Top High Growth Tech Stocks To Watch In The UK August 2024

The market in the United Kingdom has been flat in the last week but has risen 12% over the past 12 months, with earnings expected to grow by 14% annually in the coming years. In this context, identifying high growth tech stocks that align with these promising economic indicators can be a key strategy for investors looking to capitalize on future opportunities.

Top 10 High Growth Tech Companies In The United Kingdom

Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

Altitude Group | 23.46% | 27.56% | ★★★★★☆ |

Filtronic | 21.64% | 33.46% | ★★★★★★ |

YouGov | 14.30% | 29.79% | ★★★★★☆ |

Facilities by ADF | 32.33% | 94.46% | ★★★★★★ |

STV Group | 13.43% | 47.09% | ★★★★★☆ |

Redcentric | 4.89% | 63.79% | ★★★★★☆ |

Trustpilot Group | 16.23% | 31.98% | ★★★★★☆ |

IQGeo Group | 11.49% | 63.61% | ★★★★★☆ |

Beeks Financial Cloud Group | 24.63% | 57.95% | ★★★★★☆ |

Seeing Machines | 24.07% | 93.93% | ★★★★★☆ |

Click here to see the full list of 48 stocks from our UK High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Nexxen International

Simply Wall St Growth Rating: ★★★★☆☆

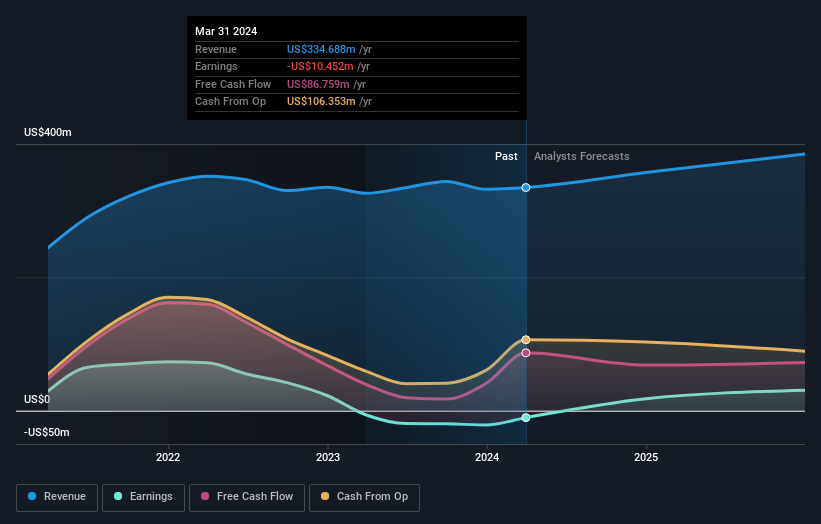

Overview: Nexxen International Ltd. offers a comprehensive software platform for advertisers to connect with publishers in Israel and has a market cap of £414.56 million.

Operations: Nexxen International Ltd. generates revenue primarily through its marketing services, which amounted to $339.02 million. The company operates an end-to-end software platform facilitating advertiser-publisher connections in Israel.

Nexxen International's recent earnings report highlights a turnaround, with Q2 sales rising to $88.58 million from $84.25 million and net income reaching $2.92 million, reversing a previous net loss of $5.61 million. The company's strategic data partnership with The Trade Desk enhances cross-channel targeting capabilities, leveraging Nexxen's unique automatic content recognition (ACR) data segments for more efficient media investment across the premium internet space. Notably, Nexxen has invested significantly in R&D, spending 8.8% of its revenue on innovative solutions that drive future growth and maintain competitive advantage in the evolving tech landscape.

Get an in-depth perspective on Nexxen International's performance by reading our health report here.

