Top SEHK Dividend Stocks To Watch In October 2024

In October 2024, the Hong Kong market has experienced significant volatility, with the Hang Seng Index seeing a notable decline amid concerns over China's economic stimulus measures. As investors navigate these uncertain times, dividend stocks on the Stock Exchange of Hong Kong (SEHK) present an attractive option for those seeking steady income streams and potential stability in their portfolios.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

China Hongqiao Group (SEHK:1378) | 8.65% | ★★★★★☆ |

Chongqing Rural Commercial Bank (SEHK:3618) | 6.78% | ★★★★★☆ |

Chow Tai Fook Jewellery Group (SEHK:1929) | 7.99% | ★★★★★☆ |

Bank of China (SEHK:3988) | 6.93% | ★★★★★☆ |

Playmates Toys (SEHK:869) | 8.70% | ★★★★★☆ |

Lion Rock Group (SEHK:1127) | 7.97% | ★★★★★☆ |

China Construction Bank (SEHK:939) | 7.09% | ★★★★★☆ |

PC Partner Group (SEHK:1263) | 9.09% | ★★★★★☆ |

Tianjin Development Holdings (SEHK:882) | 7.10% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 4.75% | ★★★★★☆ |

Click here to see the full list of 92 stocks from our Top SEHK Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

China Resources Land

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Resources Land Limited is an investment holding company involved in the investment, development, management, and sale of properties in the People’s Republic of China with a market cap of HK$186.12 billion.

Operations: China Resources Land Limited generates revenue from several segments, including CN¥239.18 billion from its Development Property Business, CN¥23.92 billion from the Investment Property Business, CN¥15.66 billion through its Eco-system Elementary Business, and CN¥14.74 billion via Asset-light Management Business.

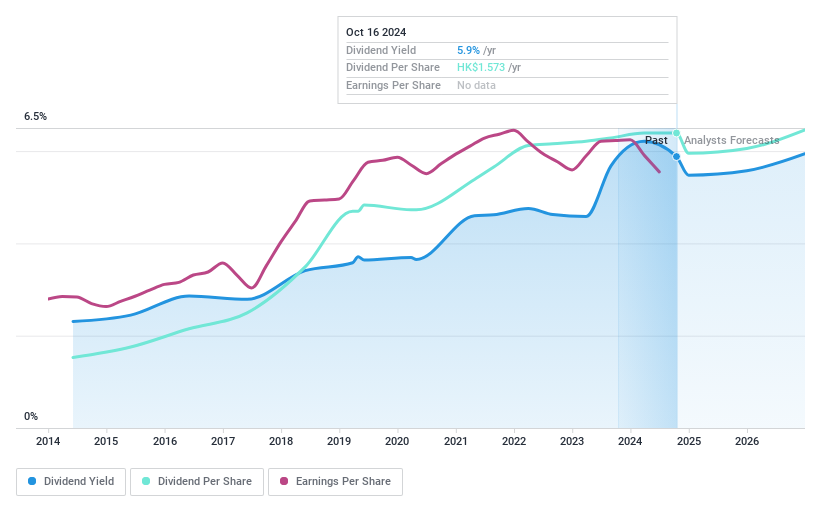

Dividend Yield: 5.9%

China Resources Land offers a mixed picture for dividend investors. While the interim dividend of RMB 0.2 per share is well-covered by earnings due to a low payout ratio, it is not supported by free cash flow, with a high cash payout ratio of 90.8%. Recent sales figures show declines in gross contracted sales and GFA year over year, which could impact future dividends. Despite this, the company has maintained stable and reliable dividends over the past decade.

China Hongqiao Group

Simply Wall St Dividend Rating: ★★★★★☆

Overview: China Hongqiao Group Limited is an investment holding company that manufactures and sells aluminum products in the People's Republic of China and Indonesia, with a market cap of HK$127.35 billion.

Operations: The revenue segment for China Hongqiao Group Limited primarily consists of the manufacture and sales of aluminum products, generating CN¥141.48 billion.

