Top TSX Dividend Stocks To Consider In August 2024

Over the last 7 days, the Canadian market has dropped 2.8%, but it remains up 8.1% over the past year with earnings forecasted to grow by 15% annually. In this context, identifying strong dividend stocks can be a prudent strategy for investors seeking stable returns and income in a fluctuating market environment.

Top 10 Dividend Stocks In Canada

Name | Dividend Yield | Dividend Rating |

Bank of Nova Scotia (TSX:BNS) | 6.72% | ★★★★★★ |

Whitecap Resources (TSX:WCP) | 7.36% | ★★★★★★ |

Secure Energy Services (TSX:SES) | 3.45% | ★★★★★☆ |

Labrador Iron Ore Royalty (TSX:LIF) | 8.56% | ★★★★★☆ |

Enghouse Systems (TSX:ENGH) | 3.46% | ★★★★★☆ |

iA Financial (TSX:IAG) | 3.41% | ★★★★★☆ |

Firm Capital Mortgage Investment (TSX:FC) | 9.02% | ★★★★★☆ |

Russel Metals (TSX:RUS) | 4.31% | ★★★★★☆ |

Royal Bank of Canada (TSX:RY) | 3.81% | ★★★★★☆ |

Canadian Natural Resources (TSX:CNQ) | 4.45% | ★★★★★☆ |

Click here to see the full list of 33 stocks from our Top TSX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

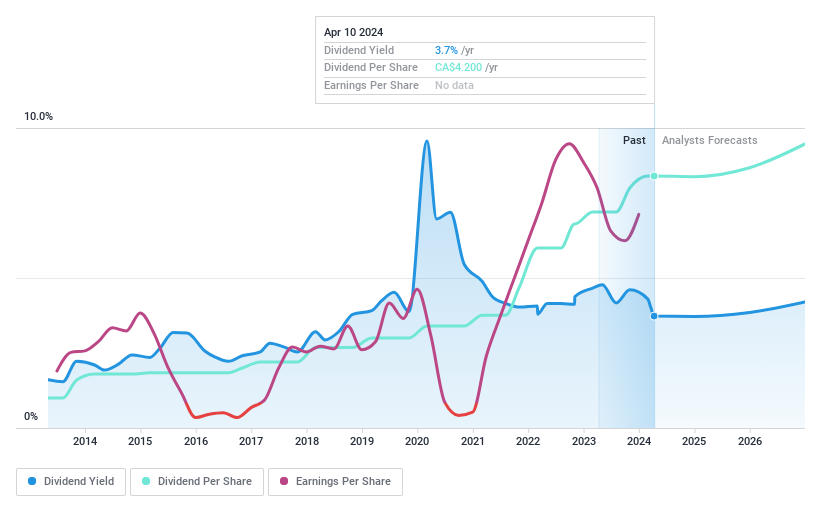

Canadian Natural Resources

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Canadian Natural Resources Limited acquires, explores for, develops, produces, markets, and sells crude oil, natural gas, and natural gas liquids (NGLs), with a market cap of approximately CA$97.89 billion.

Operations: Canadian Natural Resources Limited generates revenue from various segments, including Oil Sands Mining and Upgrading (CA$16.47 billion), Exploration and Production - North America (CA$18.15 billion), Midstream and Refining (CA$983 million), Exploration and Production - North Sea (CA$522 million), and Exploration and Production - Offshore Africa (CA$492 million).

Dividend Yield: 4.4%

Canadian Natural Resources recently declared a quarterly cash dividend of C$0.525 per share, payable on October 4, 2024. The company reported Q2 revenue of C$9.05 billion and net income of C$1.72 billion, reflecting growth from the previous year. With a payout ratio of 56.1% and a cash payout ratio of 42.7%, its dividends are well-covered by earnings and cash flows, though its yield (4.45%) is lower than the top Canadian dividend payers.

