Why the Trump tax cuts are flopping

Bill Mead of Houston is glad the tax cuts signed by President Trump last year lowered the corporate tax rate, aligning it more with rates in other nations. But the naval architect, 71, still feels the cuts were far too generous to the wealthy. “I don’t know why they need it,” he says. “They’re just going to use it to overpay for something they could have anyway. They all need to sit down at the club and think about this. They could make the country better by paying a little more.”

Overall, Mead—a Republican—disapproves of the new tax law.

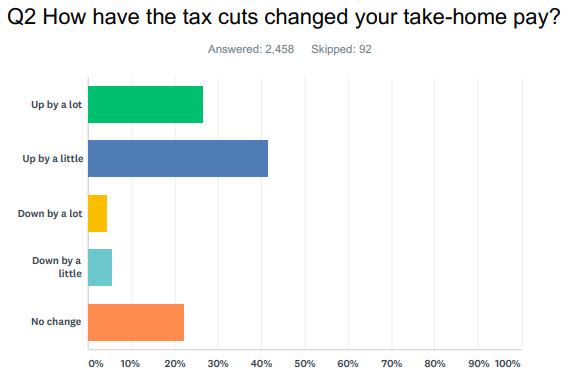

So do a lot of other Americans. In the latest Gallup poll, 48% of respondents said they disapprove of the tax cuts, while just 39% approve–which seems surprising, given that the cuts have boosted take-home pay for roughly two-thirds of workers. Republicans in Washington are so dismayed by the tax law’s unpopularity that they’re considering another round of tax cuts, although passage seems unlikely.

Yahoo Finance conducted its own flash poll on April 18 to figure out why, exactly, Americans don’t like the tax cuts. We found three basic reasons: People think the tax cuts favor the wealthy over the middle and working class. They’re suspicious that tax cuts for businesses are permanent but tax cuts for individuals are temporary. And they think it’s irresponsible to finance the tax cuts with debt that future workers will have to shoulder.

“It bothers me, because I have children and grandchildren and I wonder how this is going to affect them,” a database architect who lives in the Pacific Northwest told Yahoo Finance. His income is in the top 3%, he says, and his after-tax pay rose by about 5% this year due to the tax cuts. His daughter earns far less than he does, however, and she has seen little gain. “I got a huge benefit,” he says, “but my daughter, who makes about one-eighth what I make, saw a negligible increase in pay. We should have had a tax cut targeted at the class that’s really hurting.” The data architect is an Independent.

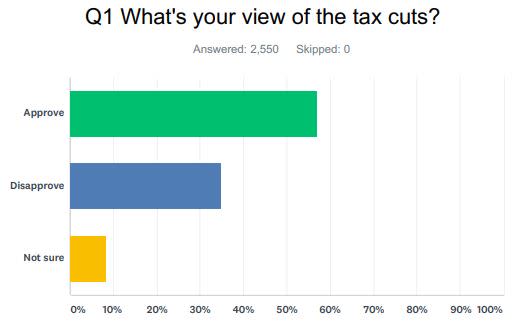

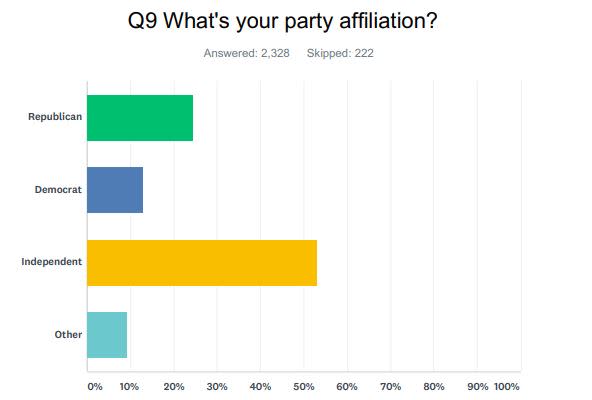

Our audience at Yahoo Finance is more enthused about the Trump tax cuts than the broader population, probably because they tend to be investors benefiting from provisions that favor shareholders and business owners. Of more than 2,000 respondents in our survey, 57% approve of the tax cuts. Our audience also favors President Trump by about 5 percentage points more than the broader population. (Full survey results are at the end of this story.)

