How Trump's tariffs would mess up the car business

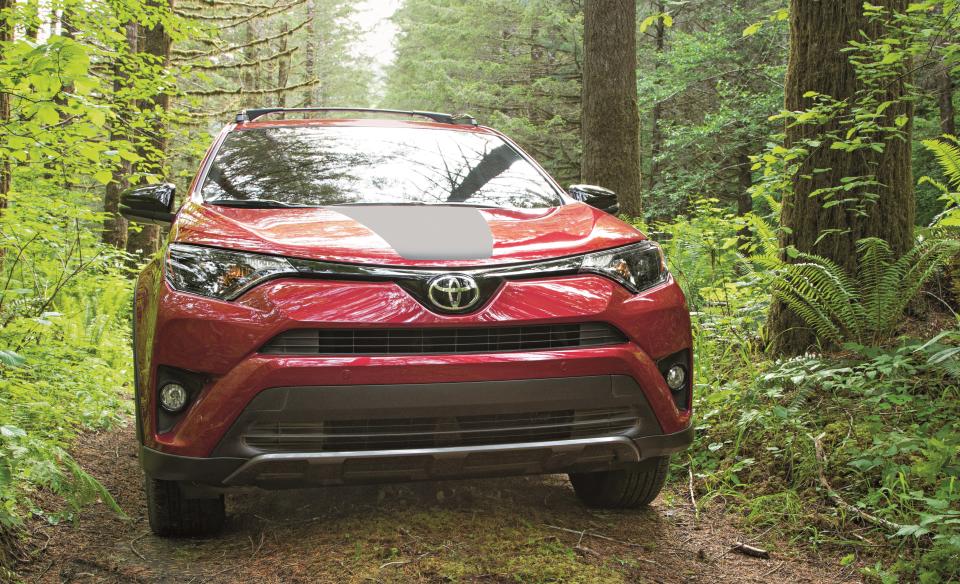

Want a hot-selling Toyota RAV 4? The typical selling price is around $25,000. But if President Trump gets his way, the price could jump to more than $31,000, because the RAV4 is an import that would be subject to a new 25% tariff Trump is considering.

Trump seems obsessed with tariffs, or at least obsessed with threatening them. In his latest effort at protectionism, Trump has directed the Commerce Department to investigate whether auto imports jeopardize America’s national security. You read that right. Trump might invoke an obscure provision of a 1962 law meant to protect America’s manufacturing base, so it remains robust if ever needed in wartime. If an investigation finds that auto imports create a vulnerability, Trump can impose tariffs to protect domestic production.

Trade experts view the national-security invocation as a canard Trump needs because he can’t find more legitimate reasons to impose tariffs. Yet the Commerce Department gave Trump national-security justification for the steel and aluminum tariffs he imposed in March. So it’s not out of the question it could do the same for auto imports. If so, Trump’s auto tariffs could be as high as 25%, according to the Wall Street Journal.

Such tariffs would cause havoc for car buyers and manufacturers, because of the way they’d disrupt the complex global supply chains that bring all the parts for a given automobile to the factory where it’s assembled. A car assembled in Michigan or Kentucky or Alabama sounds like it’s an American-made car, because American workers put the final pieces together. But cars have thousands of parts, and major components such as engines and transmissions can be built elsewhere, then imported to the United States for final assembly. Or vice versa. Automakers, over time, have devised what they believe are the most efficient systems for shipping parts and putting them together, at a cost that suits the customer and lets manufacturers turn a profit.

Trump’s tariffs would upend all that. The RAV4, for instance, is one of the most popular vehicles in the US market, yet that might change if it were suddenly far more expensive than competing vehicles that are assembled in America and would therefore be exempt from tariffs, such as the Ford Escape, Honda CR-V or Subaru Outback.

But wait, it’s not that simple. If the cost of the leading crossover rose by 25%, then competitors might raise their prices, too. And hold on a minute—some CR-Vs are assembled in the United States, but others are built in Canada. So some models would bear the tariffs while others wouldn’t.

Which cars are more American?

Automotive supply chains are so complex, in fact, that you can play a game of trivia, with surprising answers, trying to guess which cars are more American than others:

Honda Accord or Ford Fusion? This one’s easy. The Accord, built by Japan-based Honda, contains 60% US content, because major components are built here and the car is assembled in Ohio. The Fusion is assembled in Mexico and has just 40% US content.

Chevy Silverado or Toyota Tundra? The foreign-based automaker wins again. The Tundra pickup is built in Texas, with an American-made engine and a Japanese-made transmission. Its US parts content is 65%. The Silverado is built in Michigan and Indiana, but 44% of the parts come from Mexico, which leaves it with a US parts content of just 46%.

GMC Acadia or Nissan Pathfinder? The Acadia, built by General Motors, America’s biggest car company, wins by a nose, with 57% US content. The Pathfinder, built by Japan’s Nissan, has 55% US content.

You get the idea. A typical automobile includes thousands of parts sourced from all over the globe, and it’s no simple task deciding what makes any given car “American.” An annual index published by American University’s Kogod School of Business includes seven criteria to determine which cars are most American, including where the car is assembled, where the parts come from, where the parent company spends most of its research and development money and which country the profits end up in. By that methodology, 13 nameplates belonging to General Motors, Ford and Jeep top the list, with the Honda CR-V being the most American car produced by a foreign manufacturer.

Trump probably knows he would roil the industry—and dent car buyers’ wallets—if he went as far as imposing tariffs on such a high-value consumer product. So the threat is probably a scare tactic meant to aid in Trump’s effort to revamp the North American Free Trade Agreement. Those talks have reportedly stalled amid disputes over US content requirements for cars sold in the United States, which Trump wants to raise. Mexico and Canada, not surprisingly, don’t see it that way.

If Trump ever did impose import tariffs on the magnitude of 25%, it would trigger a mad scramble among manufacturers to rebuild their supply lines and get on the right side of the tariffs. That in itself would introduce new inefficiencies that would add even more to car prices, beyond the amount of the tariffs. So Trump would have to convince voters that costlier cars are in their interest. The slickest car salesman would have trouble selling that.

Confidential tip line: [email protected].Click here to get Rick’s stories by email.

Rick Newman is the author of four books, including Rebounders: How Winners Pivot from Setback to Success. Follow him on Twitter: @rickjnewman

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn