Top Dividend Stocks On Euronext Amsterdam For September 2024

As European markets continue to rally with inflation nearing the ECB's target, investors are increasingly looking for stable income sources amid economic optimism. In this context, dividend stocks on Euronext Amsterdam offer a compelling option for those seeking reliable returns. When evaluating dividend stocks, it's crucial to consider factors such as the company's payout ratio, historical dividend consistency, and overall financial health. Given the current market conditions—marked by cautious optimism and steady economic indicators—these attributes can help identify robust investment opportunities in the Dutch market.

Top 5 Dividend Stocks In The Netherlands

Name | Dividend Yield | Dividend Rating |

Koninklijke Heijmans (ENXTAM:HEIJM) | 3.53% | ★★★★☆☆ |

Aalberts (ENXTAM:AALB) | 3.20% | ★★★★☆☆ |

Randstad (ENXTAM:RAND) | 5.25% | ★★★★☆☆ |

ABN AMRO Bank (ENXTAM:ABN) | 9.69% | ★★★★☆☆ |

Signify (ENXTAM:LIGHT) | 7.08% | ★★★★☆☆ |

ING Groep (ENXTAM:INGA) | 6.74% | ★★★★☆☆ |

Acomo (ENXTAM:ACOMO) | 6.53% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Aalberts

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aalberts N.V. provides mission-critical technologies for the aerospace, automotive, building, and maritime sectors with a market cap of €3.90 billion.

Operations: Aalberts N.V. generates revenue from Building Technology (€1.74 billion) and Industrial Technology (€1.49 billion).

Dividend Yield: 3.2%

Aalberts N.V. has a mixed dividend profile, with a current yield of 3.2%, which is below the top 25% of Dutch dividend payers. Despite this, its dividends are well-covered by both earnings (41% payout ratio) and free cash flows (60.4% cash payout ratio). However, the company has had an unstable dividend track record over the past decade. Recent earnings showed a slight decline in sales and net income for H1 2024 compared to last year, but Aalberts continues to invest in growth with new facilities aimed at enhancing production efficiency and sustainability in Almere.

Take a closer look at Aalberts' potential here in our dividend report.

Our valuation report unveils the possibility Aalberts' shares may be trading at a discount.

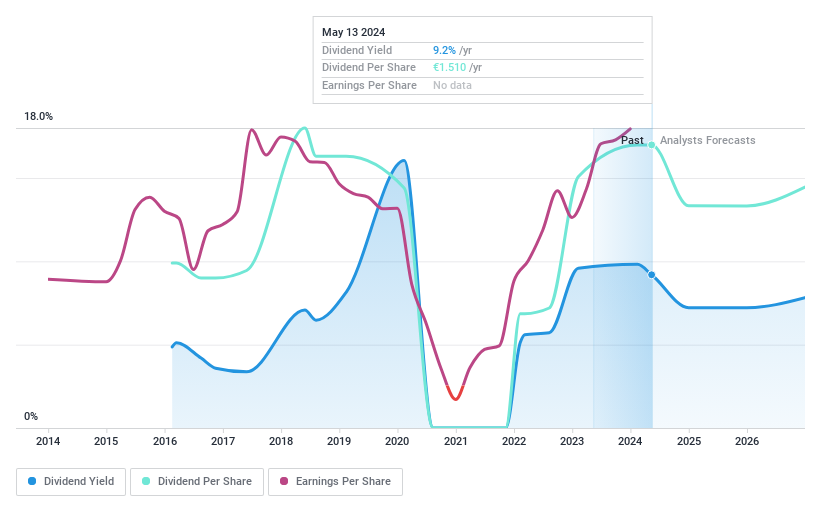

ABN AMRO Bank

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ABN AMRO Bank N.V. offers a range of banking products and financial services to retail, private, and business clients both in the Netherlands and internationally, with a market cap of €12.98 billion.

Operations: ABN AMRO Bank N.V.'s revenue segments include Corporate Banking (€3.46 billion), Wealth Management (€1.55 billion), and Personal & Business Banking (€4.02 billion).

Dividend Yield: 9.7%

ABN AMRO Bank's dividend profile shows a mixed picture. While the dividend yield of 9.69% places it in the top 25% of Dutch dividend payers, its track record is unstable, with payments being volatile over the past nine years. The current payout ratio of 50.5% indicates dividends are covered by earnings and are forecast to remain sustainable at 47.1%. Recent earnings reported a slight decline, with net income at €1.32 billion for H1 2024 compared to €1.39 billion last year, and an interim dividend set at €0.60 per share amounting to €500 million.

ING Groep

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ING Groep N.V. offers a range of banking products and services across the Netherlands, Belgium, Germany, the rest of Europe, and internationally, with a market cap of €52.14 billion.

Operations: ING Groep N.V.'s revenue segments include Retail Banking in the Netherlands (€4.97 billion), Belgium (€2.61 billion), and Germany (€2.97 billion), as well as Wholesale Banking (€6.69 billion) and Corporate Line Banking (€334 million).

Dividend Yield: 6.7%

ING Groep's recent earnings report showed a decline in net income to €1.78 billion for Q2 2024 from €2.16 billion a year ago, with net interest income also down. The company affirmed an interim dividend of €0.35 per share, maintaining its distribution policy despite the earnings drop. ING has been active in share buybacks, repurchasing significant shares worth billions this year. Though its dividend yield is attractive and covered by earnings, the payout history has been volatile over the past nine years.

Click here and access our complete dividend analysis report to understand the dynamics of ING Groep.

The valuation report we've compiled suggests that ING Groep's current price could be quite moderate.

Taking Advantage

Explore the 7 names from our Top Euronext Amsterdam Dividend Stocks screener here.

Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTAM:AALB ENXTAM:ABN and ENXTAM:INGA.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]