The major investors making money from Uber's IPO

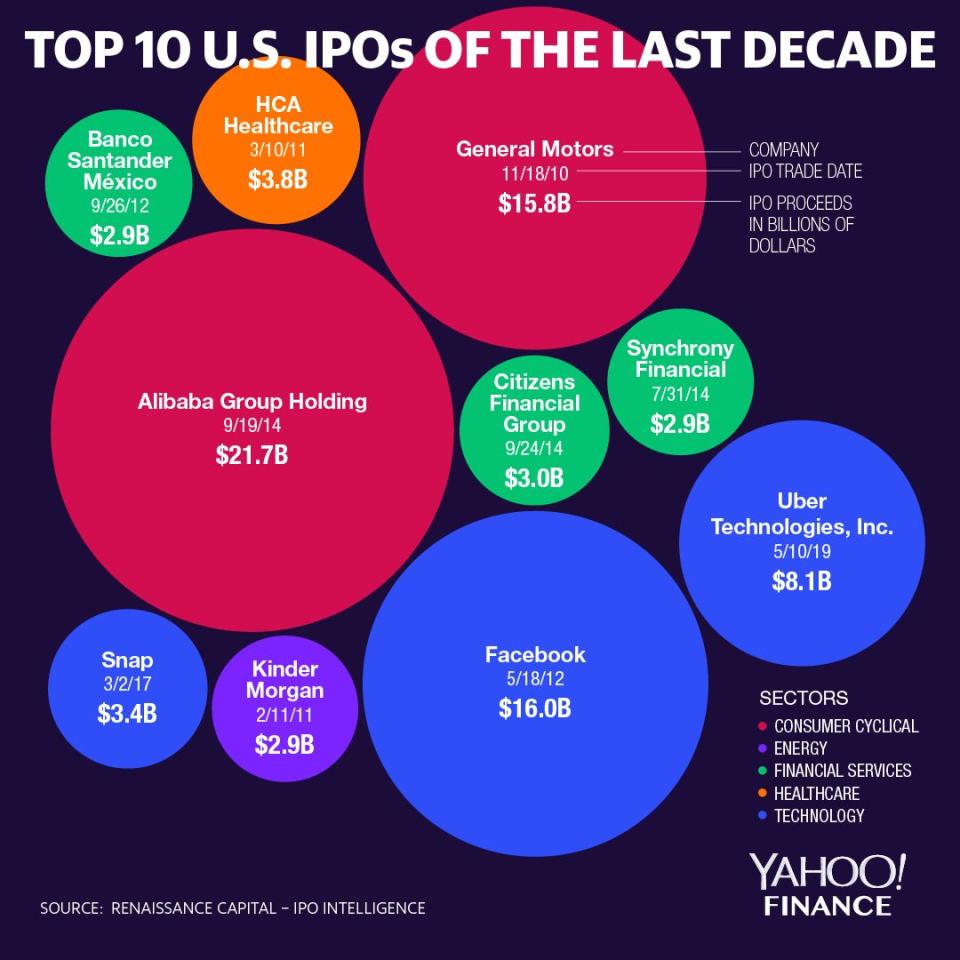

Uber’s (UBER) initial public offering is one of the largest in recent U.S. history, marking a milestone for investors, who have weathered the ride-hailing company’s significant ups-and-downs.

