Top UK Dividend Stocks For August 2024

The United Kingdom's FTSE 100 index has recently faced challenges, closing lower after weak trade data from China highlighted ongoing economic struggles. Despite these market headwinds, investors often turn to dividend stocks for their potential to provide steady income and resilience in turbulent times. In this article, we will explore three top UK dividend stocks for August 2024 that may offer stability and attractive returns amidst current global uncertainties.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

4imprint Group (LSE:FOUR) | 3.01% | ★★★★★☆ |

Impax Asset Management Group (AIM:IPX) | 7.66% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.85% | ★★★★★☆ |

Dunelm Group (LSE:DNLM) | 6.62% | ★★★★★☆ |

Man Group (LSE:EMG) | 5.89% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 5.76% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.10% | ★★★★★☆ |

NWF Group (AIM:NWF) | 4.91% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.60% | ★★★★★☆ |

James Latham (AIM:LTHM) | 5.68% | ★★★★★☆ |

Click here to see the full list of 57 stocks from our Top UK Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Alumasc Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: The Alumasc Group plc, with a market cap of £83.52 million, manufactures and sells building products, systems, and solutions across the United Kingdom and internationally.

Operations: The Alumasc Group plc's revenue segments include Water Management (£42.29 million), Building Envelope (£34.92 million), and Housebuilding Products (£14.79 million).

Dividend Yield: 4.5%

Alumasc Group's dividend payments have increased over the past decade, though they have been volatile. The company's payout ratio of 46.6% and cash payout ratio of 31.2% indicate dividends are well-covered by earnings and cash flows, respectively. Trading at 32.6% below estimated fair value, Alumasc offers good relative value despite a lower-than-top-tier dividend yield of 4.45%. Recent guidance anticipates revenue growth of 6.5%, outperforming the UK construction sector's decline.

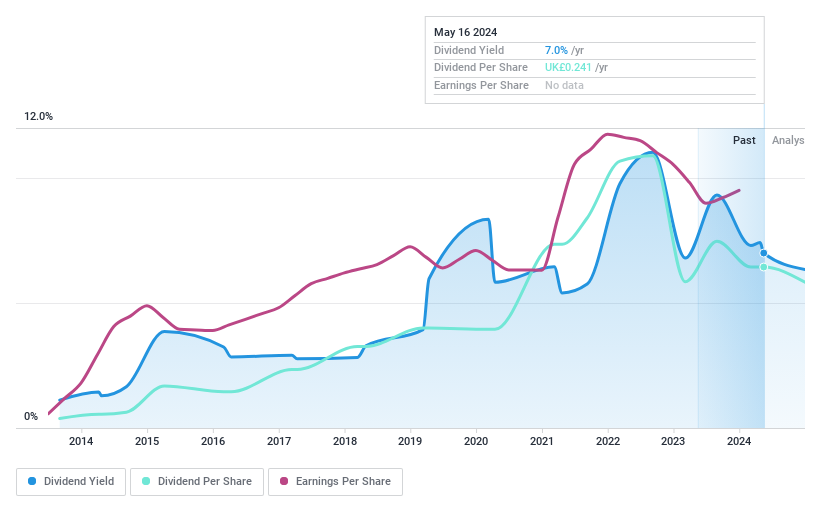

Somero Enterprises

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Somero Enterprises, Inc. designs, assembles, remanufactures, sells, and distributes concrete leveling, contouring, and placing equipment in the United States and internationally with a market cap of £184.29 million.

Operations: Somero Enterprises, Inc. generates $120.70 million in revenue from its construction machinery and equipment segment.

Dividend Yield: 7.2%

Somero Enterprises' dividend payments are well-covered by earnings (payout ratio: 46.2%) and cash flows (cash payout ratio: 74.1%). Despite a top-tier yield of 7.19%, dividends have been volatile over the past decade, raising concerns about reliability. Trading at 18.9% below estimated fair value, it offers good relative value for investors. Recent executive changes include Jesse Aho as Chief Operating Officer, focusing on global operations and new product development under CEO Jack Cooney's guidance.

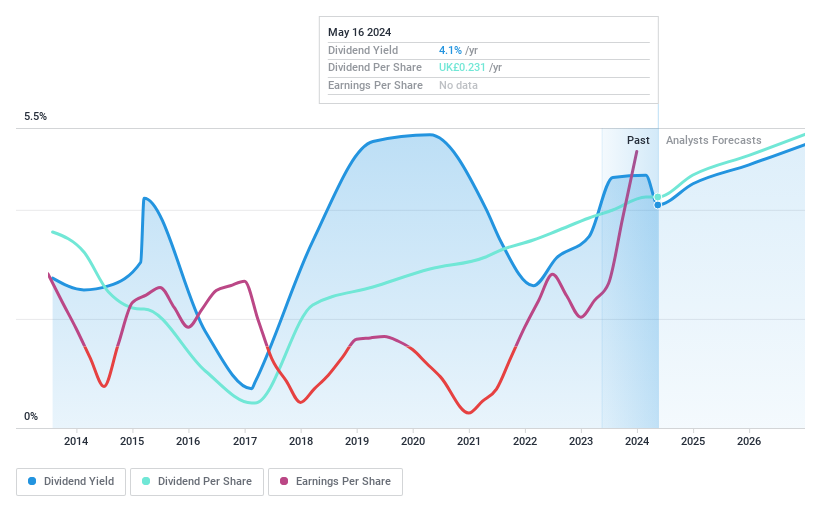

Drax Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Drax Group plc, with a market cap of £2.44 billion, operates in the United Kingdom focusing on renewable power generation through its subsidiaries.

Operations: Drax Group plc's revenue segments include £4.38 billion from Customers, £5.99 billion from Generation, and £878.40 million from Pellet Production.

Dividend Yield: 3.9%

Drax Group's dividends are well-covered by earnings (payout ratio: 14.4%) and cash flows (cash payout ratio: 23.5%), but the dividend track record has been unstable over the past decade. Despite trading at 64.4% below estimated fair value, its yield of 3.85% is lower than the top UK dividend payers. Recent news includes a £300 million share repurchase program and a reported net income increase to £339.7 million for H1 2024, up from £248.1 million last year.

Seize The Opportunity

Embark on your investment journey to our 57 Top UK Dividend Stocks selection here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:ALU AIM:SOM and LSE:DRX.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]