Treasury Secretary Mnuchin thinks a failure to pass tax reform will send stocks tumbling

Treasury Secretary Steven Mnuchin thinks the stock market’s performance depends on tax reform.

“There is no question that the rally in the stock market has baked into it reasonably high expectations of us getting tax cuts and tax reform done,” Mnuchin told Politico’s Ben White in a podcast interview published Wednesday.

“To the extent we get the tax deal done, the stock market will go up higher,” Mnuchin added. “But there’s no question in my mind that if we don’t get it done you’re going to see a reversal of a significant amount of these gains.”

If Mnuchin’s predictions come true, then one of President Donald Trump’s favorite economic indicators risks falling apart if his administration’s biggest legislative push fails. And Mnuchin’s comments amount to a threat to Congress — get tax reform done, or else.

And yet Mnuchin’s invocation of the stock market as needing tax reform to pass in order to extend its recent rally is in tension with how we’ve actually seen the stock market perform this year.

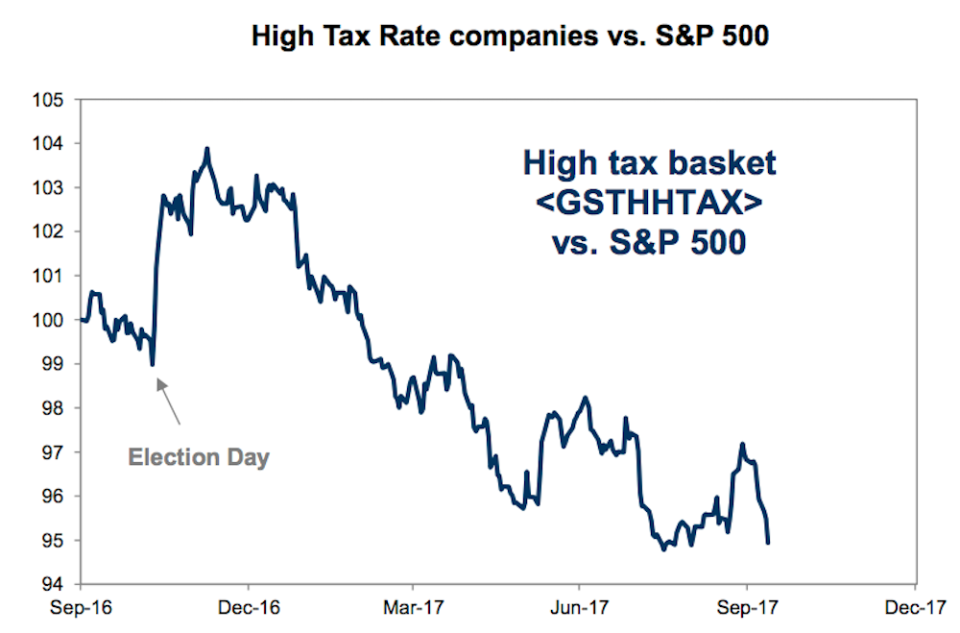

The chart below from Goldman Sachs (GS) — Mnuchin’s former employer — shows that stocks set to see the biggest gains from tax reform have actually been underperforming the broad market for months.

This indicates that investors have been fading any hopes that tax reform will be passed while the major indexes have moved to record highs. A market pinning its hopes on tax reform would likely be struggling in face of a continued lack of progress on the issue.

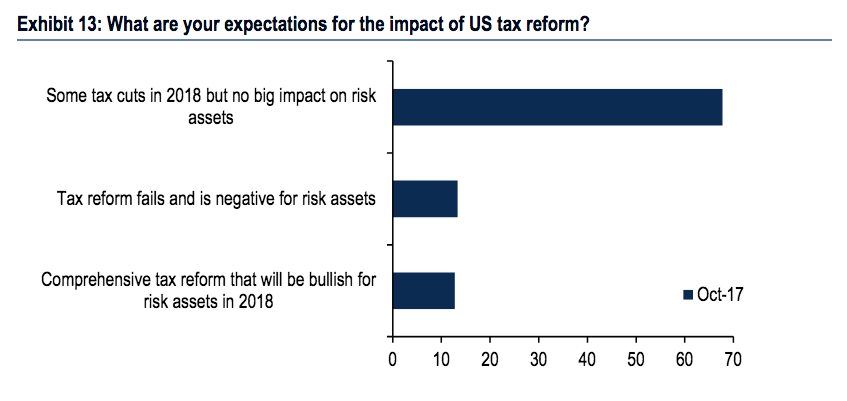

A survey of fund managers published this week by Bank of America Merrill Lynch also revealed that 68% of investors think that while some form of tax reform is coming in 2018, it will have little impact on risk assets (read: stocks). The vast majority of investors, in other words, see tax reform as essentially a non-issue for the market whether it does or doesn’t happen.

Additionally, on Tuesday we noted that Goldman CFO Marty Chavez said on the company’s earnings conference call that corporate America has also started to move past waiting for tax reform in order to make strategic decisions.

“[Tax reform] is certainly a part of our engagement with clients,” Chavez said. “I will also note, however, that clients, it seems to us, have moved towards saying tax reform would be a good thing, but it’s not stopping us from considering strategic acquisitions and sales right now.”

So not only are investors not seeming to pin their hopes on tax reform, but neither are corporate executives. Which places even more doubt in the conclusion that a failure to execute on tax reform would see a “reversal” in the stock market’s more than 20% run higher since the election.

Mnuchin’s comments are also in contrast to the position he previously sketched out for the administration on the stock market. In February, Mnuchin said the administration “absolutely” views the stock market as a report card on the economy and, by extension, the success of Trump’s economic agenda.

Since Mnuchin made those comments, the Dow is up over 11% and the S&P 500 is up more than 8%. Both indexes are at record highs and on Wednesday morning the Dow opened above 23,000 for the first time.

It seems, then, that the market is fine with the Trump administration so far, even as previously-outlined deadlines for tax reform have come and gone and the plan remains just an outline. And an outline that may yet change.

“We’ve released an outline of where we are [on tax reform],” Trump’s chief economic advisor Gary Cohn told Yahoo Finance on Tuesday.

“We’re trying to get from an outline to a bill,” Cohn added. “We’re trying to do that in the Senate and in the House. I think everything’s on the table. We are open to a lot of compromise.”

It’s unclear then why the stock market would react so negatively to a failure to pass tax reform given how little it seems is clear about what that reform would even look like.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here: