Top 3 TSX Stocks That Could Be Undervalued In August 2024

The Canadian market has been relatively steady, with investors closely watching the U.S. Federal Reserve's signals from the recent Jackson Hole symposium, anticipating potential rate cuts in the near future. In this environment of cautious optimism, identifying undervalued stocks can be a strategic move for investors looking to capitalize on potential growth opportunities amidst evolving monetary policies.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

Name | Current Price | Fair Value (Est) | Discount (Est) |

goeasy (TSX:GSY) | CA$188.59 | CA$357.94 | 47.3% |

Alvopetro Energy (TSXV:ALV) | CA$5.10 | CA$9.00 | 43.3% |

Computer Modelling Group (TSX:CMG) | CA$12.62 | CA$22.24 | 43.2% |

Kinaxis (TSX:KXS) | CA$151.20 | CA$280.04 | 46% |

Obsidian Energy (TSX:OBE) | CA$9.38 | CA$18.11 | 48.2% |

Africa Oil (TSX:AOI) | CA$2.11 | CA$3.67 | 42.5% |

Calibre Mining (TSX:CXB) | CA$2.33 | CA$4.54 | 48.7% |

Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

NFI Group (TSX:NFI) | CA$19.17 | CA$37.32 | 48.6% |

NanoXplore (TSX:GRA) | CA$2.20 | CA$4.18 | 47.4% |

Let's review some notable picks from our screened stocks.

Computer Modelling Group

Overview: Computer Modelling Group Ltd. is a software and consulting technology company that develops and licenses reservoir simulation and seismic interpretation software, with a market cap of CA$1.03 billion.

Operations: Revenue from reservoir simulation and seismic interpretation software and related services totaled CA$90.29 million, with an additional segment adjustment of CA$28.16 million.

Estimated Discount To Fair Value: 43.2%

Computer Modelling Group (CMG) is trading at CA$12.62, significantly below its estimated fair value of CA$22.24, suggesting it may be undervalued based on discounted cash flow analysis. Despite a recent drop in profit margins and net income for Q1 2024, CMG's earnings are forecast to grow faster than the Canadian market at 24.6% annually. Additionally, their innovative CCS solutions have gained traction with major projects like Sval Energi’s Trudvang project, enhancing long-term growth prospects.

Kinaxis

Overview: Kinaxis Inc. offers cloud-based subscription software for supply chain operations across the United States, Europe, Asia, and Canada with a market cap of CA$4.30 billion.

Operations: The company generates $457.72 million from its Software & Programming segment.

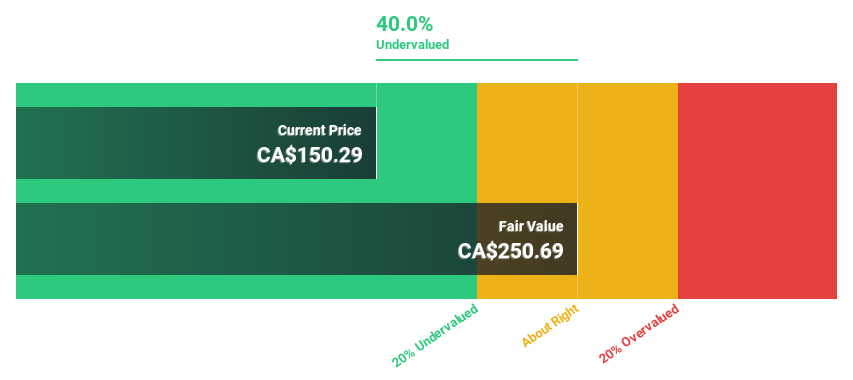

Estimated Discount To Fair Value: 46%

Kinaxis, trading at CA$151.2, is significantly undervalued with an estimated fair value of CA$280.04 based on discounted cash flow analysis. Despite recent insider selling, the company's earnings grew by 137.9% last year and are forecast to grow 48% annually over the next three years, outpacing the Canadian market. Recent client wins with Brother and Syensqo highlight Kinaxis' robust demand forecasting capabilities and supply chain solutions, supporting its long-term growth potential.

NFI Group

Overview: NFI Group Inc., with a market cap of CA$2.28 billion, manufactures and sells buses across North America, the United Kingdom, Europe, and the Asia Pacific through its subsidiaries.

Operations: The company's revenue segments include $599.83 million from Aftermarket Operations and $2.47 billion from Manufacturing Operations.

Estimated Discount To Fair Value: 48.6%

NFI Group, trading at CA$19.17, is significantly undervalued with an estimated fair value of CA$37.32 based on discounted cash flow analysis. Despite recent dilution and interest payments not being well covered by earnings, NFI's revenue is forecast to grow 16.3% annually, outpacing the Canadian market's 6.9%. Recent earnings showed a turnaround with net income of US$2.55 million for Q2 2024 compared to a loss last year, indicating improving cash flows and potential profitability within three years.

Turning Ideas Into Actions

Explore the 29 names from our Undervalued TSX Stocks Based On Cash Flows screener here.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:CMG TSX:KXS and TSX:NFI.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]