Top Dividend Stocks On The Indian Exchange

Over the last 7 days, the Indian market has risen by 1.0%, contributing to a remarkable 39% increase over the past year, with earnings projected to grow by 17% annually in the coming years. In this thriving environment, identifying strong dividend stocks can be crucial for investors seeking steady income and potential capital appreciation amidst robust market conditions.

Top 10 Dividend Stocks In India

Name | Dividend Yield | Dividend Rating |

Castrol India (BSE:500870) | 3.58% | ★★★★★★ |

Balmer Lawrie Investments (BSE:532485) | 4.60% | ★★★★★★ |

D. B (NSEI:DBCORP) | 5.10% | ★★★★★☆ |

Indian Oil (NSEI:IOC) | 8.31% | ★★★★★☆ |

VST Industries (BSE:509966) | 3.59% | ★★★★★☆ |

Redington (NSEI:REDINGTON) | 3.46% | ★★★★★☆ |

Balmer Lawrie (BSE:523319) | 3.30% | ★★★★★☆ |

Canara Bank (NSEI:CANBK) | 3.09% | ★★★★★☆ |

PTC India (NSEI:PTC) | 4.15% | ★★★★★☆ |

Bank of Baroda (NSEI:BANKBARODA) | 3.11% | ★★★★★☆ |

Click here to see the full list of 19 stocks from our Top Indian Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Bharat Petroleum

Simply Wall St Dividend Rating: ★★★★★☆

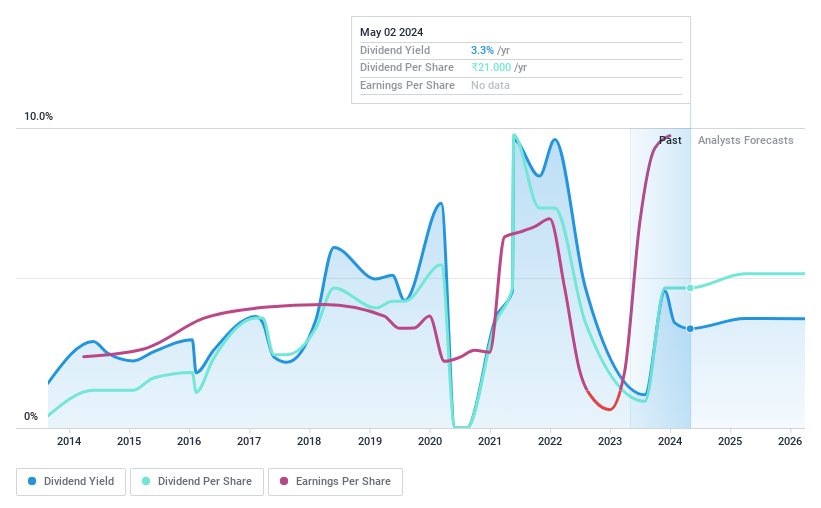

Overview: Bharat Petroleum Corporation Limited focuses on refining crude oil and marketing petroleum products both in India and internationally, with a market capitalization of ?1.52 trillion.

Operations: Bharat Petroleum Corporation Limited generates revenue primarily from its Downstream Petroleum segment, accounting for ?5.07 billion, and from Exploration & Production of Hydrocarbons, contributing ?1.92 million.

Dividend Yield: 6%

Bharat Petroleum offers a compelling dividend yield of 5.99%, ranking in the top 25% among Indian dividend payers, supported by a low payout ratio of 33.3%. However, its dividends have been volatile over the past decade. Despite trading at a favorable valuation with an 8x P/E ratio, it faces challenges due to high debt levels and forecasted earnings decline. Recent strategic moves into renewable energy through joint ventures may influence future financial stability and dividend sustainability.

Click here to discover the nuances of Bharat Petroleum with our detailed analytical dividend report.

Indian Oil

Simply Wall St Dividend Rating: ★★★★★☆

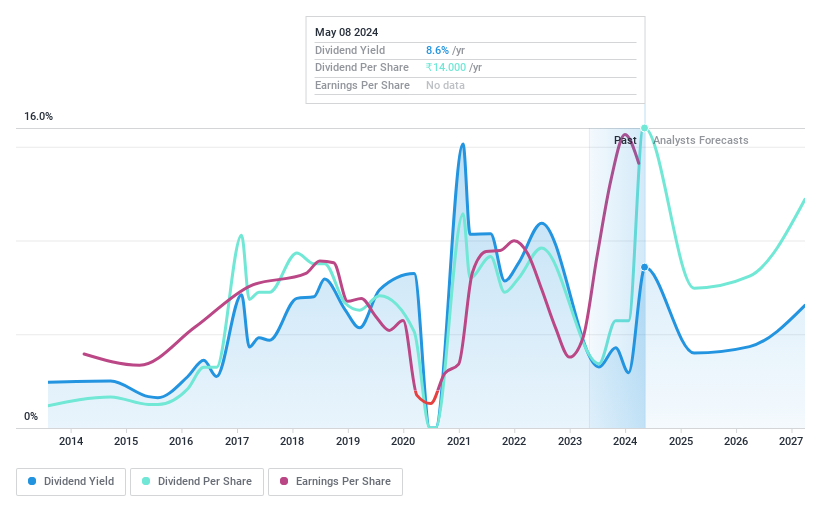

Overview: Indian Oil Corporation Limited, along with its subsidiaries, engages in refining, pipeline transportation, and marketing of petroleum products both in India and internationally, with a market cap of ?2.32 trillion.

Operations: Indian Oil Corporation Limited generates revenue primarily from its petroleum products segment, amounting to ?8.25 trillion, and its petrochemicals segment, contributing ?262.95 billion.

Dividend Yield: 8.3%

Indian Oil Corporation's dividend yield of 8.31% places it in the top quartile of Indian dividend payers, backed by a manageable payout ratio of 39.6%. While dividends have grown over the past decade, they remain volatile. The company's P/E ratio at 7.5x suggests it trades at a good value compared to the market average. A recent joint venture in biofuels aligns with its low-carbon strategy but earnings are forecasted to decline, posing potential risks to future dividends.

Uniparts India

Simply Wall St Dividend Rating: ★★★★☆☆

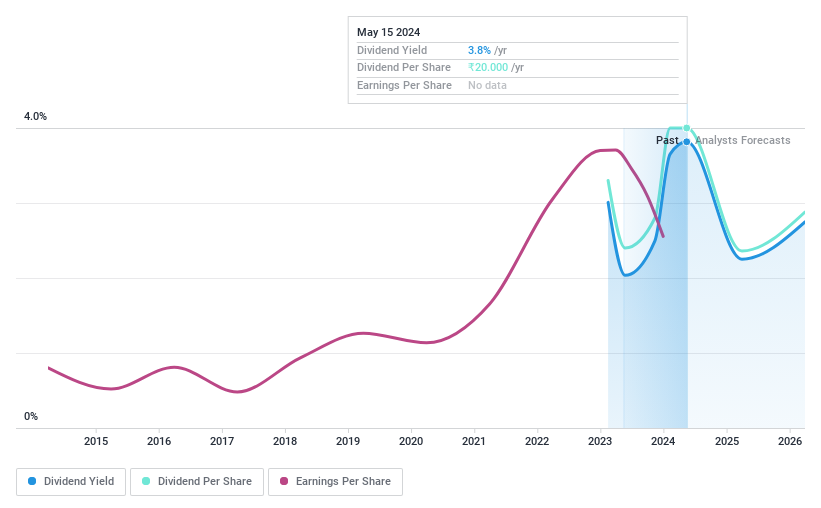

Overview: Uniparts India Limited, along with its subsidiaries, specializes in manufacturing and selling engineering systems, solutions, and assemblies mainly for off-highway vehicles across India and various international markets including the United States, Asia Pacific, Europe, and Japan; it has a market cap of ?20.54 billion.

Operations: Uniparts India Limited generates revenue primarily from its Linkage Parts and Components for Off-Highway Vehicles segment, amounting to ?11.04 billion.

Dividend Yield: 4.5%

Uniparts India's dividend yield of 4.52% ranks it among the top 25% of Indian dividend payers, supported by a payout ratio of 73.8%, indicating dividends are covered by earnings and cash flows. Despite trading at a favorable P/E ratio of 18.3x compared to the market, its dividend history is less stable with recent volatility in payments. The company approved two interim dividends totaling INR 14 per share in September, reflecting ongoing shareholder returns amidst fluctuating earnings performance.

Make It Happen

Reveal the 19 hidden gems among our Top Indian Dividend Stocks screener with a single click here.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NSEI:BPCL NSEI:IOC and NSEI:UNIPARTS.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]