Top German Growth Companies With High Insider Ownership September 2024

The German market has seen a notable uptick, with the DAX rising 2.17% following an interest rate cut from the European Central Bank. This positive momentum comes amid signs of weakening economic growth and slowing inflation in the eurozone. In this environment, growth companies with high insider ownership can be particularly attractive as they often indicate strong internal confidence in future performance and alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership In Germany

Name | Insider Ownership | Earnings Growth |

pferdewetten.de (XTRA:EMH) | 26.8% | 70.6% |

Stemmer Imaging (XTRA:S9I) | 25.2% | 23.2% |

Deutsche Beteiligungs (XTRA:DBAN) | 39.5% | 54.1% |

Exasol (XTRA:EXL) | 25.3% | 117.1% |

adidas (XTRA:ADS) | 16.6% | 41.8% |

Alelion Energy Systems (DB:2FZ) | 37.4% | 106.6% |

Stratec (XTRA:SBS) | 30.9% | 20% |

Beyond Frames Entertainment (DB:8WP) | 10.8% | 112.2% |

Redcare Pharmacy (XTRA:RDC) | 17.4% | 52.1% |

Friedrich Vorwerk Group (XTRA:VH2) | 18% | 24.6% |

Below we spotlight a couple of our favorites from our exclusive screener.

adidas

Simply Wall St Growth Rating: ★★★★★☆

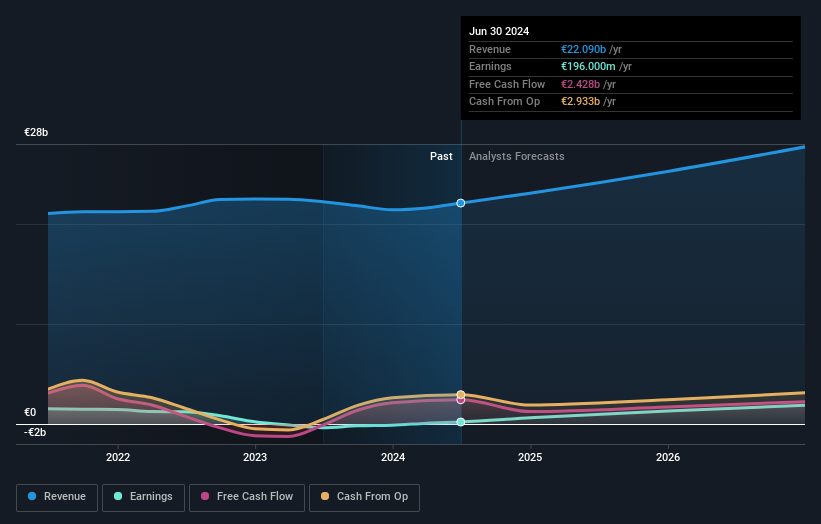

Overview: adidas AG, with a market cap of €39.32 billion, designs, develops, produces, and markets athletic and sports lifestyle products across Europe, the Middle East, Africa, North America, Greater China, the Asia-Pacific region, and Latin America.

Operations: The company's revenue segments include Greater China (€3.26 billion), Latin America (€2.39 billion), and North America (€5.07 billion).

Insider Ownership: 16.6%

Earnings Growth Forecast: 41.8% p.a.

adidas AG, a growth company with high insider ownership in Germany, has shown robust performance with Q2 2024 sales of €5.82 billion and net income of €190 million. The company raised its full-year guidance, expecting operating profit to reach around €1 billion despite unfavorable currency effects. Revenue is forecasted to grow at 8.3% annually, outpacing the German market's 5.4%. Earnings are expected to rise significantly at 41.8% per year over the next three years.

Delve into the full analysis future growth report here for a deeper understanding of adidas.

The valuation report we've compiled suggests that adidas' current price could be quite moderate.

Deutsche Beteiligungs

Simply Wall St Growth Rating: ★★★★★☆

Overview: Deutsche Beteiligungs AG is a private equity and venture capital firm specializing in direct and fund of fund investments, with a market cap of €443.76 million.

Operations: The firm's revenue segments include Fund Investment Services generating €48.00 million and Private Equity Investments contributing €27.01 million.

Insider Ownership: 39.5%

Earnings Growth Forecast: 54.1% p.a.

Deutsche Beteiligungs AG's earnings are forecast to grow significantly at 54.1% per year, well above the German market average of 20%. Despite a recent drop in profit margins from 68.4% to 23.2%, the company is trading at a substantial discount of 62.1% below its estimated fair value. Recent earnings showed revenue and net income declines, but insider participation in a €100 million private placement indicates strong internal confidence in future growth prospects.

Stemmer Imaging

Simply Wall St Growth Rating: ★★★★★☆

Overview: Stemmer Imaging AG provides machine vision technology for various applications globally and has a market cap of €317.85 million.

Operations: Revenue from machine vision technology amounts to €126.23 million.

Insider Ownership: 25.2%

Earnings Growth Forecast: 23.2% p.a.

Stemmer Imaging is experiencing significant growth potential, with earnings forecasted to rise 23.2% annually and revenue expected to grow at 13.3% per year, outpacing the German market. Despite recent declines in sales and net income, the company trades below its estimated fair value by 17.8%. Insider ownership remains strong, evidenced by a recent takeover bid from MiddleGround Capital at €48 per share, representing a substantial premium over recent prices.

Next Steps

Click this link to deep-dive into the 22 companies within our Fast Growing German Companies With High Insider Ownership screener.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include XTRA:ADS XTRA:DBAN and XTRA:S9I.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]