Top Three Dividend Stocks In Hong Kong For June 2024

As global markets navigate through varying economic signals, Hong Kong's stock market has shown resilience amidst a challenging environment marked by slowing growth and foreign selling pressures. In this context, dividend stocks in Hong Kong could appeal to investors looking for potential stability and income generation in their portfolios.

Top 10 Dividend Stocks In Hong Kong

Name | Dividend Yield | Dividend Rating |

Chongqing Rural Commercial Bank (SEHK:3618) | 8.09% | ★★★★★★ |

CITIC Telecom International Holdings (SEHK:1883) | 9.66% | ★★★★★★ |

China Construction Bank (SEHK:939) | 7.45% | ★★★★★☆ |

S.A.S. Dragon Holdings (SEHK:1184) | 8.86% | ★★★★★☆ |

China Electronics Huada Technology (SEHK:85) | 8.33% | ★★★★★☆ |

Playmates Toys (SEHK:869) | 8.96% | ★★★★★☆ |

Bank of China (SEHK:3988) | 6.60% | ★★★★★☆ |

China Mobile (SEHK:941) | 6.20% | ★★★★★☆ |

Sinopharm Group (SEHK:1099) | 4.24% | ★★★★★☆ |

International Housewares Retail (SEHK:1373) | 8.96% | ★★★★★☆ |

Click here to see the full list of 86 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

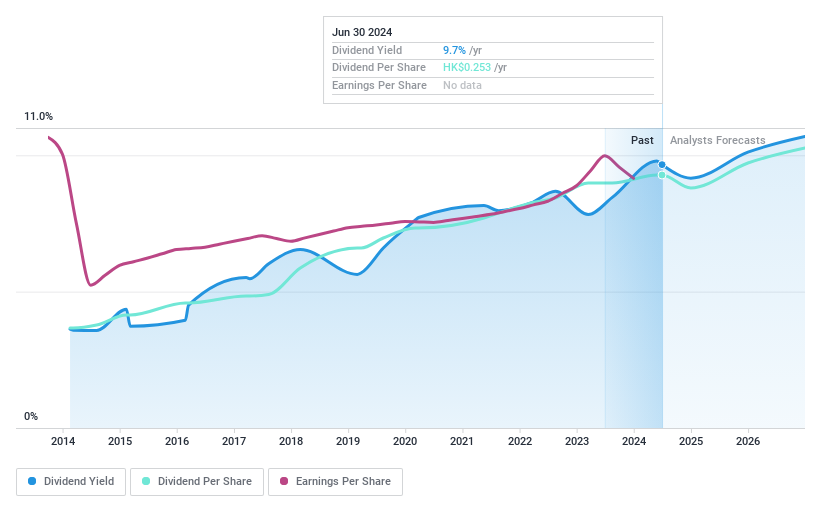

CITIC Telecom International Holdings

Simply Wall St Dividend Rating: ★★★★★★

Overview: CITIC Telecom International Holdings Limited operates globally, providing international telecommunications services with a market capitalization of approximately HK$9.70 billion.

Operations: CITIC Telecom International Holdings Limited generates its revenue primarily from international telecommunications services.

Dividend Yield: 9.7%

CITIC Telecom International Holdings offers a compelling dividend profile with a high yield of HK$9.66%, ranking in the top 25% in Hong Kong. Its dividends have shown stability and growth over the past decade, supported by earnings and cash flows with payout ratios of 76% and 59.6%, respectively. The company recently expanded its service agreements, potentially bolstering future stability and growth avenues through new framework agreements with CITIC Group for various telecommunications services until 2027.

