How delivery services like Uber Eats could keep the 'most exposed' small businesses afloat

As states and cities across the U.S. shut down non-essential services, including dining in at restaurants and bars, eateries are turning to take-out and delivery as their only means to stay afloat through the coronavirus pandemic.

And that is leading many restaurants to sign up for on-demand delivery service Uber Eats (UBER).

During a March 19 investor call, Uber CEO Dara Khosrowshahi said that Uber Eats alone saw a 10x increase in the number of self-serve signups by restaurants between March 12 and March 19 than it does during a normal week.

The delivery service’s small and medium business sales team saw a similar uptick, adding 2.5x more restaurants for Uber Eats a day than it does normally during an average week, Khosrowshahi explained.

“I think this is the time when restaurants are saying, we need incremental demand,” JMP Securities analyst Ronald Josey told Yahoo Finance. “And right now the only way to get incremental demand, or a way to get incremental demand is through advertising and, or, being distributed on these apps.”

Restaurants are getting hammered

Restaurants and bars have been financially hammered by lockdowns from New York to California, and with states like Massachusetts, Illinois, Pennsylvania, Ohio, and Texas following suit, the establishments face an uncertain future.

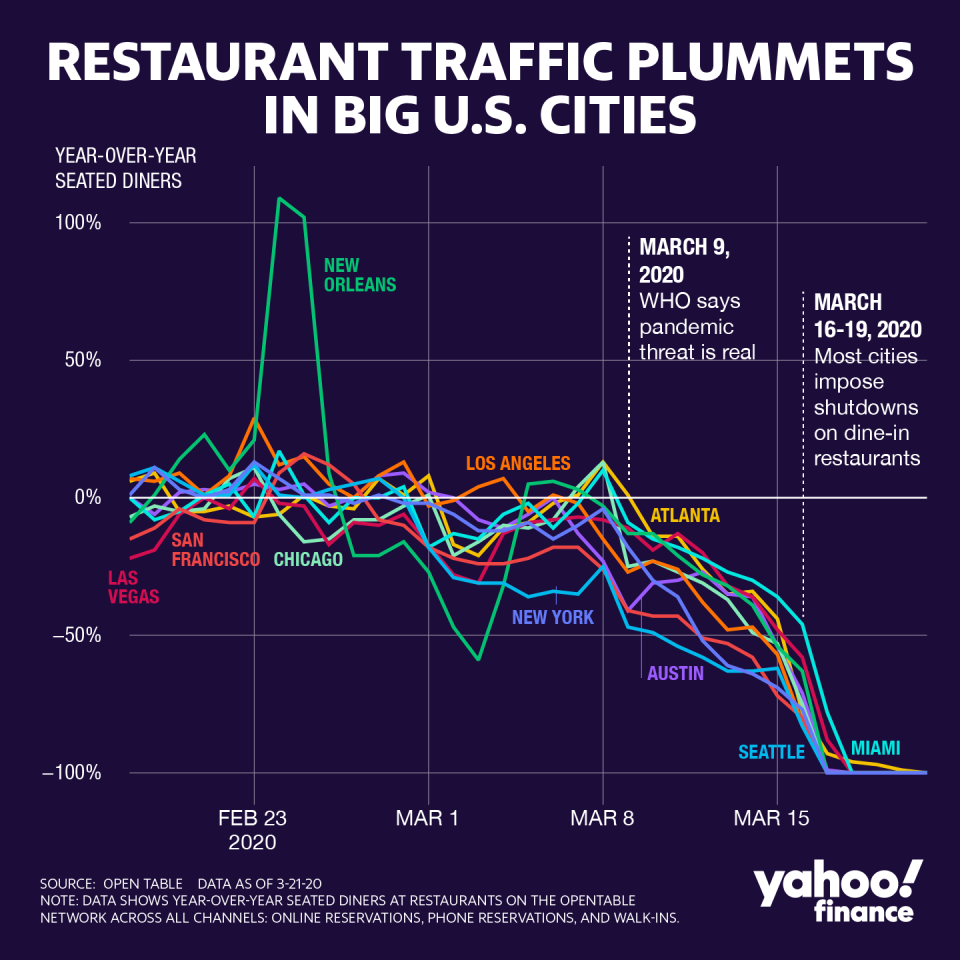

According to data from OpenTable, eat-in diners across its network of 60,000 international restaurants saw a year-over-year decline of between 10% and 19% on March 9, which further collapsed to between 95% and 100% as of March 22. On March 16, New York, New Jersey, and Connecticut ordered the closure of restaurants to dine-in customers. California later followed suit, with several other states making similar moves in the days that followed.

Only restaurants in Australia were seeing declines of less than 90%, with dine-in customers falling just 66%. On March 24, however, Australia ordered the closure of dine-in restaurants and bars, allowing for take-out and delivery only.

Coronavirus shutdowns are hurting industries across the economy from car dealerships and salons to specialty retailers like Apple and Nike. But among the hardest hit are the travel and restaurant industries.

“Restaurants are the most exposed group, one of the most exposed small businesses out there,” Josey said.

“You have perishable items, and you have a payroll, and you have rent to pay, and if you don’t get the orders it’s really hard. And so I think that, with folks not going out, broadly speaking, and certainly the social distancing that’s happening, food delivery is just something that you’re going to see more and more of.”

The increase in business to delivery services hasn’t been lost on those companies’ CEOs, either. In early March, Uber’s Khosrowshahi told the Morgan Stanley 2020 Technology, Media & Telecom Conference in San Francisco that while the company’s ride-hailing business is likely to take a beating during the outbreak, Eats will likely see a boost.

“Certainly our rides business to the extent that people stop leaving their house will take a hit, while our business Eats will probably actually benefit,” he said.

Andrew Wiederhorn, CEO of FAT Brands (FAT), a franchising company that works with the likes of Fatburger and Ponderosa Steakhouse, told Yahoo Finance that franchise partners FAT works with are seeing an increase in the number of customers who get takeout.

“We are seeing an uptick in delivery across our fast casual brand,” Wiederhorn said. “We normally do 40% of our business to-go or delivery, and today it’s up probably 10 points, which is strong.”

Cutting fees to keep restaurants open

While delivery services are seeing a boom, they often have a contentious relationship with restaurants and bars.

Delivery and processing fees from firms ranging from DoorDash to Uber Eats have become a major sticking point for restaurateurs and regulators alike. Such fees can run between 15% and 30% depending on the service a restaurant works with, and can lead to unprofitable deliveries.

Eateries have been pushing back against those fees as delivery services have steadily taken off. In New York City, council members have called for a 10% cap on delivery fees. Business groups in other states including Chicago are also pushing back against delivery fees, which they see as onerous.

Delivery service companies, meanwhile, say that they help provide exposure to restaurants that they might not otherwise see, and that they benefit from the advertising offered by their apps.

In a dramatic, if temporary, shift, however, delivery services are increasingly waiving or delaying their normal fees delivery and processing fees, to help keep restaurants solvent.

Uber Eats has said that it will, for a time, waive fees for independent restaurants in the U.S. and Canada, while DoorDash says it will waive or reduce fees through April. Grubhub (GRUB), meanwhile, said it will suspend collecting up to $100 million in fees, though restaurants will eventually have to pay those back.

Not all restaurants will be able to lean on delivery for the long term, though. Wiederhorn explained that some establishments simply don’t have the cash flow to stay open under current conditions.

Will the bump stick?

For those that can survive, the question remains: Will the bump from the coronavirus stick around for delivery services?

“I think whenever you have times of crisis like these, any service that can minimize any friction is going to have staying power,” Josey said.

Delivery services are already massive in themselves. As of Q4, Grubhub had 22.6 million active diners who ordered through the service in the last year. Uber Eats, meanwhile recorded a 73% year-over-year increase in gross bookings, jumping to $4.4 million as of Q4 2019.

And those numbers are only expected to jump as a result of the virus. In other words, the days of using the delivery menu stuffed in the kitchen junk drawer may finally be coming to an end.

More from Dan:

‘Hopeless and scared’: Uber and Lyft drivers face financial ruin after coronavirus

Microsoft and Slack add millions of users amid coronavirus lockdowns

Here’s where to get your iPhone fixed with Apple closing stores around the world

Internet providers are cutting data caps, speeding up service as more Americans work from home

Got a tip? Email Daniel Howley at [email protected] or [email protected], and follow him on Twitter at @DanielHowley.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn, YouTube, and reddit.