Top Dividend Stocks To Consider In July 2024

As the United States market navigates through a cautious phase with retail investors holding back on aggressive buying ahead of earnings season, dividend stocks remain a compelling consideration for those seeking steady income streams. In light of current economic dynamics and market sentiment, such stocks could offer relative stability and consistent returns amidst broader market fluctuations.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

Columbia Banking System (NasdaqGS:COLB) | 7.53% | ★★★★★★ |

Resources Connection (NasdaqGS:RGP) | 5.47% | ★★★★★★ |

Premier Financial (NasdaqGS:PFC) | 6.32% | ★★★★★★ |

OceanFirst Financial (NasdaqGS:OCFC) | 5.21% | ★★★★★★ |

Silvercrest Asset Management Group (NasdaqGM:SAMG) | 5.17% | ★★★★★★ |

Dillard's (NYSE:DDS) | 4.88% | ★★★★★★ |

Citizens Financial Group (NYSE:CFG) | 4.77% | ★★★★★★ |

CompX International (NYSEAM:CIX) | 5.31% | ★★★★★★ |

Regions Financial (NYSE:RF) | 4.92% | ★★★★★★ |

Huntington Bancshares (NasdaqGS:HBAN) | 4.83% | ★★★★★★ |

Click here to see the full list of 210 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Credicorp

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Credicorp Ltd. is a diversified financial services company offering banking, insurance, and health services primarily in Peru, with a market capitalization of approximately $12.97 billion.

Operations: Credicorp Ltd. generates its revenue from diversified financial services including banking, insurance, and health-related services mainly in Peru.

Dividend Yield: 5.7%

Credicorp Ltd. trades 33% below estimated fair value with earnings expected to grow by 11.16% annually. Despite a high bad loans ratio at 6.2%, dividends are covered by earnings at a 55.7% payout ratio, though the dividend record has been unstable and unreliable over the past decade. Recent positive developments include a reported net income increase to PEN 1,511.66 million in Q1 2024 and an increased dividend announcement of PEN 35 per share, payable on June 14th, without withholding tax.

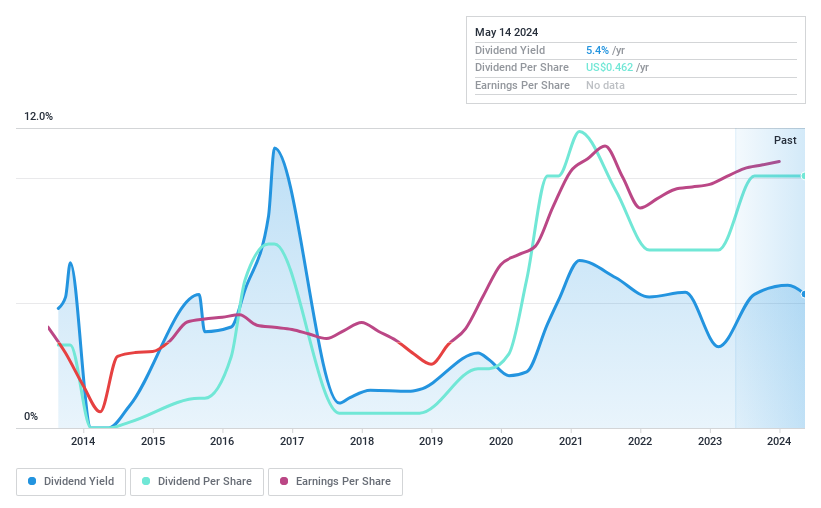

DRDGOLD

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DRDGOLD Limited is a South African gold mining company specializing in the retreatment of surface gold tailings, with a market capitalization of approximately $808.95 million.

Operations: DRDGOLD Limited generates its revenue primarily through two segments: Ergo, which brought in ZAR 4.34 billion, and FWGR, contributing ZAR 1.47 billion.

Dividend Yield: 5%

DRDGOLD has seen a 14.9% earnings growth over the past year and forecasts revenue growth at 21.23% annually. Despite a dividend yield of 4.98%, which ranks in the top quartile for US stocks, its dividends are not well supported by free cash flow or earnings, indicating potential sustainability issues. Additionally, while dividends have increased over the decade, they've also been notably volatile and unreliable, with a payout ratio at 54.8%. The company's P/E ratio stands favorable at 11x compared to the US market average of 16.6x.

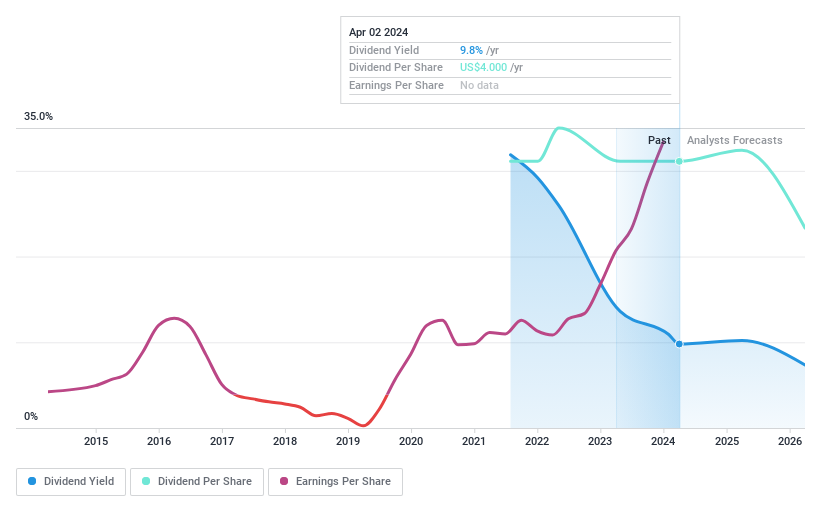

DorianG

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dorian LPG Ltd., operating globally, specializes in transporting liquefied petroleum gas using its fleet of LPG tankers, with a market capitalization of approximately $1.86 billion.

Operations: Dorian LPG Ltd. generates its revenue primarily from international transportation services, amounting to $558.83 million.

Dividend Yield: 9.2%

Dorian LPG Ltd. recently declared an irregular dividend of US$1.00 per share, payable on May 30, 2024, totaling approximately US$40.6 million. Despite a stable recent payout, the company's dividend history is short and erratic over the past three years with a high yield of 9.16%. Financially, Dorian LPG shows robust annual earnings growth of 78.3%, but future earnings are expected to decline by an average of 32.7% annually over the next three years, questioning the sustainability of future dividends despite a reasonable payout ratio of 52.4% and cash payout ratio at 47.9%. The stock's valuation appears attractive with a P/E ratio significantly below the market average at just 6.1x.

Delve into the full analysis dividend report here for a deeper understanding of DorianG.

Our expertly prepared valuation report DorianG implies its share price may be too high.

Make It Happen

Click this link to deep-dive into the 210 companies within our Top Dividend Stocks screener.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NYSE:BAP NYSE:DRD and NYSE:LPG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]