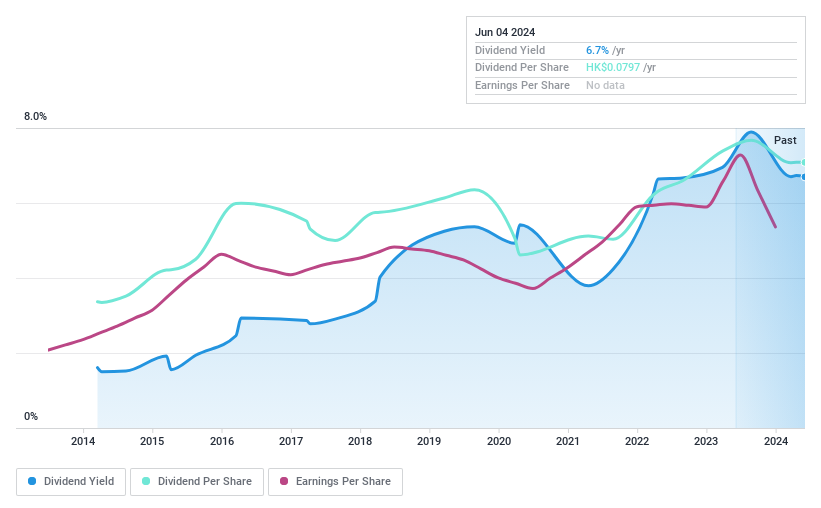

Dawnrays Pharmaceutical (Holdings)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Dawnrays Pharmaceutical (Holdings) Limited is an investment holding company that specializes in developing, manufacturing, and selling non-patented pharmaceutical medicines both in Mainland China and internationally, with a market capitalization of approximately HK$1.82 billion.

Operations: Dawnrays Pharmaceutical (Holdings) Limited generates revenue primarily through two segments: Finished Drugs, which brought in CN¥1.02 billion, and Intermediates and Bulk Medicines, contributing CN¥210.05 million.

Dividend Yield: 6.6%

Dawnrays Pharmaceutical has demonstrated a fluctuating dividend history, with recent approval for a final dividend of HK$0.065 per share for 2023. Despite this, its dividend yield of 6.56% trails the top quartile in Hong Kong's market by 1.41 percentage points. Positively, its dividends are sustainably covered by earnings and cash flows, with payout ratios at 33.4% and 87.6%, respectively, and it benefits from a low price-to-earnings ratio of 5.2x compared to the market average of 9.5x.

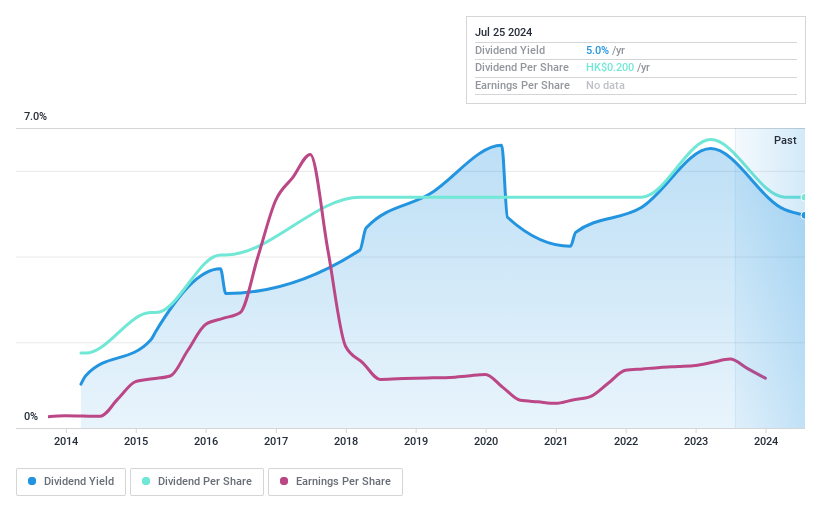

Tian An China Investments

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tian An China Investments Company Limited operates as an investment holding company, focusing on property investment, development, and management in the People's Republic of China, Hong Kong, the United Kingdom, and Australia, with a market capitalization of approximately HK$5.83 billion.

Operations: Tian An China Investments Company Limited generates revenue primarily through property development at HK$1.53 billion, followed by property investment with HK$591.38 million and healthcare services contributing HK$394.15 million.

Dividend Yield: 5%

Tian An China Investments has recently adjusted its dividend to HK$0.20 per share, reflecting a cautious approach amidst a significant revenue drop from HK$5.09 billion to HK$2.78 billion in 2023. Despite lower earnings, the dividend is supported by a robust coverage with a low payout ratio of 24.1% and cash payout ratio of 16.9%. The firm's consistent dividend growth over the past decade and stable payments underscore reliability, although its yield of 5.03% remains below Hong Kong’s top quartile performers.

Taking Advantage

Delve into our full catalog of 86 Top Dividend Stocks here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include SEHK:1883SEHK:2348SEHK:28 and

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]