Top SGX Dividend Stocks To Consider In August 2024

The Singapore market has been grappling with a sophisticated impersonation scam that resulted in $10.6 million in losses in June alone, highlighting the need for vigilance among investors. In such uncertain times, dividend stocks can offer a reliable income stream and stability, making them an attractive option for cautious investors.

Top 10 Dividend Stocks In Singapore

Name | Dividend Yield | Dividend Rating |

BRC Asia (SGX:BEC) | 6.96% | ★★★★★☆ |

UOB-Kay Hian Holdings (SGX:U10) | 6.67% | ★★★★★☆ |

China Sunsine Chemical Holdings (SGX:QES) | 6.38% | ★★★★★☆ |

Multi-Chem (SGX:AWZ) | 8.47% | ★★★★★☆ |

UOL Group (SGX:U14) | 3.72% | ★★★★★☆ |

Bumitama Agri (SGX:P8Z) | 6.58% | ★★★★★☆ |

Singapore Exchange (SGX:S68) | 3.45% | ★★★★★☆ |

Singapore Airlines (SGX:C6L) | 6.89% | ★★★★★☆ |

Civmec (SGX:P9D) | 4.91% | ★★★★★☆ |

YHI International (SGX:BPF) | 6.56% | ★★★★★☆ |

Click here to see the full list of 21 stocks from our Top SGX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

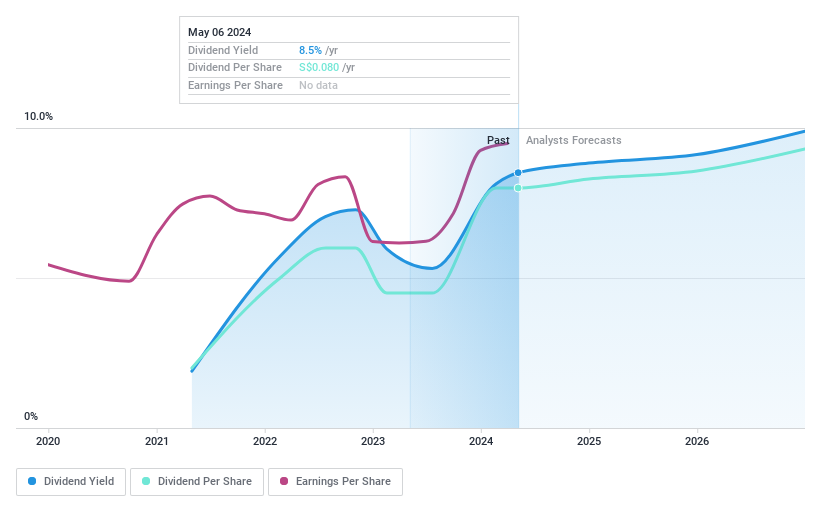

Aztech Global

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aztech Global Ltd. is involved in the research, development, engineering, and manufacturing of IoT devices, data-communication products, and LED lighting products across Singapore, North America, China, Europe, and other international markets; it has a market cap of SGD825.99 million.

Operations: Aztech Global Ltd. generates revenue from three primary segments: IoT devices, data-communication products, and LED lighting products.

Dividend Yield: 9.3%

Aztech Global's dividend payments have increased but remain volatile over the past three years. The company's dividends are covered by earnings (59.5% payout ratio) and cash flows (62.1% cash payout ratio). Despite a high dividend yield of 9.35%, its track record is unstable. Recent earnings for H1 2024 showed net income growth to S$46.66 million from S$42.92 million, though sales declined slightly to S$373.2 million from S$388.58 million last year.

