Top German Dividend Stocks For October 2024

As the German economy faces a challenging year with predictions of contraction and a notable drop in factory orders, investors are keenly observing how these factors impact market dynamics. Despite these hurdles, dividend stocks remain an attractive option for those seeking steady income streams amidst economic uncertainty. In such times, strong dividend-paying stocks can provide stability and potential income, making them appealing to investors looking to navigate the current market landscape.

Top 10 Dividend Stocks In Germany

Name | Dividend Yield | Dividend Rating |

Edel SE KGaA (XTRA:EDL) | 6.22% | ★★★★★★ |

Deutsche Post (XTRA:DHL) | 4.87% | ★★★★★★ |

SAF-Holland (XTRA:SFQ) | 5.93% | ★★★★★☆ |

OVB Holding (XTRA:O4B) | 4.69% | ★★★★★☆ |

DATA MODUL Produktion und Vertrieb von elektronischen Systemen (XTRA:DAM) | 7.35% | ★★★★★☆ |

Uzin Utz (XTRA:UZU) | 3.29% | ★★★★★☆ |

Mercedes-Benz Group (XTRA:MBG) | 9.34% | ★★★★★☆ |

Allianz (XTRA:ALV) | 4.58% | ★★★★★☆ |

FRoSTA (DB:NLM) | 3.39% | ★★★★★☆ |

MVV Energie (XTRA:MVV1) | 3.76% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top German Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

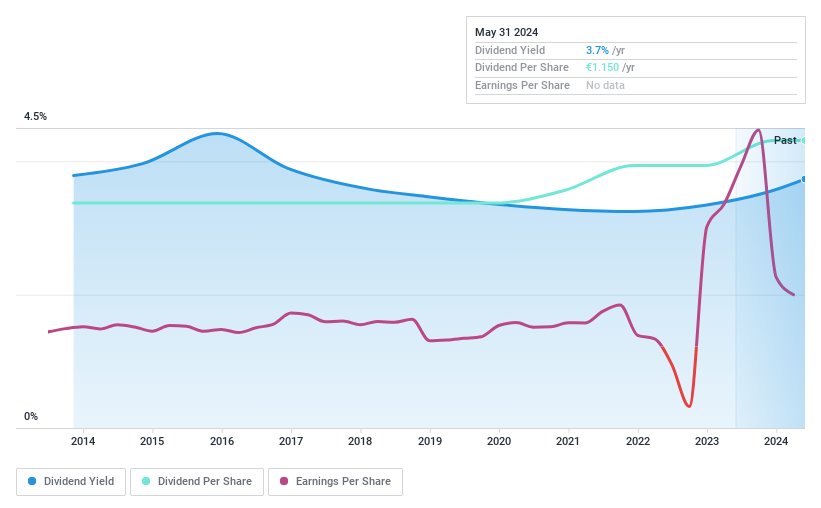

MVV Energie

Simply Wall St Dividend Rating: ★★★★★☆

Overview: MVV Energie AG, along with its subsidiaries, operates in Germany offering electricity, heat, gas, water, and waste treatment and disposal services with a market cap of €2.02 billion.

Operations: MVV Energie AG's revenue segments include electricity (€2.34 billion), heat (€1.05 billion), gas (€1.73 billion), water (€0.11 billion), and waste treatment and disposal (€0.36 billion).

Dividend Yield: 3.8%

MVV Energie's dividend yield of 3.76% is lower than the top quartile of German dividend payers but remains reliable and stable, having grown over the past decade. The company's dividends are well-covered by both earnings (payout ratio: 47.1%) and cash flows (cash payout ratio: 59.9%). Despite a recent decline in net income due to significant one-off items, MVV maintains a favorable price-to-earnings ratio of 12.5x compared to the broader market's 16.4x, though its high debt level warrants attention for potential investors.