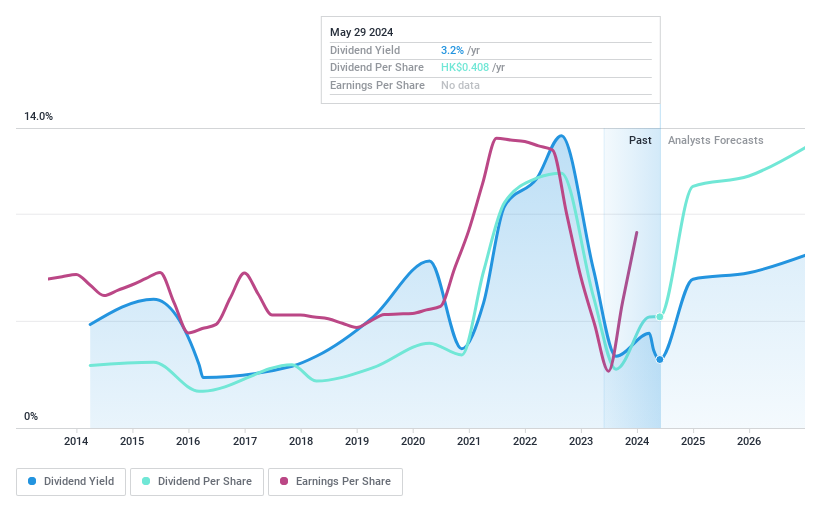

Dividend Yield: 8.6%

China Hongqiao Group's interim dividend of HK$0.59 per share is well-supported by a low payout ratio of 42.3% and a cash payout ratio of 48.6%, indicating strong coverage by earnings and cash flows. Despite an unstable dividend history, recent earnings growth—CNY 9.15 billion in net income for H1 2024—suggests potential sustainability moving forward. The stock trades at a significant discount to its estimated fair value, offering good relative value compared to peers in the Hong Kong market.

Bank of Communications

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Communications Co., Ltd. offers commercial banking products and services in China with a market capitalization of approximately HK$542.66 billion.

Operations: Bank of Communications Co., Ltd. generates revenue through its Corporate Banking Business (CN¥98.09 billion), Personal Banking (CN¥76.86 billion), and Treasury Business (CN¥23.21 billion) segments in China.

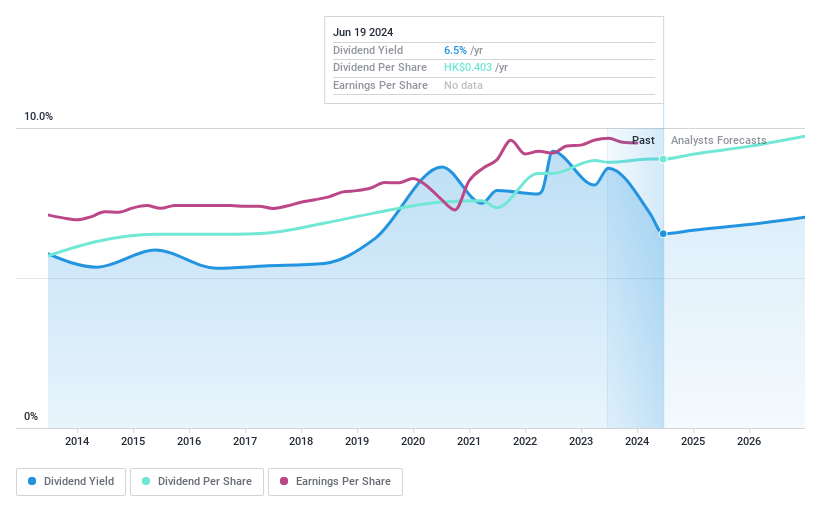

Dividend Yield: 6.4%

Bank of Communications offers a stable dividend yield of 6.43%, supported by a low payout ratio of 49%, ensuring dividends are well-covered by earnings. The bank's dividend payments have grown consistently over the past decade, and its earnings are projected to grow annually by 5.54%. Although its yield is below the top tier in Hong Kong, the stock trades at a substantial discount to its estimated fair value, potentially providing attractive value for investors.

Seize The Opportunity

Dive into all 92 of the Top SEHK Dividend Stocks we have identified here.

Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1109 SEHK:1378 and SEHK:3328.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]