Top Growth Companies With High Insider Ownership On Euronext Paris In October 2024

In October 2024, the French market has been buoyed by a second consecutive interest rate cut from the European Central Bank, which has fueled optimism for further monetary easing and contributed to a modest rise in major stock indexes like France's CAC 40. In this environment of potential economic support, growth companies with high insider ownership are particularly noteworthy as they often indicate strong alignment between management and shareholders, potentially offering resilience and strategic focus amid evolving market conditions.

Top 10 Growth Companies With High Insider Ownership In France

Name | Insider Ownership | Earnings Growth |

VusionGroup (ENXTPA:VU) | 13.4% | 81.7% |

Icape Holding (ENXTPA:ALICA) | 30.2% | 33.9% |

Arcure (ENXTPA:ALCUR) | 21.4% | 26.6% |

STIF Société anonyme (ENXTPA:ALSTI) | 16.4% | 22.9% |

La Fran?aise de l'Energie (ENXTPA:FDE) | 19.9% | 31.9% |

WALLIX GROUP (ENXTPA:ALLIX) | 19.6% | 94.8% |

Adocia (ENXTPA:ADOC) | 11.7% | 64% |

Munic (ENXTPA:ALMUN) | 27.1% | 174.1% |

S.M.A.I.O (ENXTPA:ALSMA) | 17.4% | 103.8% |

MedinCell (ENXTPA:MEDCL) | 15.8% | 93.9% |

Let's take a closer look at a couple of our picks from the screened companies.

Exclusive Networks

Simply Wall St Growth Rating: ★★★★☆☆

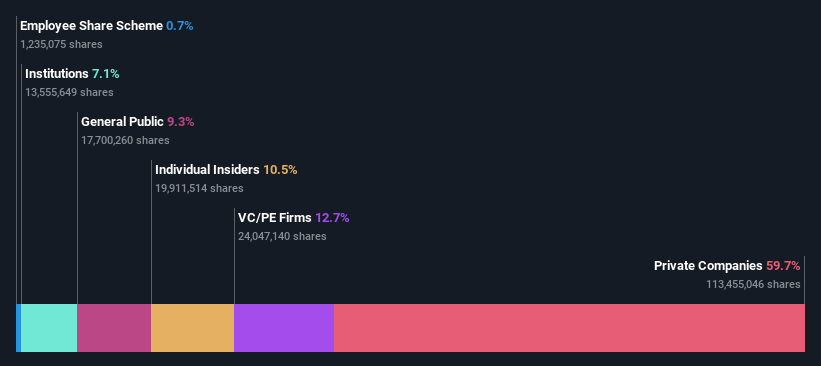

Overview: Exclusive Networks SA is a global cybersecurity specialist focusing on digital infrastructure, with a market cap of €2.14 billion.

Operations: The company's revenue is primarily derived from three regions: EMEA with €4.19 billion, APAC with €480 million, and the Americas with €705 million.

Insider Ownership: 13.1%

Exclusive Networks is poised for significant earnings growth, projected at 33.5% annually, outpacing the French market's average. Despite a recent dip in profit margins from 5.5% to 2.7%, revenue growth is expected at 13.1% per year, surpassing the market rate of 5.6%. With substantial insider ownership and a pending buyout valuing it at €2.2 billion (US$2.4 billion), its strategic direction includes refinancing existing debt post-acquisition by CD&R and Permira consortiums.

OVH Groupe

Simply Wall St Growth Rating: ★★★★☆☆

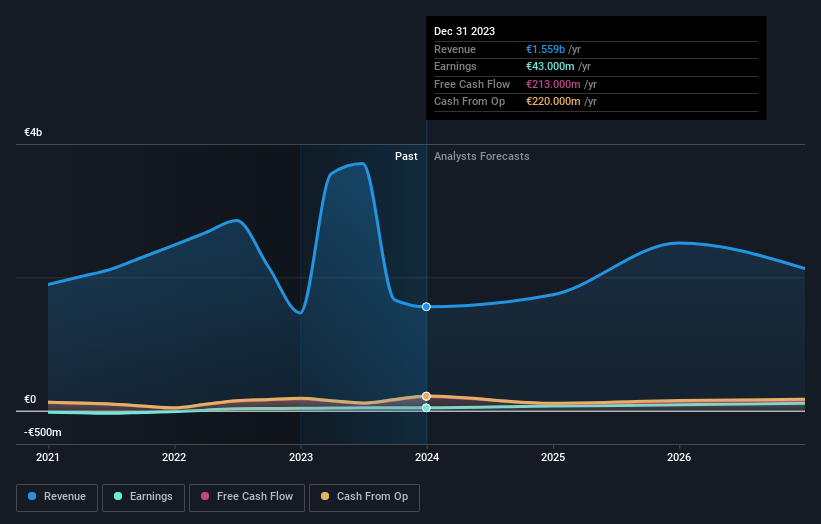

Overview: OVH Groupe S.A. offers public and private cloud services, shared hosting, and dedicated server solutions globally, with a market cap of €1.36 billion.

Operations: The company's revenue segments include €169.01 million from public cloud, €589.61 million from private cloud, and €185.43 million from web cloud services.

Insider Ownership: 10.5%

OVH Groupe is positioned for robust growth, with earnings expected to rise 101.37% annually, surpassing the French market's average. Despite a highly volatile share price recently, it trades at 41.2% below its estimated fair value, suggesting potential undervaluation. Revenue is forecast to grow at 9.7% per year, faster than the market's 5.6%. While insider trading data over the past three months is unavailable, OVH aims for profitability within three years.

VusionGroup

Simply Wall St Growth Rating: ★★★★★★

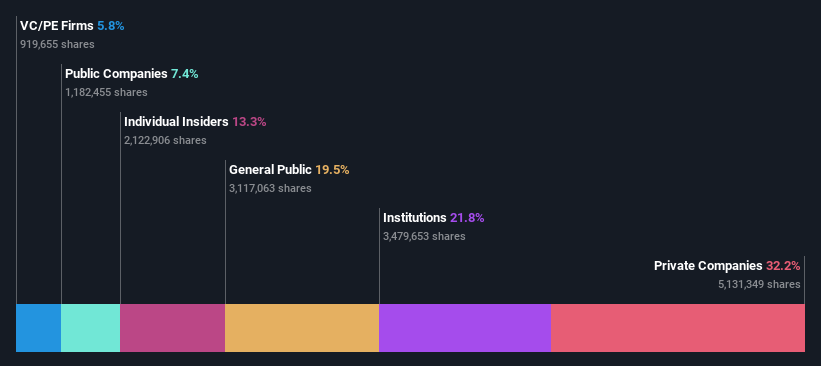

Overview: VusionGroup S.A. offers digitalization solutions for commerce across Europe, Asia, and North America with a market capitalization of €2.26 billion.

Operations: The company's revenue is primarily derived from installing and maintaining electronic shelf labels, totaling €830.16 million.

Insider Ownership: 13.4%

VusionGroup is poised for significant growth, with revenue expected to increase by 28.4% annually, outpacing the French market's 5.6%. Analysts anticipate profitability within three years, supported by a high forecasted return on equity of 25.7%. Despite recent net losses of €24.4 million in H1 2024, a strategic partnership with Ace Hardware highlights VusionGroup's innovative digital solutions and potential for operational efficiency gains in the DIY sector.

Taking Advantage

Get an in-depth perspective on all 23 Fast Growing Euronext Paris Companies With High Insider Ownership by using our screener here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include ENXTPA:EXN ENXTPA:OVH and ENXTPA:VU.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]