Top 3 TSX Dividend Stocks For Reliable Income

In light of recent market volatility, Canadian investors are seeking stability amidst the fluctuations. One reliable strategy is to focus on dividend stocks, which can provide a steady income stream even during uncertain times.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.64% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 6.98% | ★★★★★★ |

Secure Energy Services (TSX:SES) | 3.28% | ★★★★★☆ |

Labrador Iron Ore Royalty (TSX:LIF) | 8.56% | ★★★★★☆ |

Enghouse Systems (TSX:ENGH) | 3.55% | ★★★★★☆ |

Sun Life Financial (TSX:SLF) | 4.58% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.39% | ★★★★★☆ |

iA Financial (TSX:IAG) | 3.30% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.16% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 3.74% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top TSX Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

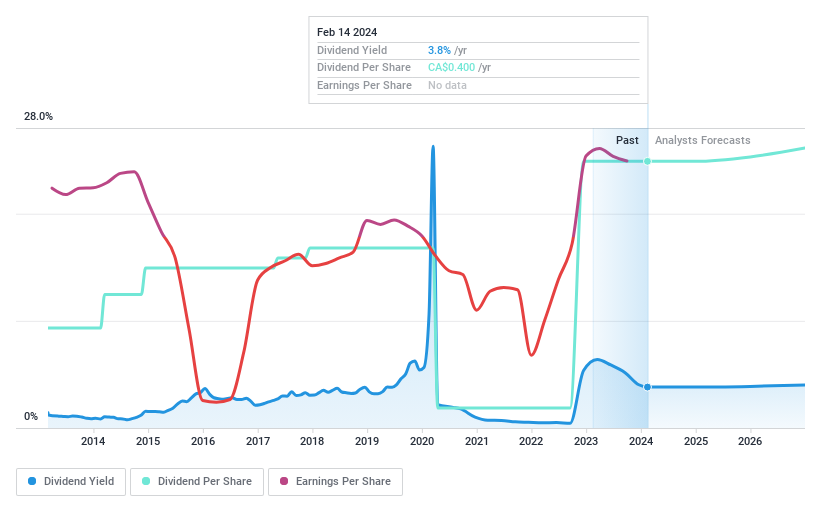

Aecon Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aecon Group Inc. provides construction and infrastructure development services to private and public sector clients in Canada, the United States, and internationally, with a market cap of CA$1.11 billion.

Operations: Aecon Group Inc.'s revenue segments include Concessions at CA$34.47 million and Construction at CA$4.04 billion.

Dividend Yield: 4.2%

Aecon Group Inc. recently secured substantial contracts, including a $928 million SkyTrain project and a $700 million nuclear contract, boosting its Construction segment backlog. However, financial results for Q2 2024 showed significant losses with net loss at C$123.89 million and diluted loss per share at C$1.99. Despite these challenges, Aecon's board approved a quarterly dividend of C$0.19 per share to be paid on October 2, 2024, maintaining its long-standing dividend stability but raising concerns about sustainability given the high payout ratio relative to earnings.

Secure Energy Services

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Secure Energy Services Inc. operates in the waste management and energy infrastructure sectors across Canada and the United States, with a market cap of CA$2.90 billion.

Operations: Secure Energy Services Inc. generates revenue primarily from its Energy Infrastructure segment at CA$8.61 billion and Environmental Waste Management (EWM) segment at CA$1.13 billion.

Dividend Yield: 3.3%

Secure Energy Services reported strong financial performance for the first half of 2024, with sales reaching C$5.40 billion and net income at C$454 million. The company declared a quarterly dividend of C$0.10 per share, covered by both earnings (payout ratio: 20.1%) and cash flows (cash payout ratio: 38.6%). Recent buybacks totaling C$178.5 million indicate confidence in its financial stability, supported by an undrawn $800 million credit facility extended to May 2027 for operational flexibility.

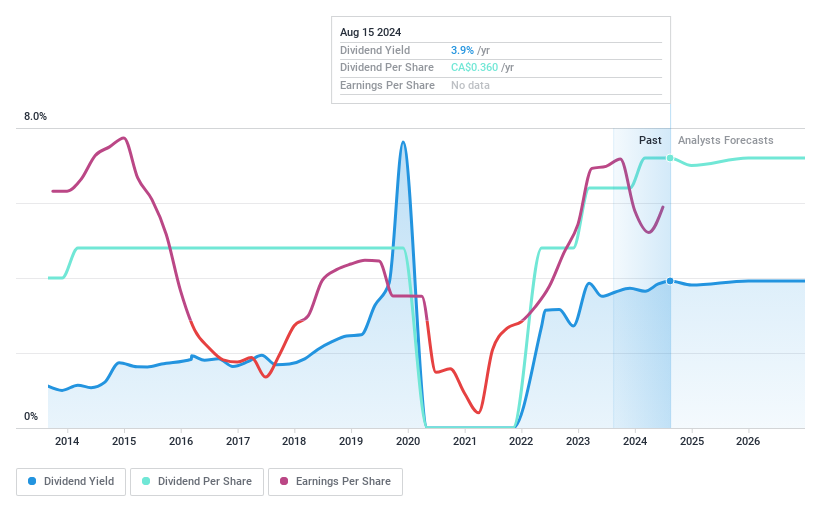

Total Energy Services

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Total Energy Services Inc. operates as an energy services company primarily in Canada, the United States, and Australia with a market cap of CA$355.48 million.

Operations: Total Energy Services Inc. generates revenue from four primary segments: Well Servicing (CA$89.94 million), Contract Drilling Services (CA$299.62 million), Compression and Process Services (CA$393.38 million), and Rentals and Transportation Services (CA$80.86 million).

Dividend Yield: 3.9%

Total Energy Services reported second-quarter 2024 earnings of C$15.47 million, up from C$6.2 million a year ago, with sales rising to C$213.33 million. The company declared a quarterly dividend of C$0.09 per share, well-covered by earnings (payout ratio: 32%) and cash flows (cash payout ratio: 25%). Despite its low P/E ratio of 8.4x and growing dividends over the past decade, the dividend yield remains modest at 3.92% compared to top Canadian payers.

Make It Happen

Get an in-depth perspective on all 33 Top TSX Dividend Stocks by using our screener here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:ARE TSX:SES and TSX:TOT.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]