

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Civmec Limited (SGX:P9D) is an investment holding company that offers construction and engineering services to the energy, resources, infrastructure, marine, and defense sectors in Australia with a market cap of SGD454.29 million.

Operations: Civmec Limited generates revenue from various sectors in Australia, including A$46.02 million from Energy, A$752.82 million from Resources, and A$105.52 million from Infrastructure, Marine & Defence.

Dividend Yield: 5.4%

Civmec recently changed its name to Civmec Singapore Limited and ratified a new constitution. The company announced a joint venture with Austal Limited for the LAND8710 Phase 2 project, enhancing its strategic position. Recent contract awards total A$174 million, including significant projects in shipbuilding and maintenance. Civmec's dividend yield of 5.36% is lower than top-tier payers but remains reliable and well-covered by earnings (45.4%) and cash flows (27%).

Take a closer look at Civmec's potential here in our dividend report.

The valuation report we've compiled suggests that Civmec's current price could be quite moderate.

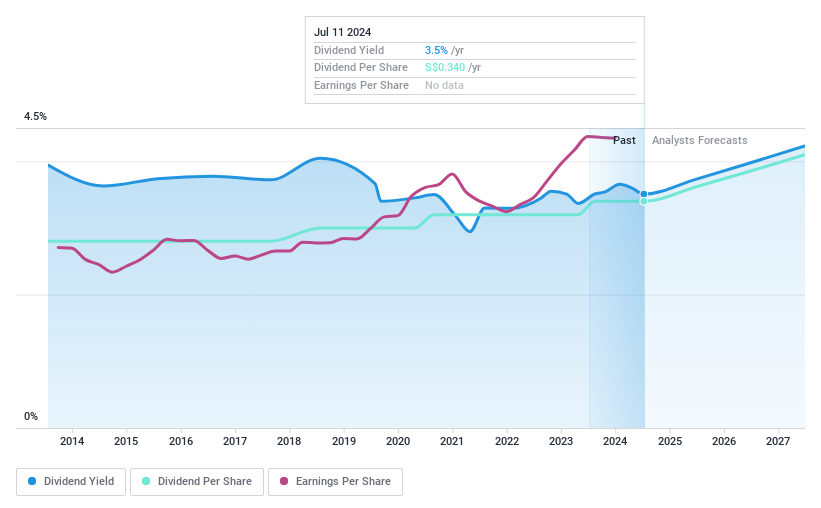

Singapore Exchange

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Singapore Exchange Limited operates an integrated securities and derivatives exchange, related clearing houses, and an electricity market in Singapore, with a market cap of SGD10.67 billion.

Operations: Singapore Exchange Limited generates revenue from four main segments: Equities - Cash (SGD334.94 million), Platform and Others (SGD240.20 million), Equities - Derivatives (SGD334.05 million), and Fixed Income, Currencies, and Commodities (SGD322.50 million).

Dividend Yield: 3.6%

Singapore Exchange Limited reported revenue of S$1.23 billion and net income of S$597.91 million for the year ended June 30, 2024, reflecting steady growth. The company offers a reliable dividend yield of 3.61%, which has been stable and growing over the past decade. Dividends are well-covered by earnings (payout ratio: 61.7%) and cash flows (cash payout ratio: 69.8%). However, its yield is lower compared to top-tier dividend payers in Singapore's market.

Unlock comprehensive insights into our analysis of Singapore Exchange stock in this dividend report.

Seize The Opportunity

Unlock our comprehensive list of 18 Top SGX Dividend Stocks by clicking here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:AGS SGX:P9D and SGX:S68.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]