Trump's election has interest in private jets at the highest level since before the financial crisis

We’ve written a lot about how Donald Trump’s election win is boosting business and consumerconfidence.

And now we’ve got another segment of the economy getting a lift from Trump’s win: private jets.

In its latest survey of the business jet market, UBS’ aerospace team led by the David Strauss found its overall Business Jet Market Index hit 53, 5% better than its last survey and the fifth straight improvement for the reading.

But the biggest standout areas of the survey were, like the broader economic data we’ve been tracking, in the expectations and outlook responses.

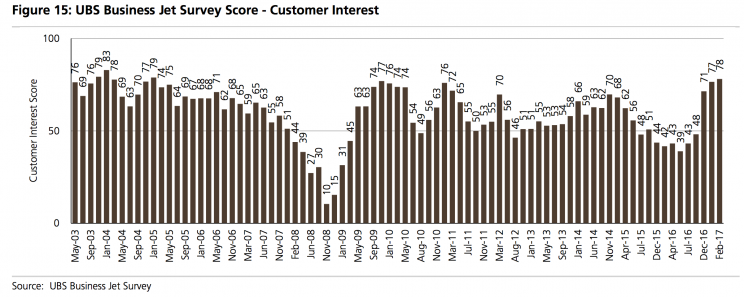

UBS’ customer interest score hit 78 in February, the highest since January 2005. Sixty percent of the 153 respondents from UBS’ survey indicated that customer interest had improved since its last survey while just 3% said interest had declined. In January, 55% of respondents said customer interest had improved.

Additionally, 65% of respondents indicated that they expect the election to positive impact the market, though this is slightly less than the 72% who expected a positive impact in UBS’ last survey. Some of this optimism, however, is beginning to trickle into actual action from jet buyers or leasers.

“In terms of validating this optimism,” UBS writes, “49% have seen an increase in transactions since the election while only 5% have seen lower volumes.”

Now, this survey comes amid a private jet market that is still not in great shape, as UBS notes there exists an inventory overhang and weak utilization.

And as one professional in the market told UBS, “Trump Bump has given way to ‘wait and see’ — will there be a trade war? Will there be an import tax? Will manufacturing have to restructure? With any uncertainty in the overall economy or political environment, aircraft owners choose to wait. Expect to see pick up in sales late this year once we understand what a Trump government will look and act like.”

Perhaps not unexpectedly, then, the business jet market sounds a lot like the tension we’re seeing in markets between investors and analysts.

Last week, for the first time we saw some of this increased confidence turning into increased spending.

And while improving spending from consumers, and increased investment from businesses, are the sorts of trends that underwrite improvements in actual economic performance, better private jet markets probably won’t make any difference on Main Street.

—

Myles Udland is a writer at Yahoo Finance. Follow him on Twitter @MylesUdland

Read more from Myles here:

Yahoo Finance

Yahoo Finance