The Trump tax cuts will help Republicans more than Democrats

The tax cuts Congress is likely to pass by the end of the year will benefit many Americans, harm some and leave others unaffected. Perhaps it’s no surprise that Republicans across the country will benefit more from the cuts than Democrats or Independents, according to a new Yahoo Finance analysis of election data.

The legislation, likely to pass with majority Republican support and virtually no Democratic votes, will generally provide bigger tax cuts for higher earners, in terms of both the percentage increase in after-tax income, and the dollar value of that income. So the party with wealthier members is likely to enjoy more of the benefits.

Anecdotal reporting suggests Democrats have become the party of affluent urban elites, while Republicans increasingly count blue-collar workers and the rural poor among their numbers. While those trends may be legitimate, it is also true that Republican voters are wealthier in general than either Democrats or Independents.

Yahoo Finance analyzed data from a comprehensive study of 2016 voters conducted by American National Election Studies, a nonpartisan research group. The survey covered more than 3,900 voters both before and after the 2016 elections. Here’s how the parties break down by income:

The portion of Republicans with incomes over $100,000 is nearly 5 percentage points higher than the portion of Democrats meeting that threshold. At the lower end, the portion of Democrats with incomes below $50,000 is 13 points higher than the portion of Republicans.

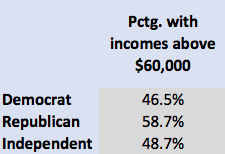

We sliced the numbers another way, to see what percentage of each group had household income above the national median, which is around $59,000. Since the income data is split into $5,000 increments, we calculated the portion of each group with incomes above $60,000:

So a larger portion of Republicans has incomes above $100,000 and above the national median, making the GOP the wealthiest party. Democrats are the least wealthy. Independents generally fall in the middle.

So why will tax cuts benefit the Republicans more? Because the more you earn, the bigger your tax cuts are likely to be.

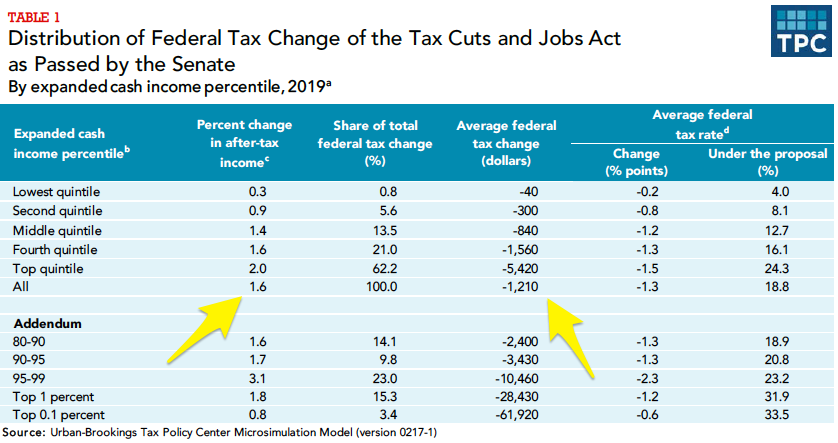

The nonpartisan Tax Policy Center has produced the best estimate so far of how the tax cuts will affect individual taxpayers. Here’s their analysis of the Senate legislation, which is most similar to the final bill House and Senate negotiators seem to have agreed on as of Dec. 13. The arrows show where the net effects are for each income group:

The size of the tax break increases—in both percentage and dollar terms—the higher up the income ladder you go. The top 20% of earners, with household incomes above $112,000 or so, would see an average tax cut of 2%, or $5,420 per year. The bottom 20% would see an average tax cut of 0.3%, or $40 per year. The final legislation may be even more generous to the wealthy, because it would cut the top rate from 39.6% to 37%, whereas the Senate bill would only have cut it to 38.5%.

Since there are more Republicans than Democrats (or Independents) in the upper-income group, R’s would benefit more than D’s. That’s in addition to another change that will disproportionately benefit people who live in low-tax states—which heavily lean Republican—and punish residents of high-tax states, which heavily lean Democratic. Capping the total amount of deductions for state and local taxes to $10,000 could generate a big tax hit for people who itemize their deductions and claim well in excess of $10,000 in state and local taxes today. That’s one big reason a package of “tax cuts” could actually raise taxes for at least 11 million U.S. taxpayers. Some Republicans have even likened their tax bill as “death to Democrats,” indicating premeditated intent to harm members of the other party.

The Trump tax cuts seem overwhelmingly likely to pass. But that doesn’t mean they’ll be permanent. The unpopularity of the overall plan suggests Democrats could dismantle some of the cuts if they retake control of the government in 2020 or later. Until then, we’re likely to have a very uneven set of tax cuts improving some people’s finances and harming other people’s–along with a lot of bitterness about the designated winners and losers.

Confidential tip line: [email protected]. Encrypted communication available.

Read more:

Rick Newman is the author of four books, including Rebounders: How Winners Pivot from Setback to Success. Follow him on Twitter: @rickjnewman