Top Dividend Stocks On Euronext Paris In August 2024

As the European economy experiences a boost from the Paris Olympics and hopes rise for interest rate cuts by central banks, France's CAC 40 Index has gained significant traction. In this favorable market environment, investors are increasingly looking at dividend stocks as a reliable source of income and stability. A good dividend stock typically offers consistent payouts, strong financial health, and resilience in varying economic conditions—qualities that are particularly appealing amid current optimistic market sentiments.

Top 10 Dividend Stocks In France

Name | Dividend Yield | Dividend Rating |

Vicat (ENXTPA:VCT) | 6.39% | ★★★★★★ |

Rubis (ENXTPA:RUI) | 6.78% | ★★★★★★ |

CBo Territoria (ENXTPA:CBOT) | 6.78% | ★★★★★★ |

Samse (ENXTPA:SAMS) | 6.12% | ★★★★★☆ |

Arkema (ENXTPA:AKE) | 4.17% | ★★★★★☆ |

VIEL & Cie société anonyme (ENXTPA:VIL) | 4.00% | ★★★★★☆ |

Caisse Régionale de Crédit Agricole Mutuel du Languedoc Société coopérative (ENXTPA:CRLA) | 5.72% | ★★★★★☆ |

Exacompta Clairefontaine (ENXTPA:ALEXA) | 4.62% | ★★★★★☆ |

Piscines Desjoyaux (ENXTPA:ALPDX) | 7.97% | ★★★★★☆ |

Eiffage (ENXTPA:FGR) | 4.38% | ★★★★☆☆ |

Click here to see the full list of 34 stocks from our Top Euronext Paris Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

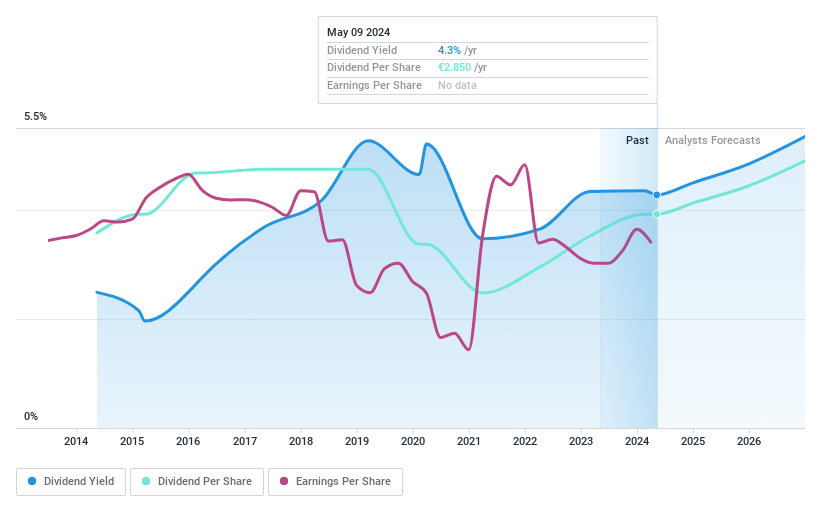

Société BIC

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Société BIC SA manufactures and sells stationery, lighters, shavers, and other products worldwide with a market cap of €2.52 billion.

Operations: Société BIC SA generates its revenue from four main segments: Flame for Life (€820 million), Blade Excellence (€540 million), Human Expression (€838 million), and Other Products (€29 million).

Dividend Yield: 4.7%

Société BIC's earnings grew by 19.6% over the past year, and its dividend payments are well-covered by both earnings (payout ratio: 55.4%) and cash flows (cash payout ratio: 41.9%). However, dividend reliability has been an issue, with a volatile history over the past decade despite overall growth in payouts. Recent financial results show mixed performance with Q2 sales at €617.8 million down from €638.2 million last year but net income increased to €77.2 million from €70.8 million previously.

Dive into the specifics of Société BIC here with our thorough dividend report.

Upon reviewing our latest valuation report, Société BIC's share price might be too pessimistic.

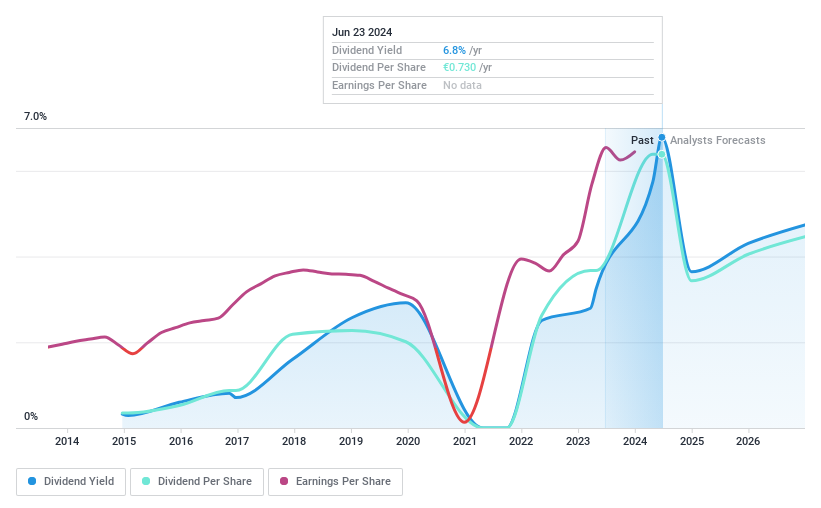

Bénéteau

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bénéteau S.A. designs, manufactures, and sells boats and leisure homes in France and internationally, with a market cap of €742.19 million.

Operations: Bénéteau S.A. generates revenue primarily from its boat segment, which accounts for €1.47 billion.

Dividend Yield: 8%

Bénéteau's dividend yield of 7.96% places it among the top 25% of French dividend payers but has been unreliable over the past decade, with significant volatility. Although its payout ratio is low at 37.2%, indicating dividends are well-covered by earnings, the lack of free cash flows raises concerns about sustainability. Additionally, future earnings are forecast to decline by an average of 21.9% annually over the next three years, potentially impacting future dividend stability.

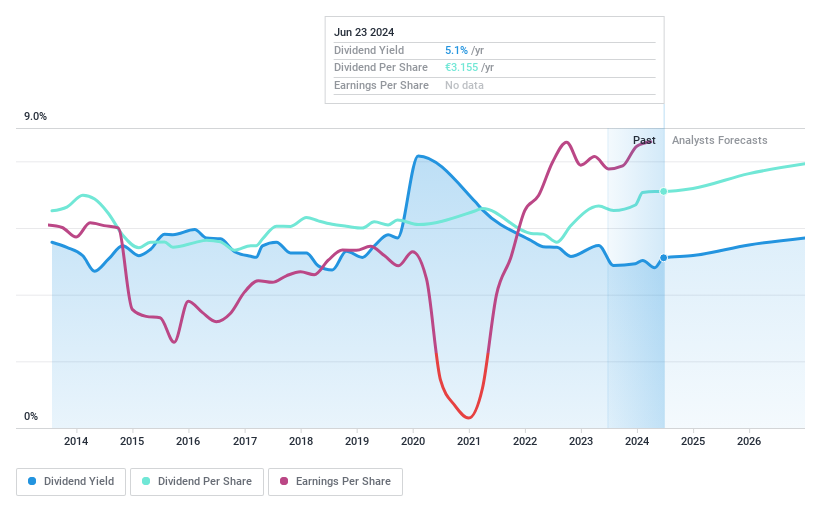

TotalEnergies

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: TotalEnergies SE is a multi-energy company that produces and markets oil, biofuels, natural gas, green gases, renewables, and electricity across France, Europe, North America, Africa, and internationally with a market cap of €144.36 billion.

Operations: TotalEnergies SE's revenue segments include Integrated LNG ($21.46 billion), Integrated Power ($27.01 billion), Marketing & Services ($71.38 billion), Refining & Chemicals ($134.98 billion), and Exploration & Production ($47.20 billion).

Dividend Yield: 4.9%

TotalEnergies has a solid dividend coverage with a payout ratio of 37.7%, supported by both earnings and cash flows, making its dividends sustainable. However, the dividend yield of 4.91% is below the top quartile in France, and past dividend payments have been volatile. Recent business expansions into renewable energy and strategic alliances indicate a focus on long-term growth despite current forecasts predicting an average annual earnings decline of 4% over the next three years.

Next Steps

Gain an insight into the universe of 34 Top Euronext Paris Dividend Stocks by clicking here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ENXTPA:BB ENXTPA:BEN and ENXTPA:TTE.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]