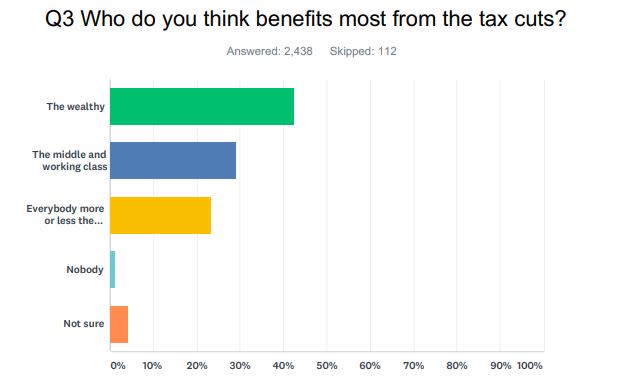

Who benefits most from the tax cuts?

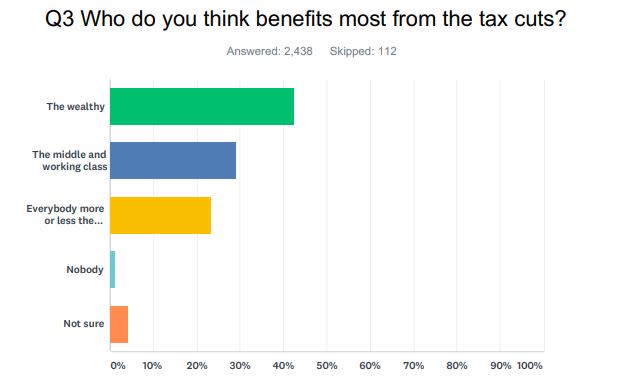

Yet even among a group favorably disposed toward tax cuts, two glaring objections to the GOP tax law appear in our survey results. First, a plurality—42%–think the tax cuts favor the wealthy most of all. Only 29.6% say they favor the working and middle class.

Respondents are also concerned about the $1.8 trillion in new debt the US government will have to issue over the next decade, to make up for federal revenue lost to the tax cuts. “This was adding fuel to a fire already burning fine,” says Mike, a Wisconsin investment adviser. “We should be running, at worst, a break-even budget right now and stacking some dry powder. It was just a classic case of borrowing from the future at the stupidest possible time.” Mike is a Republican.

In our survey, 44.5% of respondents said short-term benefits from the tax cuts is not worth the additional debt. Only 39.4% feel the benefits are worth the additional debt.

There’s some good news in our survey for supporters of the tax cuts—69% of respondents think they’ll help the economy, on net, while only 29.9% think they’ll hurt the economy. But some people need to be convinced.

Carl Hensley, who runs a small trading firm in northwest Indiana, thinks the tax cuts are a “gift for wealthy people” while the “middle class is getting very short-term benefits.” But he concedes that businesses might use some of the windfall to produce more in the United States and create more jobs. “If that occurs, then great,” says Hensley, a 63-year-old Republican. “But it just doesn’t seem the direction this is going.”

Hensley doesn’t object to the business-tax cuts, but he would have preferred cuts contingent on new investment and new jobs. Instead, he sees companies putting most of the windfall into dividend hikes, share buybacks and other moves that mainly benefit investors. Maybe that’s why Republicans in Washington want a redo.

Here are the full results of our survey, conducted online via SurveyMonkey on April 18:

Confidential tip line: [email protected]. Click here to get Rick’s stories by email.

Read more:

Rick Newman is the author of four books, including Rebounders: How Winners Pivot from Setback to Success. Follow him on Twitter: @rickjnewman

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn