Top US Growth Companies With Significant Insider Ownership In July 2024

Amid a buoyant U.S. stock market, with the Dow Jones and S&P 500 hitting record highs in July 2024, investors are witnessing robust corporate earnings and optimistic market sentiment. In such an environment, growth companies with high insider ownership can be particularly compelling, as significant insider stakes often align management’s interests with those of shareholders, potentially leading to prudent long-term decision making in response to evolving economic conditions.

Top 10 Growth Companies With High Insider Ownership In The United States

Name | Insider Ownership | Earnings Growth |

PDD Holdings (NasdaqGS:PDD) | 32.1% | 23.3% |

Atour Lifestyle Holdings (NasdaqGS:ATAT) | 26% | 22.1% |

GigaCloud Technology (NasdaqGM:GCT) | 25.9% | 25.2% |

Victory Capital Holdings (NasdaqGS:VCTR) | 12% | 34% |

Duolingo (NasdaqGS:DUOL) | 15% | 48.1% |

Super Micro Computer (NasdaqGS:SMCI) | 14.3% | 40.2% |

Credo Technology Group Holding (NasdaqGS:CRDO) | 14.7% | 60.9% |

Carlyle Group (NasdaqGS:CG) | 29.2% | 23.6% |

EHang Holdings (NasdaqGM:EH) | 32.8% | 74.3% |

BBB Foods (NYSE:TBBB) | 22.9% | 94.7% |

Let's uncover some gems from our specialized screener.

LINKBANCORP

Simply Wall St Growth Rating: ★★★★★☆

Overview: LINKBANCORP, Inc., functioning as a bank holding company for The Gratz Bank, offers a range of banking products and services to individuals, families, nonprofits, and businesses in Pennsylvania with a market cap of approximately $260.37 million.

Operations: The company generates its revenue primarily through banking activities, totaling $51.27 million.

Insider Ownership: 29.4%

Earnings Growth Forecast: 83.9% p.a.

LINKBANCORP has shown promising financial performance with a significant increase in net interest income to US$24.88 million and net income of US$5.73 million for Q1 2024, reversing a previous loss. Despite substantial insider selling recently, the company's revenue growth rate is forecasted at 37.8% annually, outpacing the market significantly. However, challenges include shareholder dilution over the past year and a dividend that may not be sustainable given current earnings coverage. Recent index additions underscore its evolving market perception.

Click to explore a detailed breakdown of our findings in LINKBANCORP's earnings growth report.

The valuation report we've compiled suggests that LINKBANCORP's current price could be inflated.

Alkami Technology

Simply Wall St Growth Rating: ★★★★★☆

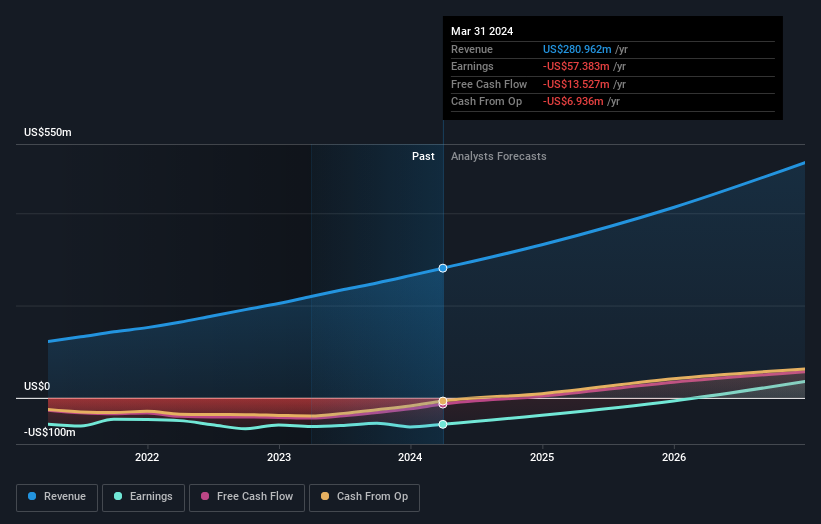

Overview: Alkami Technology, Inc. provides cloud-based digital banking solutions in the United States and has a market capitalization of approximately $3.09 billion.

Operations: The company generates its revenue primarily from internet software and services, amounting to $280.96 million.

Insider Ownership: 14.5%

Earnings Growth Forecast: 92.1% p.a.

Alkami Technology, Inc.'s recent extension of its credit facilities and increased financial covenants highlight its strategic financial management amid expansion efforts. The company's partnership renewal with Mountain America Credit Union underscores its robust position in providing advanced digital banking solutions, enhancing client retention and service capabilities. Despite no substantial insider buying recently, Alkami's inclusion in the Russell 2000 Growth-Defensive Index reflects positive market recognition. However, shareholder dilution over the past year poses a concern for investor equity value.

Our valuation report unveils the possibility Alkami Technology's shares may be trading at a premium.

APi Group

Simply Wall St Growth Rating: ★★★★☆☆

Overview: APi Group Corporation, operating globally, offers safety and specialty services with a market capitalization of approximately $10.37 billion.

Operations: The company generates revenues primarily from two segments: Safety Services at $4.89 billion and Specialty Services, including Industrial Services, at $2.04 billion.

Insider Ownership: 12.2%

Earnings Growth Forecast: 126.6% p.a.

APi Group, recently added to the Russell Midcap Value Index and dropped from several Russell 2000 indices, is navigating a complex index reclassification while adjusting its financial outlook. The company raised its 2024 revenue guidance to US$7.15 billion to US$7.35 billion, reflecting optimism despite reporting a mixed first quarter with earnings rising but revenues slightly down year-over-year. APi's strategic moves include no recent insider buying or selling, signaling stable insider confidence amidst these transitions.

Dive into the specifics of APi Group here with our thorough growth forecast report.

Upon reviewing our latest valuation report, APi Group's share price might be too pessimistic.

Where To Now?

Reveal the 182 hidden gems among our Fast Growing US Companies With High Insider Ownership screener with a single click here.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include NasdaqCM:LNKB NasdaqGS:ALKT and NYSE:APG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]

Yahoo Finance

Yahoo Finance