Informa

Simply Wall St Growth Rating: ★★★★☆☆

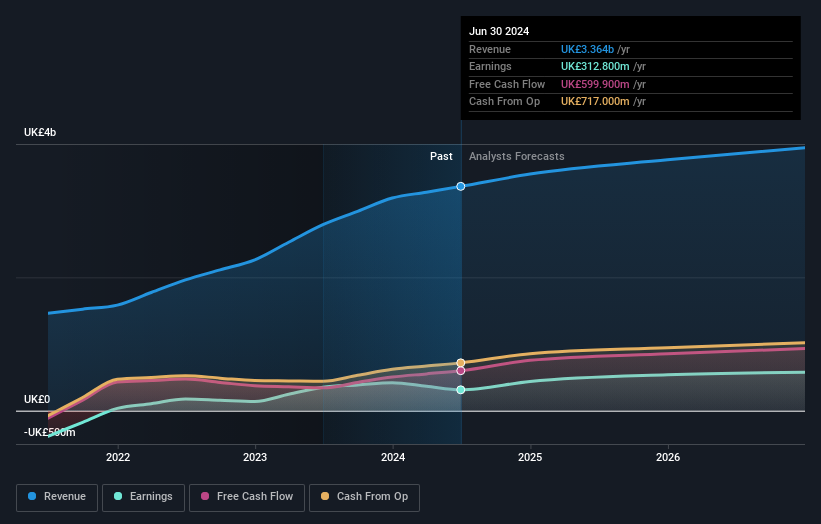

Overview: Informa plc operates as an international events, digital services, and academic research company in the United Kingdom, Continental Europe, the United States, China, and internationally with a market cap of £10.94 billion.

Operations: Informa generates revenue primarily from its four segments: Informa Tech (£426.70 million), Informa Connect (£630.20 million), Informa Markets (£1.67 billion), and Taylor & Francis (£636.70 million). The company leverages a diverse portfolio of events, digital services, and academic research to drive its business operations across multiple regions globally.

Informa's revenue is projected to grow at 6.7% annually, outpacing the UK market's 3.7% growth rate, while its earnings are expected to surge by 21.5% per year over the next three years. Despite a significant one-off loss of £213.5 million impacting recent results, Informa has demonstrated resilience with sales reaching £1.70 billion in H1 2024 compared to £1.52 billion a year ago and net income of £147.3 million for the same period. The company repurchased approximately 41 million shares for £338.9 million in H1 2024, enhancing shareholder value amidst ongoing strategic initiatives and robust R&D investments aimed at driving future growth and maintaining competitive advantage in the tech landscape.

Dive into the specifics of Informa here with our thorough health report.

Evaluate Informa's historical performance by accessing our past performance report.

Trustpilot Group

Simply Wall St Growth Rating: ★★★★★☆

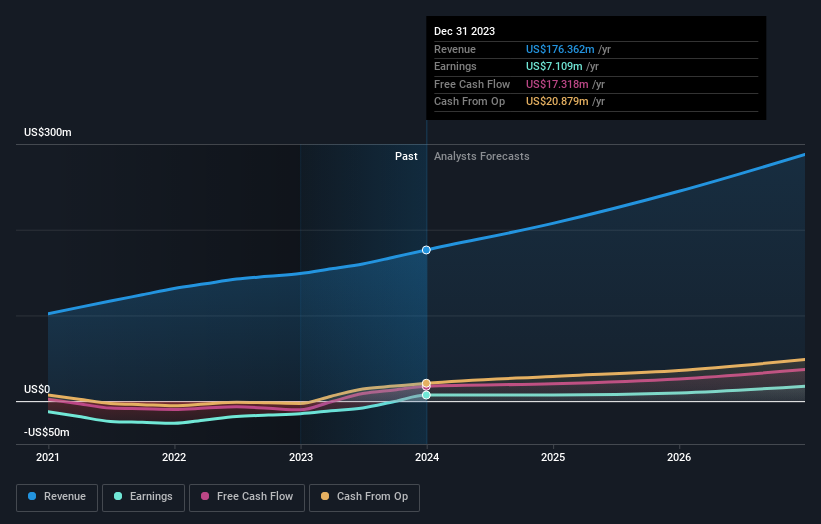

Overview: Trustpilot Group plc develops and hosts an online review platform for businesses and consumers globally, with a market cap of £838.73 million.

Operations: Trustpilot Group plc generates revenue primarily from its Internet Information Providers segment, amounting to $176.36 million. The company operates in the United Kingdom, North America, Europe, and internationally.

Trustpilot Group's revenue is projected to grow at 16.2% annually, significantly outpacing the UK market's 3.7% growth rate. The company's earnings are also forecasted to rise by 32% per year, driven by their recent profitability and strong performance in the Interactive Media and Services industry. Notably, Trustpilot has invested heavily in R&D, with expenditures accounting for a substantial portion of their budget to sustain innovation and competitive edge in the tech landscape.

Click to explore a detailed breakdown of our findings in Trustpilot Group's health report.

Examine Trustpilot Group's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

Discover the full array of 48 UK High Growth Tech and AI Stocks right here.

Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:NEXN LSE:INF and LSE:TRST.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Yahoo Finance

Yahoo Finance