Trump calls a key part of the Republican tax plan 'too complicated'

How President-elect Donald Trump might actually execute his policy promises is starting to come into focus.

And one thing that’s clear is the typical complications lawmakers and citizens alike have come to expect from major pieces of legislation don’t seem likely to be acceptable to Trump.

In an interview with The Wall Street Journal, Trump spoke out against one of the most contentious parts of the House Republican plan to overhaul the US tax code.

According to the Journal’s report published Monday night, Trump called the border adjustment element of the House Republican plan “too complicated,” adding that, “Anytime I hear border adjustment, I don’t love it. Because usually it means we’re going to get adjusted into a bad deal. That’s what happens.”

On Tuesday, however, AshLee Strong, national press secretary for House Speaker Paul Ryan, said, “We’re very confident we’ll get it done,” according to Politico’s Rachel Bade.

As currently constructed, the House Republican plan would incentivize US companies to locate production in the US as it would tax goods based on where they are sold, not created. This would happen via a border adjustment tax which taxes imports and allows exports to be exempt.

But the most significant part of Trump decrying the currently-proposed border adjustment as “too complicated” is that it provides a window into how Trump is likely, at least in the early days of his administration, to try and get policy executed.

Make no mistake, border adjustment taxes are fairly complicated. How are multinational companies with operations inside the US to be treated? Think about a car, constructed and sold in the US, but built with many parts sourced from overseas. How are taxes applied there and at what stage in the process?

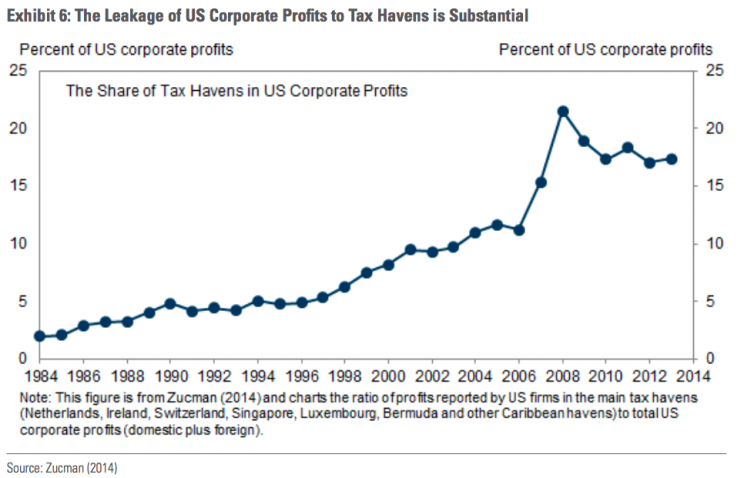

The current tax code allows companies to build goods in low-tax countries and then import those goods to the US, creating incentives for things like tax inversions among other maneuvers. This chart from Goldman Sachs shows how US corporate profits have increasingly been parked outside the US over the last several decades.

And there is also concern the House Republican plan, as constructed, could run afoul of the US’ obligations as a member of the WTO.

A recent note from Goldman Sachs outlines how this could even lead to a broader trade conflict. “The other potential cost is the potential for increased trade frictions,” the firm writes.

Goldman adds:

The policy, as it has been described in various proposals over the last several years, is very likely to be found to violate the WTO prohibition on border-adjusting direct taxes like the corporate income tax. Over the long run, it is possible that WTO rules could be changed to allow for such a system, but the outlook here is unclear.

If no changes are made, trading partners would likely retaliate; the largest authorization of trade retaliation ever awarded in a US trade dispute came after a WTO panel found that the last US attempt at using the corporate tax to encourage exports did not comply with WTO rules. If such a policy increases long-run trade frictions, it could offset some of the policy’s potential long run benefits to growth.

And the border tax adjustment, we’d note, is but a small part of the tax overhaul proposed by House Republicans and sought as a core part of Trump’s campaign promises. Headline corporate tax rates, tweaks to personal income taxes, and estate taxes are all among the many issues addressed in the plan.

Seemingly every politician in the last generation has sought some sort of tax reform. And whether you want to raise or lower taxes, simplifying the tax code is often a cornerstone of any campaign pledge.

But given the ballooning of the US tax law from around 26,000 pages in 1986 to 70,000 pages in 2016, according to the House Republican plan, it’s clear that modern US politics have featured talk of simplifying crossed with a reality of more bloat.

Trump, however, has never before been in elected office. And while the US government’s three branches require some level of compromise, markets have more or less taken Trump at his word even when his pledges — like a $1 trillion infrastructure plan — fall outside typical Republican orthodoxy.

Notably, in the same interview Trump bemoaned the complication of a border adjustment tax, Trump said the US dollar was “too strong,” sending the value of the dollar down about 0.6% in early trade on Tuesday.

The thinking behind a border adjustment tax is simple: companies are gaming the US tax system to avoid taxes while the US tax code allows for loopholes other countries prevent. This tax, then, is about the US getting what some lawmakers think the government is due.

Slapping a tariff on imports is certainly a simpler way to “make right” a complicated global tax and trade environment. But these tariffs would seem likely to set off a cascade of similarly punitive trade measures from other major trading partners. The question, then, is whether Trump can be convinced to avoid this outcome.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles: