Top US Dividend Stocks Including Citizens Financial Services

As the U.S. stock market navigates mixed performances, with the Dow Jones Industrial Average reaching record highs while the S&P 500 and Nasdaq Composite experience slight declines, investors are keenly observing how economic indicators and Federal Reserve policies will shape future trends. Amidst this backdrop, dividend stocks remain a compelling option for those seeking steady income and potential growth. In this article, we explore three top U.S. dividend stocks, including Citizens Financial Services, highlighting what makes them attractive choices in today's market environment.

Top 10 Dividend Stocks In The United States

Name | Dividend Yield | Dividend Rating |

WesBanco (NasdaqGS:WSBC) | 4.90% | ★★★★★★ |

Columbia Banking System (NasdaqGS:COLB) | 5.55% | ★★★★★★ |

Dillard's (NYSE:DDS) | 5.33% | ★★★★★★ |

Premier Financial (NasdaqGS:PFC) | 5.36% | ★★★★★★ |

OTC Markets Group (OTCPK:OTCM) | 4.70% | ★★★★★★ |

OceanFirst Financial (NasdaqGS:OCFC) | 4.37% | ★★★★★★ |

Regions Financial (NYSE:RF) | 4.34% | ★★★★★★ |

CVB Financial (NasdaqGS:CVBF) | 4.51% | ★★★★★★ |

Chevron (NYSE:CVX) | 4.48% | ★★★★★★ |

Virtus Investment Partners (NYSE:VRTS) | 4.33% | ★★★★★★ |

Click here to see the full list of 170 stocks from our Top US Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Citizens Financial Services

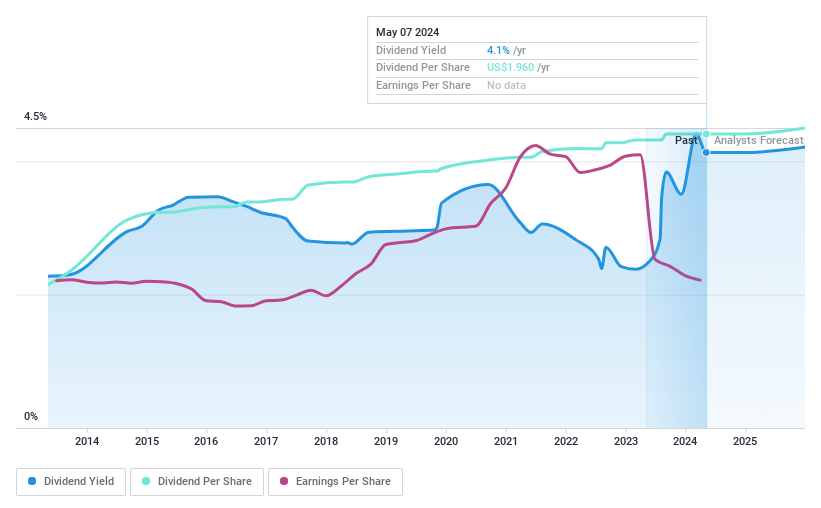

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Citizens Financial Services, Inc., a bank holding company with a market cap of $268.46 million, offers a range of banking products and services to individual, business, governmental, and institutional customers.

Operations: Citizens Financial Services, Inc. generates $98.19 million in revenue from its Community Banking segment.

Dividend Yield: 3.4%

Citizens Financial Services offers a reliable dividend yield of 3.44% with stable and growing payouts over the past decade, supported by a low payout ratio (33.7%). Despite trading at 56.7% below its estimated fair value, recent earnings growth (51% last year) and strong net income ($12.3 million for six months ended June 30, 2024) highlight its financial health. Recent buybacks and executive appointments further solidify its strategic positioning in the market.

Magic Software Enterprises

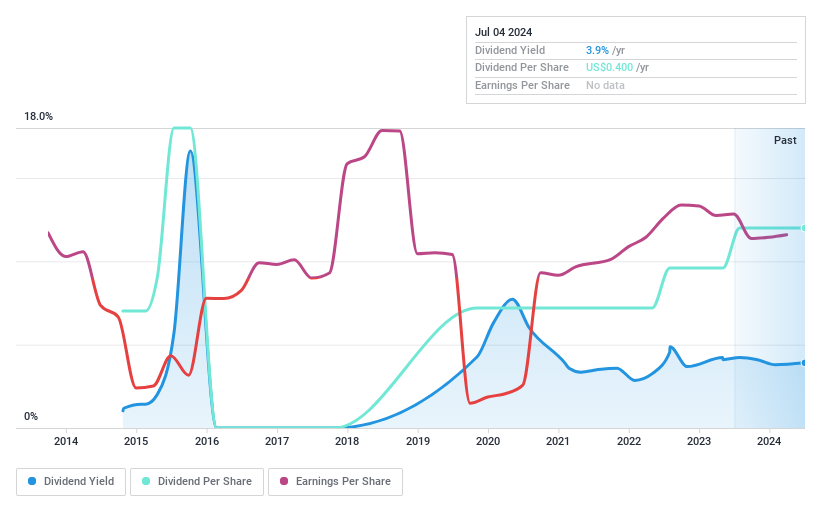

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Magic Software Enterprises Ltd. offers proprietary application development, vertical software solutions, business process integration, IT outsourcing software services, and cloud-based services in Israel and internationally, with a market cap of $583.30 million.

Operations: Magic Software Enterprises Ltd. generates revenue through proprietary application development, vertical software solutions, business process integration, IT outsourcing software services, and cloud-based services in Israel and internationally.

Dividend Yield: 4.5%

Magic Software Enterprises has a mixed dividend profile. Despite a volatile dividend history over the past decade, recent payouts have been well-covered by both earnings (70.4% payout ratio) and cash flows (35.6% cash payout ratio). The company reiterated its 2024 revenue guidance between US$540 million and US$550 million, suggesting stable financial expectations. However, recent auditor changes could introduce some uncertainty. Currently, Magic Software’s dividend yield of 4.47% places it in the top quartile of U.S. dividend payers.

SunCoke Energy

Simply Wall St Dividend Rating: ★★★★★☆

Overview: SunCoke Energy, Inc. is an independent producer of coke in the Americas and Brazil with a market cap of $729.92 million.

Operations: SunCoke Energy, Inc.'s revenue segments include Logistics ($96.60 million), Brazil Coke ($35.90 million), and Domestic Coke ($1.89 billion).

Dividend Yield: 5.5%

SunCoke Energy's recent earnings report for Q2 2024 showed a decline in sales to US$470.9 million from US$534.4 million a year ago, though net income rose slightly to US$21.5 million. The company increased its quarterly dividend by 20% to $0.12 per share, payable on September 3, 2024. Despite past volatility and high debt levels, the current dividend yield of 5.53% is among the top quartile in the U.S., with dividends covered by both earnings and cash flows at reasonable payout ratios of 54.5% and 68.4%, respectively.

Click here to discover the nuances of SunCoke Energy with our detailed analytical dividend report.

Upon reviewing our latest valuation report, SunCoke Energy's share price might be too pessimistic.

Seize The Opportunity

Unlock more gems! Our Top US Dividend Stocks screener has unearthed 167 more companies for you to explore.Click here to unveil our expertly curated list of 170 Top US Dividend Stocks.

Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include NasdaqCM:CZFS NasdaqGS:MGIC and NYSE:SXC.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]