The Trump tax cuts aren’t trickling down yet

Economists are watching closely for signs the Trump tax cuts are boosting business spending, which would signal more hiring, rising pay and stronger economic growth.

They’re still squinting.

A variety of economic indicators shows that business spending, which Trump and his allies predicted would surge on account of the tax cuts Trump signed late last year, is healthy—but little changed from recent years. “Business investment is on track to have a solid year,” economist Ryan Sweet of Moody’s Analytics tells Yahoo Finance. “But there’s little evidence we are in a boom. The new tax legislation isn’t providing a significant boost to capital expenditures.”

[Check out our Trumponomics Report Card.]

It still could, as business leaders execute strategic decisions that typically play out over several years. But the trend so far in 2018 has actually been a bit weaker than in 2017. Here’s the data for four measures of business spending:

Capital goods orders, excluding aircraft and defense. This includes business spending on machinery, equipment, computers, office furniture and most other things companies need to operate. Spending picked up in 2016 and accelerated in 2017. But the rate of growth has actually slipped since then.

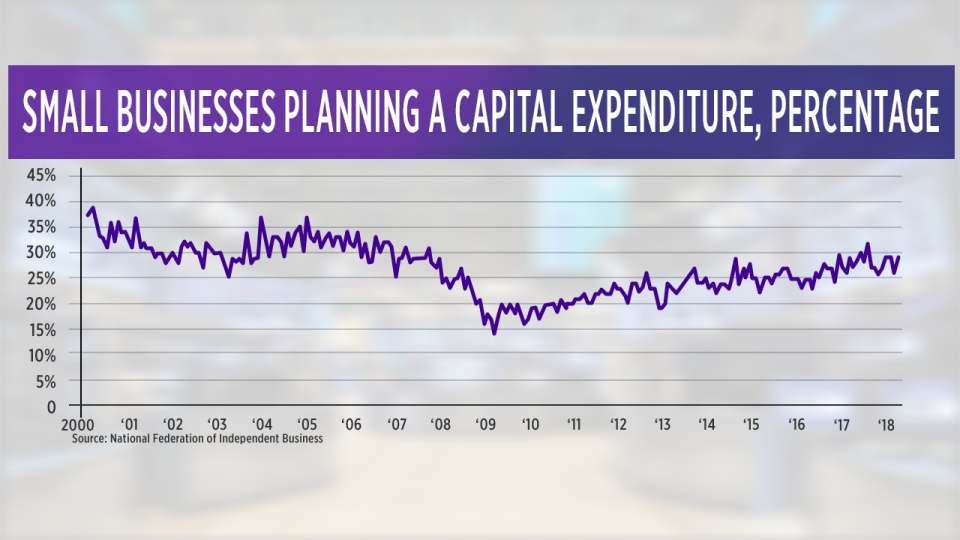

Small-business spending plans. This survey by the National Federation of Independent Business measures the percentage of business owners saying they plan to increase spending on equipment or facilities within the next three months. It has generally been drifting upward since the lows of 2009, but at 29%, is now three points lower than it was last August.

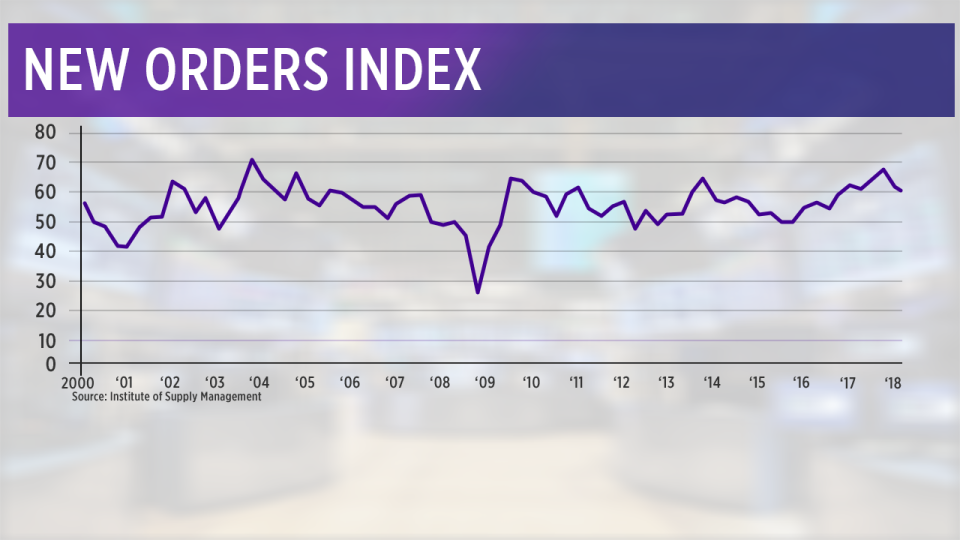

ISM manufacturing new orders index. This is a survey of businesses conducted monthly by the Institute for Supply Management, which asks, among other things, about the level of new orders manufacturing firms are receiving from customers. The index has been climbing since 2015, but it’s lower now than it was at the end of 2017.

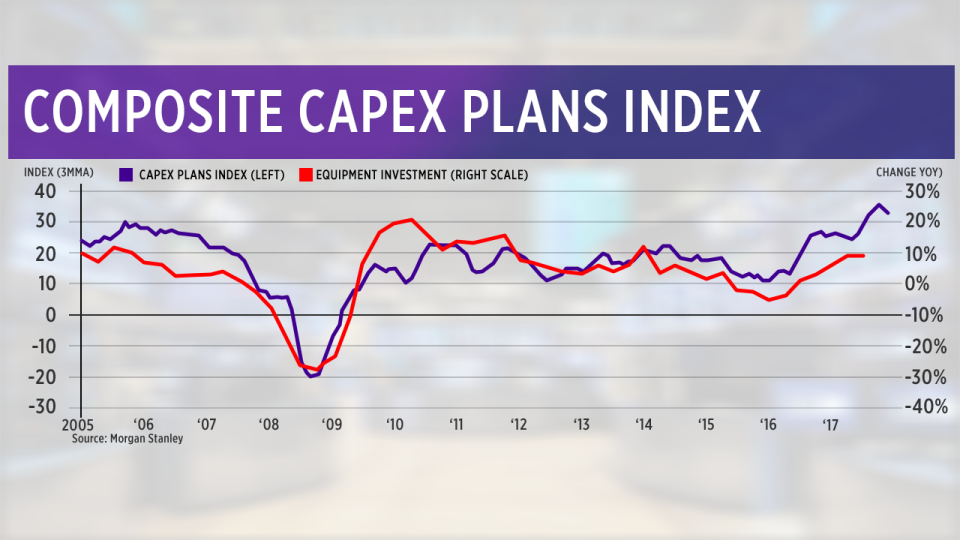

Morgan Stanley capital-expenditure plans index. This index tracks data on manufacturing spending plans in several Federal Reserve business surveys, and often signals spending that takes place about three months in the future. This index hit a record high in March, but fell back in April and May. Morgan Stanley says the data “remains consistent with continued strength in capital spending,” but doesn’t attribute that to tax cuts. A bigger factor: rising oil prices, which have triggered more investment at energy firms that profit more as prices rise.

Businesses don’t invest new money just because their profits go up or their cash pile grows. They only invest when they feel the return on that spending will be better than if they used the money in other ways. CEOs are generally optimistic about the economy, but they also have concerns about Trump’s penchant for protectionism and tariffs, along with labor shortages and a possible recession starting in 2019 or 2020. And they know there are chronic issues restraining economic growth—an aging population, low workforce participation, a subpar education system—which means future demand for goods and services may not be strong enough to warrant new investment today.

There’s something else companies can do with a tax-cut windfall: direct it to shareholders, through stock buybacks and dividend hikes. And that, they are doing with gusto. Share buybacks for S&P 500 companies hit a record of more than $187 billion in the first quarter, according to S&P Dow Jones Indices. Dividend hikes so far this year average 13.7%, the most since 2014, and the pace of hikes is running ahead of prior years. During the last 12 months, S&P 500 companies for the first time ever returned more than $1 trillion to investors through those two mechanisms. More is likely coming. “As for the full year of 2018, I believe we are looking at a new record for both buybacks and dividends,” says Howard Silverblatt, senior index analyst for S&P Dow Jones Indices.

Buybacks reduce the number of shares in circulation, which tends to drive up the price, as long as demand for the stock remains consistent. Dividend increases are essentially cash payments to shareholders, and they also tend to boost a stock’s value. The S&P 500 index is down slightly for the year, so those shareholder rewards haven’t triggered a giant rally. But stocks would probably be lower still without the buybacks and dividend hikes. And the rally may yet materialize, if dark clouds such as Trump’s protectionist threats dissipate. Besides, the shareholder class has enjoyed double-digit returns since Trump took office. Many ordinary workers wonder when their turn is coming.

Confidential tip line: [email protected]. Click here to get Rick’s stories by email.

Rick Newman is the author of four books, including Rebounders: How Winners Pivot from Setback to Success. Follow him on Twitter: @rickjnewman

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn