Trump's trade war is undercutting his hopes for the dollar

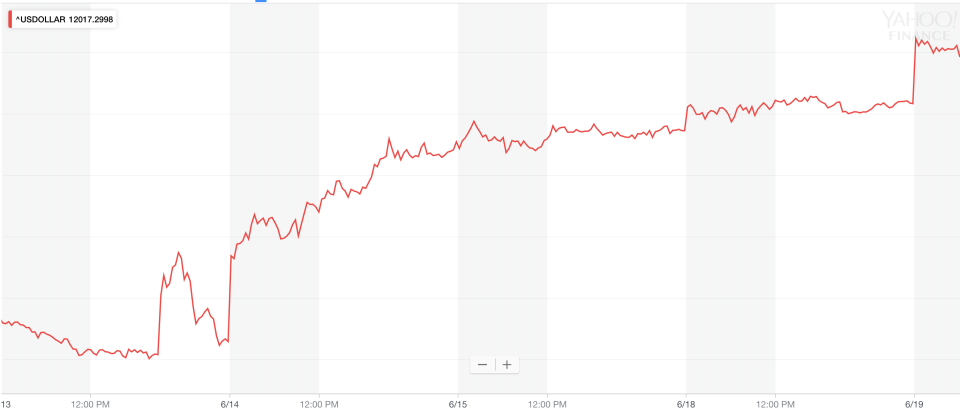

Fears of a looming trade war between the U.S. and China are paradoxically helping to increase the value of the U.S. dollar in global currency markets, analysts say, potentially undercutting a Trump administration policy goal.

U.S. President Donald Trump on Tuesday threatened to impose tariffs on $200 billion of Chinese goods and further tariffs if Beijing retaliates, which Chinese lawmakers have said they will. That has escalated fears of a global tit-for-tat that could derail the current buoyancy in world financial markets.

Trump and members of his administration have long expressed their desire for a weaker dollar, which helps multi-national firms offer competitive prices and increases the value of their profits overseas when they convert them from the local country’s currency back into dollars.

Trump’s latest exercise in trade war diplomacy, first with European and North American allies and now with China, is crushing market sentiment, pushing stocks lower and paradoxically sending flows to the U.S. dollar, analysts said.

“It’s primarily a movement out of [emerging market] and other at-risk currencies into the U.S. dollar,” Kathy Lien, managing director of FX Strategy at BK Asset Management in New York, told Yahoo Finance.

Lien, on Monday, sent out a note to clients detailing how the trade war was helping the dollar climb.

Currency traders also are piling into the Japanese yen, which is often sought in times of market stress because of the country’s large current account surplus. However, the currency reaction is largely a result of the move out of stocks and other riskier assets, analysts said.

“The clearest reaction probably is seen in equities because trade wars are not good for companies. That’s a pretty obvious statement,” said Gennadiy Goldberg, interest rates strategist at TD Securities. “It does compress margins, it disrupts supply changes, potentially. So there are unseen costs or … impacts for companies that are certainly not growth positive.”

‘The trade war is broadly viewed as being negative for U.S.’

The benchmark S&P 500 was on track to fall by the most in three weeks Tuesday and the CBOE Volatility Index, a gauge of market fear, rose the most in three weeks in early trading. Along with lower stock prices, U.S. Treasury note prices are higher, meaning yields are lower, and currencies such as the South African rand, Brazilian real and Australian dollar, which are considered riskier, saw losses.

Trade war fear also is straining the usual correlation between U.S. Treasury yields and the dollar. Typically, when a country’s government bonds offer higher yield it makes the currency more attractive to hold, drawing investors.

“The trade war broadly is viewed as being negative for U.S., so it puts a little bit of a lid on rates,” said Thomas Simons, money market economist at Jefferies and Co.

Market analysts said they don’t expect the dollar’s strength to continue, though, because at some point the safe-haven appeal of the dollar will start to wane and worries about the state of a synchronized global growth story will weigh on it. Additionally, traders said they don’t think Trump can continue his battle with China because of U.S. election realities.

“The president wants to be in a strong position, look strong, act strong and show no signs of weakness, but at the end of the day he faces an election and that’s not the case in China,” said John Doyle, director of markets at Tempus Inc in Washington. “These kinds of trade wars do play out over a long period of time, and the collateral damage in all this will be the American consumer. That’s not China’s problem.”

Earlier this year, the Chinese Communist Party rolled back its two-term presidential limit, clearing the way for President Xi Jinping to lead the nation for as long as he chooses.

“If you roll this out over the next year, year and a half, someone’s going to have to blink,” Doyle said, “and it might have to be the United States because our political realities are different than theirs.”

Read more:

It’s the end of the world as we know it, and investors feel bullish

Would you invest in a company that sells $100 bottles of water?

Fund managers warn a downturn is coming and it’s ‘going to be ugly’

—

Dion Rabouin is a markets reporter for Yahoo Finance. Follow him on Twitter: @DionRabouin.

Follow Yahoo Finance on Facebook, Twitter, Instagram, and LinkedIn.