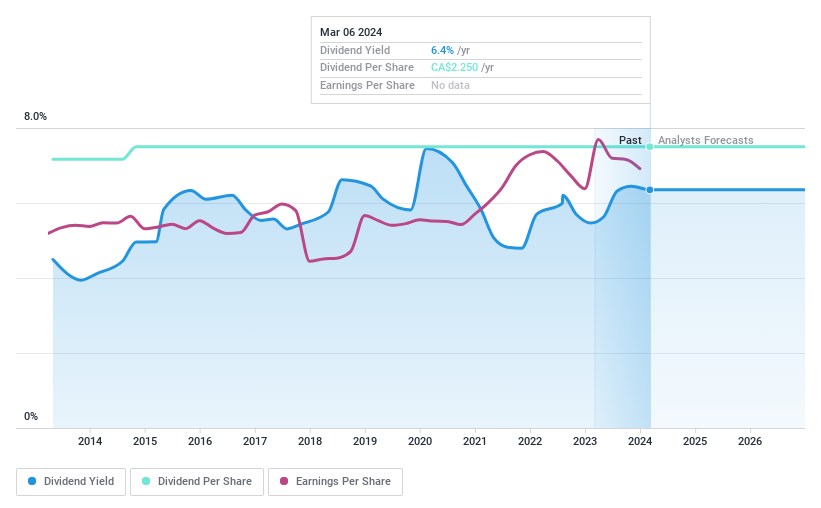

IGM Financial

Simply Wall St Dividend Rating: ★★★★★☆

Overview: IGM Financial Inc. is a Canadian wealth and asset management company with a market cap of CA$8.64 billion.

Operations: IGM Financial Inc. generates revenue through its wealth management and asset management segments in Canada.

Dividend Yield: 6.2%

IGM Financial's dividend yield of 6.23% is slightly below the top 25% of Canadian dividend payers. The company's dividends are well-covered by both earnings (62.9% payout ratio) and cash flows (70.8% cash payout ratio). Recent Q2 results showed revenue growth to C$816.31 million and net income rising to C$216.19 million, with diluted EPS increasing to C$0.91 from C$0.57 a year ago, reflecting financial stability for sustained dividend payments.

Click here to discover the nuances of IGM Financial with our detailed analytical dividend report.

Our valuation report here indicates IGM Financial may be undervalued.

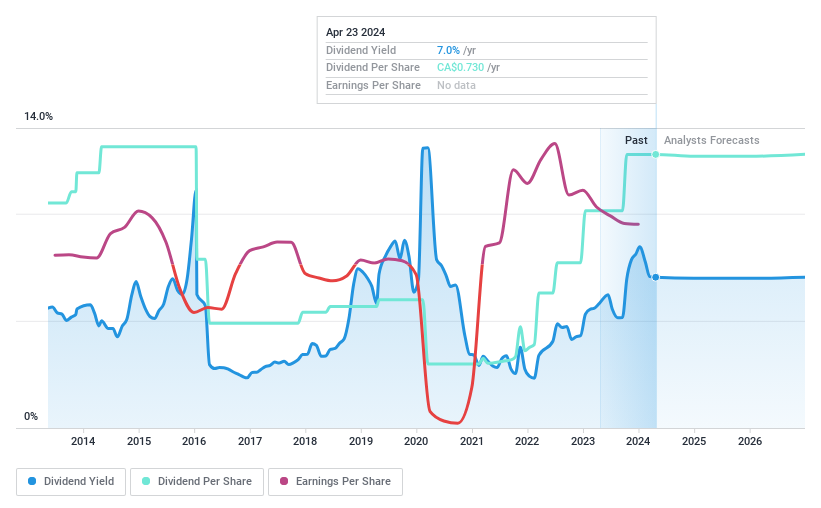

Whitecap Resources

Simply Wall St Dividend Rating: ★★★★★★

Overview: Whitecap Resources Inc., with a market cap of CA$5.91 billion, is an oil and gas company that focuses on the acquisition, development, and production of petroleum and natural gas assets in Western Canada.

Operations: Whitecap Resources Inc. generates revenue primarily from its Oil & Gas - Exploration & Production segment, which amounted to CA$3.37 billion.

Dividend Yield: 7.4%

Whitecap Resources offers a high dividend yield of 7.36%, placing it in the top 25% of Canadian dividend payers. The company's dividends are well-covered by earnings (54.2% payout ratio) and cash flows (68.8% cash payout ratio). Recent Q2 results showed revenue growth to C$905.4 million and net income rising to C$244.5 million, indicating financial stability for sustained dividend payments amidst an active acquisition strategy and share repurchase program.

Unlock comprehensive insights into our analysis of Whitecap Resources stock in this dividend report.

Where To Now?

Investigate our full lineup of 33 Top TSX Dividend Stocks right here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Want To Explore Some Alternatives?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include TSX:CNQ TSX:IGM and TSX:WCP.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]