President Trump tweeted about ‘quantitative tightening’ — here’s what that is

President Donald Trump tweeted Tuesday afternoon that the Federal Reserve should cut the benchmark interest rate by 1%, on the eve of the central bank’s third policy-setting meeting of the year.

The president criticized Fed Chairman Jerome Powell and the Federal Open Market Committee for “incessantly” raising interest rates four times in 2018 and doing “quantitative tightening,” all while China adds “great stimulus to its economy” by keeping rates low.

China is adding great stimulus to its economy while at the same time keeping interest rates low. Our Federal Reserve has incessantly lifted interest rates, even though inflation is very low, and instituted a very big dose of quantitative tightening. We have the potential to go...

— Donald J. Trump (@realDonaldTrump) April 30, 2019

....up like a rocket if we did some lowering of rates, like one point, and some quantitative easing. Yes, we are doing very well at 3.2% GDP, but with our wonderfully low inflation, we could be setting major records &, at the same time, make our National Debt start to look small!

— Donald J. Trump (@realDonaldTrump) April 30, 2019

Trump has publicly harped on “quantitative tightening” multiple times over the last two months: once on April 27 at a rally in Green Bay, Wisconsin, three times on the White House lawn on April 5, and three times at the Conservative Political Action Conference on March 2.

But what is quantitative tightening, why should anyone care, and why does Trump think it hurts his economic reform?

Quantitative easing, but in reverse

To understand quantitative tightening, you have to understand quantitative easing.

During the financial crisis, housing markets collapsed and sent ripple effects through the economy as bad mortgage-backed securities and other collateralized and credit products sent the financial services industry into a tailspin.

To absorb the deteriorating assets and inject liquidity into the economy, the Ben Bernanke-led Fed booked a large amount of agency mortgage-backed securities and agency debt in a strategy of unconventional monetary policy called “quantitative easing.”

In 2011, the Fed tried another form of quantitative easing: adding long-term Treasurys to its balance sheet. Deemed the “Operation Twist” program, the process effectively flattened the yield curve and signaled its commitment to accommodative monetary policy as it attempted to crawl out of recession.

