The top food delivery companies to watch in 2019

Despite increasing competition and a shrinking lead in market share, food delivery unicorn GrubHub (GRUB) is up nearly 160% since its 2014 IPO.

Now, as delivery competitors gear up to potentially go public in 2019, there may be more opportunities for investors to get in on a market that’s projected to grow over 630% by 2020, according to Morgan Stanley estimates.

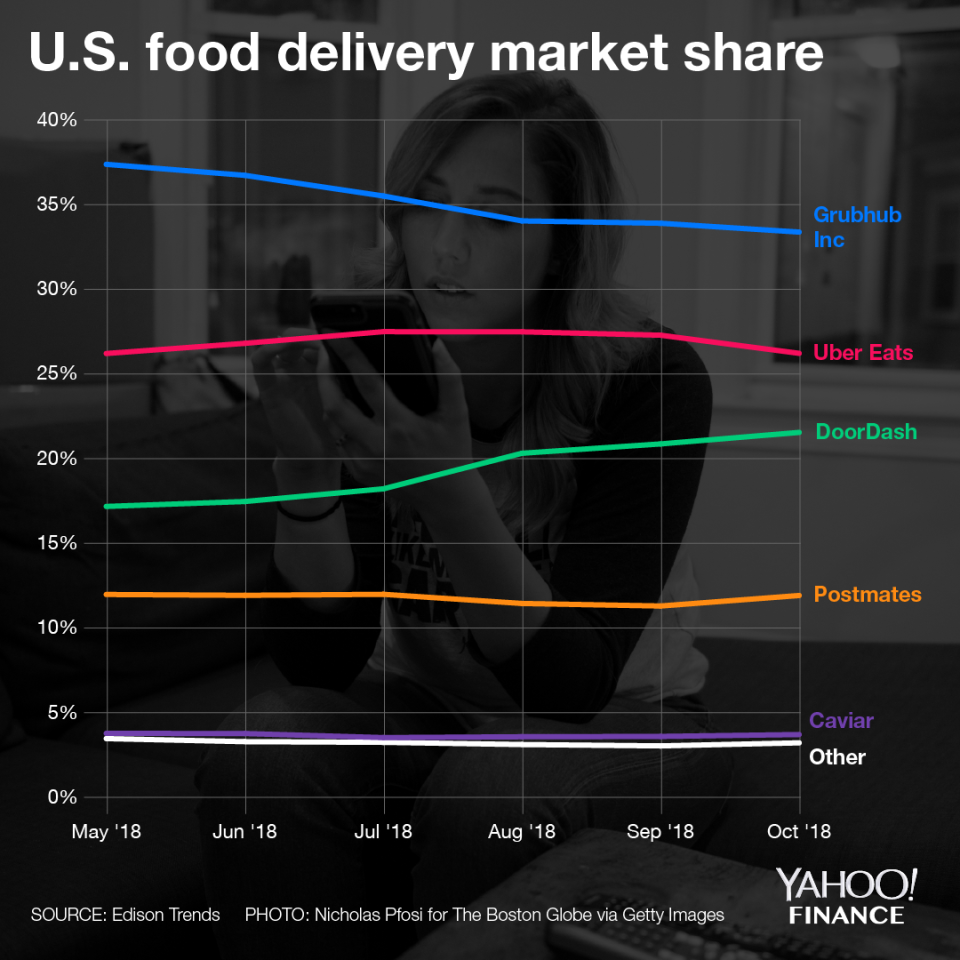

Between UberEats, DoorDash, and Postmates, we could see the top three privately-held delivery names all take the plunge to go public next year. Collectively, those names together account for roughly 60% of the U.S. market, according to data compiled by Edison Trends for Yahoo Finance. Since May of 2018, DoorDash’s market share has increased by 4%, while GrubHub’s has declined by the same amount.

Race for cash

Each of the companies in the space have raised significant rounds as recently as this summer to expand their offerings to new markets in an increasingly crowded space. Postmates, founded in 2011, raised $300 million this summer in a round led by investment firm Tiger Global that valued it at $1.2 billion, according to Fortune. DoorDash, founded in 2013, raised $800 million across two separate rounds this year: A $535 million round led by SoftBank that valued the company at $1.4 billion in March, which came before a $250 million round in August that more than doubled its valuation to $4 billion.

What may be more impressive than both of those unicorn milestones, however, is the fact that Uber CEO Dara Khosrowshahi revealed earlier this year at Recode’s May Code Conference that UberEats topped a $6 billion run rate just four years after entering the delivery space in 2014. The success even prompted a renewed look into the grocery delivery space. To compare, GrubHub is on pace to hit around $5 billion in total food sales for 2018. UberEats also reportedly earned a valuation of around $20 billion in IPO proposals from Morgan Stanley and Goldman Sachs, the two banks seeking to lock up the lead underwriting position. Whether there’s investor demand in Uber at a valuation that high remains to be seen.

But as the battle over many of the same customers, delivery drivers, and restaurants intensifies, it’s not surprising to see these companies increasingly raising capital, according to Atish Davda, co-founder of EquityZen, a platform for buying and selling private company shares that’s worked with one out of every three unicorns.

“At the end of the day it’s about scale and who is going to have more restaurants and faster delivery times,” he said. “But also, because of the growth in the industry, there’s real pressure to scale otherwise they are going to be left behind.”

Offering price concessions to lock up delivery partnerships at major restaurants, like Chipotle’s partnership with DoorDash, UberEats’ arrangement with McDonald’s, or GrubHub’s deals with Yum! Brands, will likely continue to be ways to fuel growth, albeit at a cost. GrubHub’s publicly reported gross profit margins have slipped every quarter this year to a 2018 low of 46%. As more pressure mounts with increasingly well-funded competitors nipping at its heels, it may be an important number to keep an eye on.

This is the third installment in a series looking at what to expect in the 2019 IPO market. Our first story highlighted the trends investors need to look out for heading into next year. Our second compared two of the most high profile IPOs expected next year — Uber and Lyft.

Zack Guzman is a senior writer and on-air reporter covering entrepreneurship, startups, and breaking news at Yahoo Finance. Follow him on Twitter @zGuz.

Read more:

Why 2019’s IPO outlook is bleaker than it should be

Where SoftBank’s Vision Fund is deploying its $100 billion

Juul surpasses Facebook as fastest startup to reach decacorn status