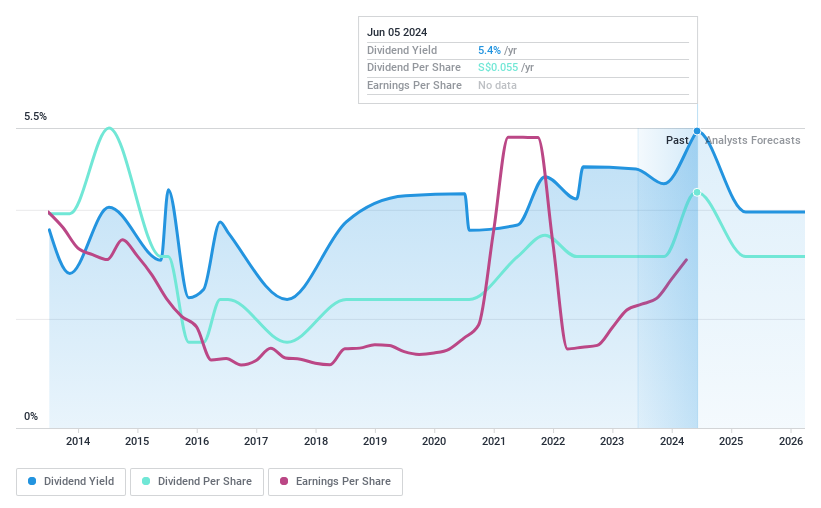

Boustead Singapore

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Boustead Singapore Limited, an investment holding company with a market cap of SGD477.47 million, provides energy engineering, real estate, geospatial, and healthcare technology solutions across various regions including Singapore, Australia, Malaysia, the United States, Europe, Asia Pacific, North and South America, the Middle East and Africa.

Operations: Boustead Singapore Limited generates revenue from several segments: Geospatial (SGD212.67 million), Healthcare (SGD10.58 million), Energy Engineering (SGD174.41 million), and Real Estate Solutions (SGD369.46 million).

Dividend Yield: 5.5%

Boustead Singapore's dividend payments have been inconsistent over the past decade, though recent increases are notable. The proposed final tax-exempt dividend of 4.0 cents per share for FY2024 highlights a positive trend. With a payout ratio of 40.9% and cash payout ratio of 28.8%, dividends are well-covered by earnings and cash flows. Despite a lower yield compared to top-tier payers, its strong earnings growth (41.6%) underpins sustainability prospects.

Dive into the specifics of Boustead Singapore here with our thorough dividend report.

Our valuation report here indicates Boustead Singapore may be overvalued.

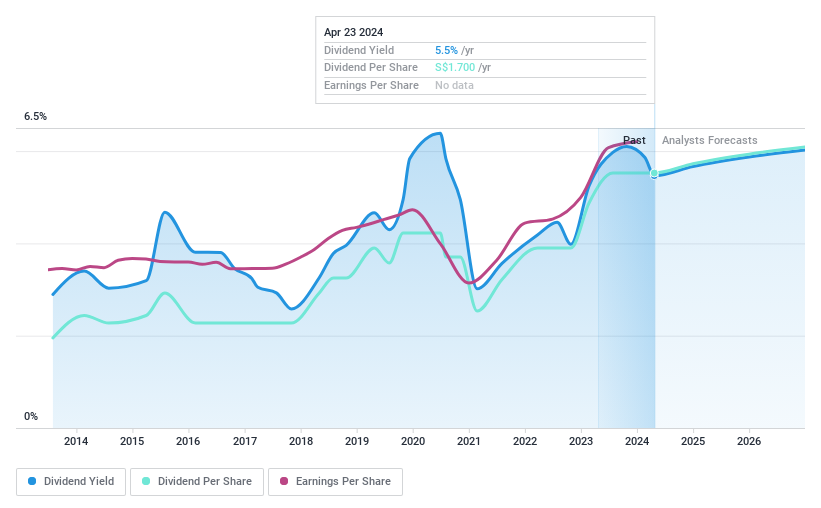

United Overseas Bank

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: United Overseas Bank Limited, along with its subsidiaries, offers a range of banking products and services globally and has a market cap of SGD54.13 billion.

Operations: United Overseas Bank Limited generates revenue through various segments, including SGD4.89 billion from Group Retail, SGD3.57 billion from Group Wholesale Banking, and SGD1.42 billion from Global Markets operations.

Dividend Yield: 5.3%

United Overseas Bank's dividends are currently covered by earnings with a payout ratio of 50.8% and forecasted to remain sustainable at 49.2% in three years. However, the dividend payments have been volatile over the past decade, impacting reliability. Trading at 48.1% below estimated fair value could indicate potential for capital appreciation, but investors should consider the bank's low allowance for bad loans (85%) and relatively lower yield compared to top-tier dividend payers in Singapore.

Make It Happen

Investigate our full lineup of 21 Top SGX Dividend Stocks right here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SGX:8AZ SGX:F9D and SGX:U11.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]