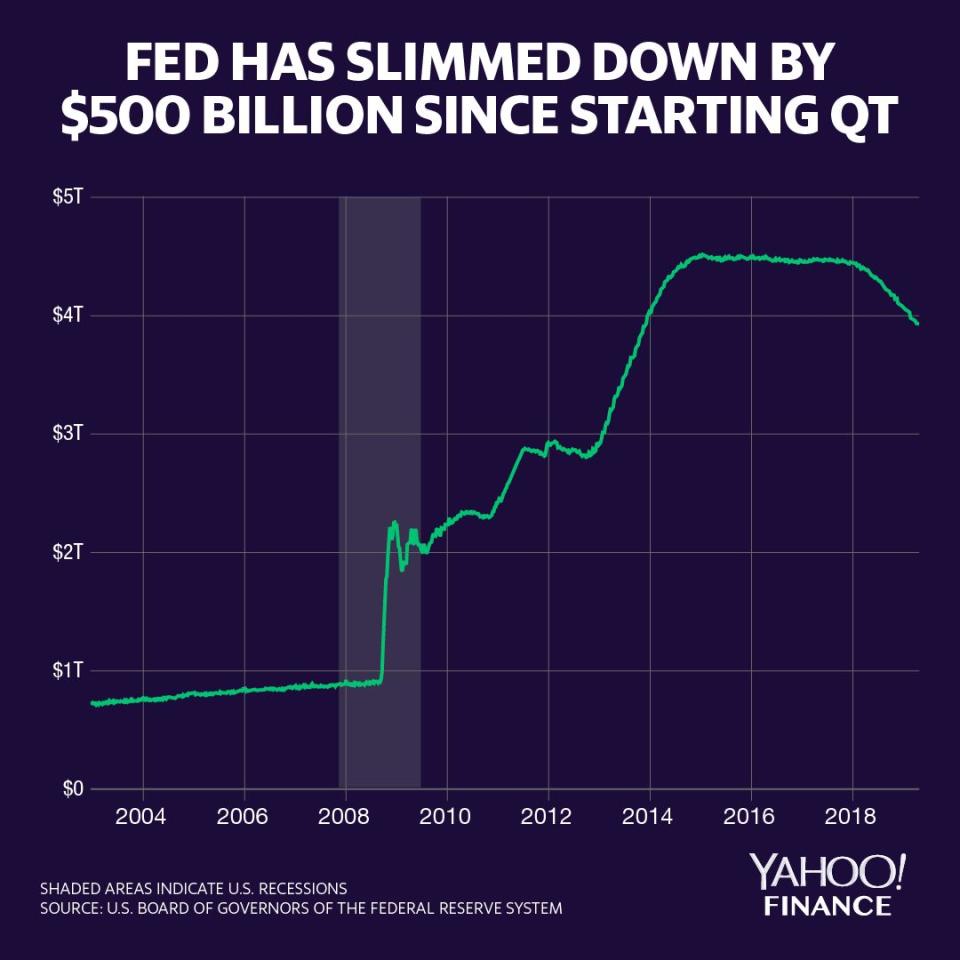

These collective efforts expanded the Fed’s balance sheet to about $4.5 trillion.

With the Fed now in an effort to normalize rates, the Fed hopes to undo its holdings of these unconventional assets, as well. Through the process of “quantitative tightening,” the Fed wants to clean its balance sheet so that it is primarily comprised of shorter-term Treasurys.

At the end of 2017, the Fed began that process and has since shed over $500 billion. The Fed has telegraphed that it will slow the pace of its winddown in May, and ultimately conclude the unwind process by the end of September this year.

‘Feel the market’

Quantitative easing was an unprecedented form of monetary policy, and some market participants worry about the effects of undoing that process.

At the end of 2018, the likes of investor Stan Druckenmiller and former Fed Governor Kevin Warsh urged the Fed not to raise rates amid concerns that the balance sheet unwind creates a “double-barreled blitz” of policy impediments that could threaten a U.S. economy still capable of growth.

Trump piggybacked on the op-ed and advised the Fed to “feel the market, don’t just go by meaningless numbers.”

I hope the people over at the Fed will read today’s Wall Street Journal Editorial before they make yet another mistake. Also, don’t let the market become any more illiquid than it already is. Stop with the 50 B’s. Feel the market, don’t just go by meaningless numbers. Good luck!

— Donald J. Trump (@realDonaldTrump) December 18, 2018

The Fed’s dual mandate is price stability and maximum employment, not market pricing.

Critics argued that quantitative tightening is constraining because it pulls the liquidity that it flooded markets with in the post-crisis period, and some investors blamed the unwind for the market volatility around Christmas time.

Fed officials, like St. Louis Fed President James Bullard, has said that the effects of unwinding the balance sheet have been “relatively minor,” arguing that having interest rates so close to zero means that balance sheet changes are less potent.

And Fisher Investment founder Ken Fisher told Yahoo Finance the December sell-off was driven primarily by hedge funds closing, not the Fed.

100 basis points?

Trump argued Tuesday that the Fed needs to ease rates by 1%, claiming that China has added “great stimulus” to its economy by keeping interest rates low.

His repeated desire for lower rates has been repeated by White House adviser Larry Kudlow and floated Fed nominee Stephen Moore.

Trump’s circle of economic advisers believe that if the Fed had kept rates low and stopped unwinding its balance sheet, the administration’s economic efforts through deregulation and tax reform would have been more potent.

In 2018, GDP figures were in line with the White House’s promise of 3% growth. In 2019, uncertainty over the waning effects of tax reform and a possible spillover from slowing economic growth abroad has economists estimating a low shot at the U.S. economy growing by 3% this year.

Still, GDP figures for the first quarter of 2019 came in at 3.2%, boosted by government spending and net exports.

Trump continues to play what-if, not only asking the Fed to stop raising rates and halt its balance sheet unwinding, but urging Powell to in fact cut rates and buy more assets to expand its balance sheet.

For the Fed’s part, Powell insisted during 2018 that the economy could absorb the rate hikes amid “strong” economic activity. The Fed then shifted toward a dovish tone in its January meeting, and then followed through on its change by signaling no rate hikes in its March meeting.

Trump will likely be watching closely as the Fed concludes its next policy-setting meeting Wednesday, May 1.

—

Brian Cheung is a reporter covering the banking industry and the intersection of finance and policy for Yahoo Finance. You can follow him on Twitter @bcheungz.

Why markets are looking for clues on an 'insurance cut' from the Fed

FOMC Preview: Inflation in view as Fed expected to hold on rates

Bank CEOs quiet on M&A ambitions as expectations for consolidation build

Bank investors face a 'conundrum' in an inverting yield curve

Congress may have accidentally freed nearly all banks from the Volcker Rule