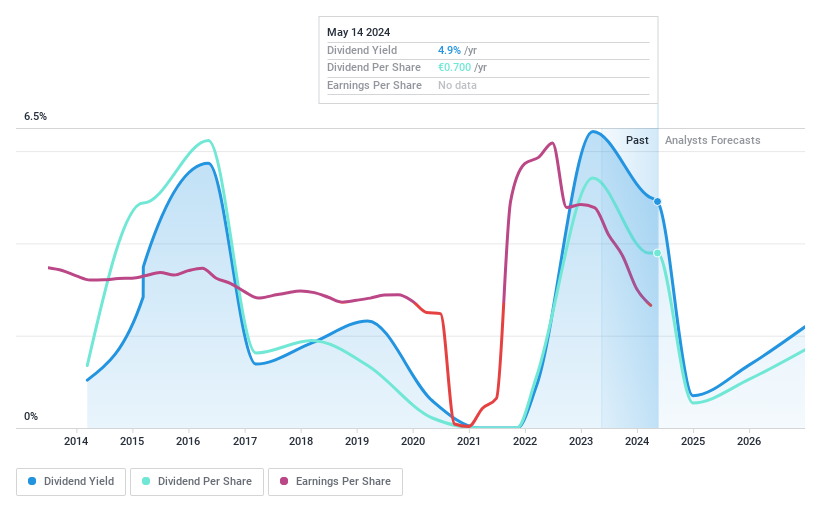

K+S

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: K+S Aktiengesellschaft, with a market cap of €1.88 billion, operates globally as a supplier of mineral products for the agricultural, industrial, consumer, and community sectors.

Operations: K+S Aktiengesellschaft generates revenue of €3.72 billion from its Operating Unit Europe+.

Dividend Yield: 6.7%

K+S offers a dividend yield of 6.66%, ranking in the top 25% of German dividend payers, yet its sustainability is questionable due to a high payout ratio of 2952.2%. Despite increased sales in Q2, profit margins have significantly declined from last year, and earnings do not adequately cover dividends. Although dividends have grown over the past decade, they remain volatile and unreliable. Recent presentations at investment conferences highlight ongoing investor engagement amidst financial challenges.

Dive into the specifics of K+S here with our thorough dividend report.

Our valuation report unveils the possibility K+S' shares may be trading at a premium.

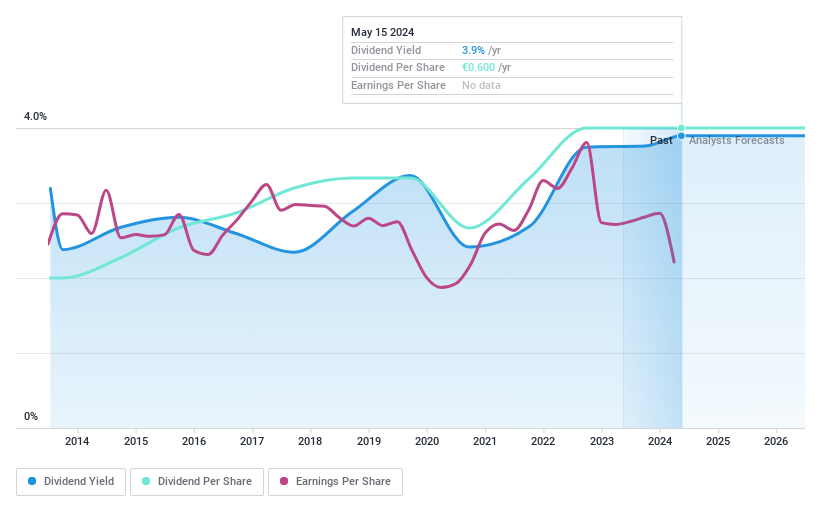

Schloss Wachenheim

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Schloss Wachenheim AG is a producer and distributor of sparkling and semi-sparkling wine products in Europe and internationally, with a market cap of €122.76 million.

Operations: Schloss Wachenheim AG generates its revenue primarily from the Alcoholic Beverages segment, amounting to €441.51 million.

Dividend Yield: 3.9%

Schloss Wachenheim's dividend yield of 3.87% is below the top tier in Germany, but its payout ratio of 50.2% suggests dividends are covered by earnings despite a lack of free cash flows. While recent earnings show a slight decline in net income to €9.47 million, dividends have been stable and growing over the past decade with little volatility. However, sustainability concerns persist due to insufficient coverage by cash flows, impacting long-term reliability for investors seeking consistent returns.

Turning Ideas Into Actions

Click this link to deep-dive into the 33 companies within our Top German Dividend Stocks screener.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:MVV1 XTRA:SDF and XTRA:SWA.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]