Top SEHK Growth Companies With High Insider Ownership August 2024

As global markets react to anticipated interest rate cuts and economic activities show mixed signals, the Hong Kong market remains a focal point for investors seeking growth opportunities. In this environment, companies with high insider ownership often signal confidence from those who know the business best, making them attractive options for discerning investors.

Top 10 Growth Companies With High Insider Ownership In Hong Kong

Name | Insider Ownership | Earnings Growth |

iDreamSky Technology Holdings (SEHK:1119) | 18.8% | 104.1% |

Pacific Textiles Holdings (SEHK:1382) | 11.2% | 37.7% |

Zylox-Tonbridge Medical Technology (SEHK:2190) | 18.7% | 70.6% |

Tian Tu Capital (SEHK:1973) | 34% | 70.5% |

RemeGen (SEHK:9995) | 16.1% | 52.2% |

Adicon Holdings (SEHK:9860) | 22.4% | 28.3% |

Zhejiang Leapmotor Technology (SEHK:9863) | 15% | 76.4% |

Biocytogen Pharmaceuticals (Beijing) (SEHK:2315) | 13.9% | 100.1% |

Beijing Airdoc Technology (SEHK:2251) | 28.6% | 83.9% |

DPC Dash (SEHK:1405) | 38.2% | 92.6% |

We're going to check out a few of the best picks from our screener tool.

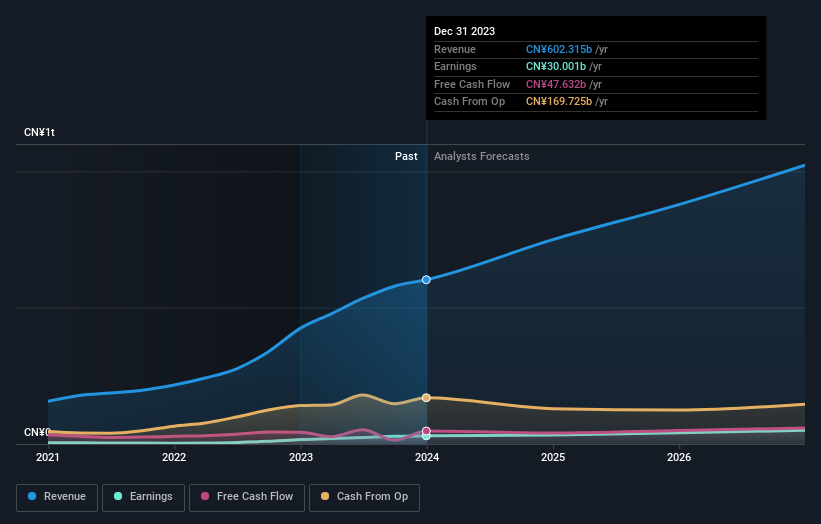

BYD

Simply Wall St Growth Rating: ★★★★☆☆

Overview: BYD Company Limited, along with its subsidiaries, operates in the automobile and battery sectors across China, Hong Kong, Macau, Taiwan, and internationally with a market cap of HK$724.49 billion.

Operations: BYD's revenue is primarily generated from its automobile and battery businesses in the People’s Republic of China, Hong Kong, Macau, Taiwan, and internationally.

Insider Ownership: 30.1%

Earnings Growth Forecast: 15.2% p.a.

BYD has demonstrated significant growth with production and sales volumes increasing year-over-year, reaching 1.96 million units produced and 1.95 million units sold by July 2024. Recent strategic partnerships, such as the multi-year deal with Uber to deploy 100,000 electric vehicles globally, bolster its market presence. The company's earnings are forecasted to grow at an annual rate of 15.22%, outpacing the Hong Kong market average of 10.9%.

Techtronic Industries

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Techtronic Industries Company Limited designs, manufactures, and markets power tools, outdoor power equipment, and floorcare and cleaning products across North America, Europe, and internationally with a market cap of HK$193.70 billion.

Operations: The company's revenue segments include $13.23 billion from Power Equipment and $965.09 million from Floorcare & Cleaning products.

Insider Ownership: 25.4%

Earnings Growth Forecast: 15.3% p.a.

Techtronic Industries has shown consistent growth, with recent earnings reporting US$7.31 billion in sales and US$550.37 million in net income for H1 2024. The company announced an interim dividend of HKD 1.08 per share and appointed Steven Philip Richman as Executive Director, enhancing leadership stability. Insider ownership remains strong with more shares bought than sold recently, supporting its robust forecasted earnings growth of 15.32% annually, outpacing the Hong Kong market average of 10.9%.

Beisen Holding

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Beisen Holding Limited is an investment holding company that offers cloud-based human capital management solutions for enterprises in China, with a market cap of HK$2.54 billion.

Operations: Revenue from providing cloud-based HCM solutions and related professional services amounted to CN¥854.74 million.

Insider Ownership: 31.7%

Earnings Growth Forecast: 98% p.a.

Beisen Holding's revenue grew to CNY 854.74 million for FY2024, but net loss widened to CNY 3.21 billion due to increased share-based payments and changes in fair value of redeemable convertible preferred shares. Despite a volatile share price, revenue is forecasted to grow faster than the Hong Kong market at 15% per year, with expected profitability within three years. Insider ownership remains high with more shares bought than sold recently, indicating confidence in future growth prospects.

Where To Now?

Access the full spectrum of 51 Fast Growing SEHK Companies With High Insider Ownership by clicking on this link.

Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include SEHK:1211 SEHK:669 and SEHK:9669.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]