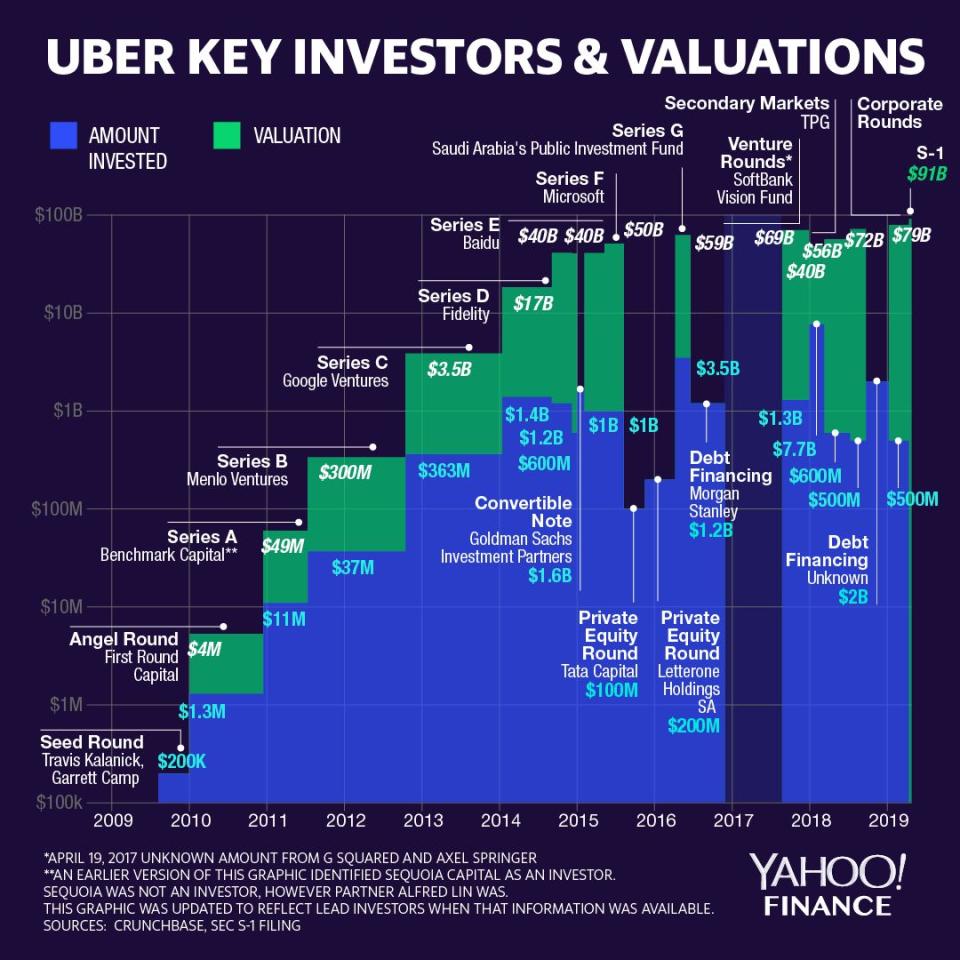

Since Travis Kalanick, Garrett Camp, and Oscar Salazar founded Uber in 2009, the San Francisco-based ride-hailing business has raised almost $25 billion from at least 95 investors, including First Round Capital, Sequoia Capital, TPG Growth, Microsoft (MSFT), and PayPal (PYPL). Those investors are poised to win big after Uber goes public on Friday.

On Thursday, the company priced its IPO at $45 per share. At that price, the company raised $8.1 billion at a valuation of $82.4 billion. Uber got off to a bad start on Friday when it traded below its $45 IPO price.

“Uber has been one of the biggest mega-rocket ships of all time,” says Kevin Laws, CEO of AngelList, an online startup investing and jobs platform that Uber used to raise a significant amount of its $1.5 million seed round in 2010. “It was a good company that serves a need, and there are lots of those out there. But a lot of the elements were there: they had a good founding team and a good set of advisers surrounding them, and so it had a lot of the elements that good startup has.”

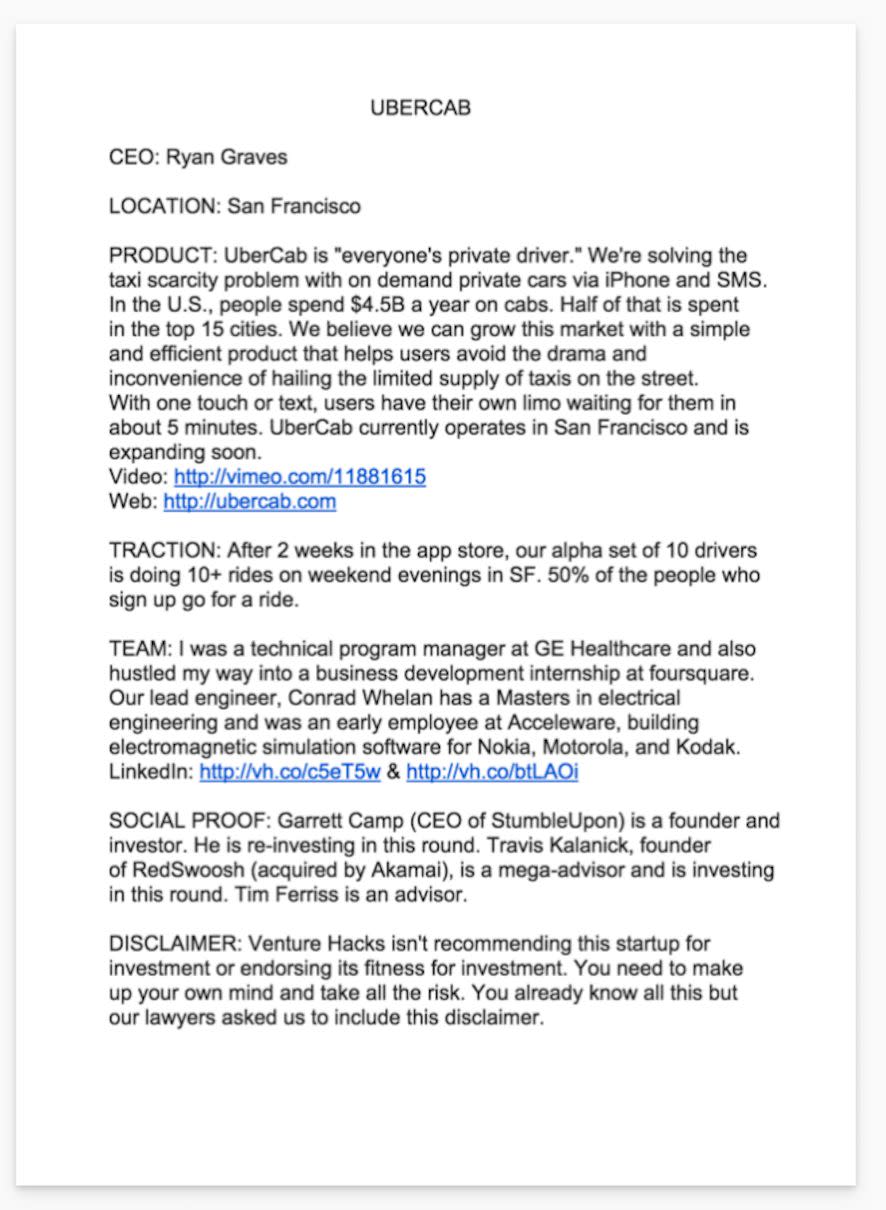

Uber’s early investor pitch

In Uber’s AngelList pitch to potential early investors, obtained by Yahoo Finance, then-UberCab described its initial pilot phase including 10 drivers in San Francisco managing more than 10 rides on “weekend evenings.” (Uber now deploys 3.9 million drivers across more than 700 cities, according to its S-1 filing, stating that “only 2% of the population in the 63 countries where we operate used our offerings” in fourth-quarter 2018.)

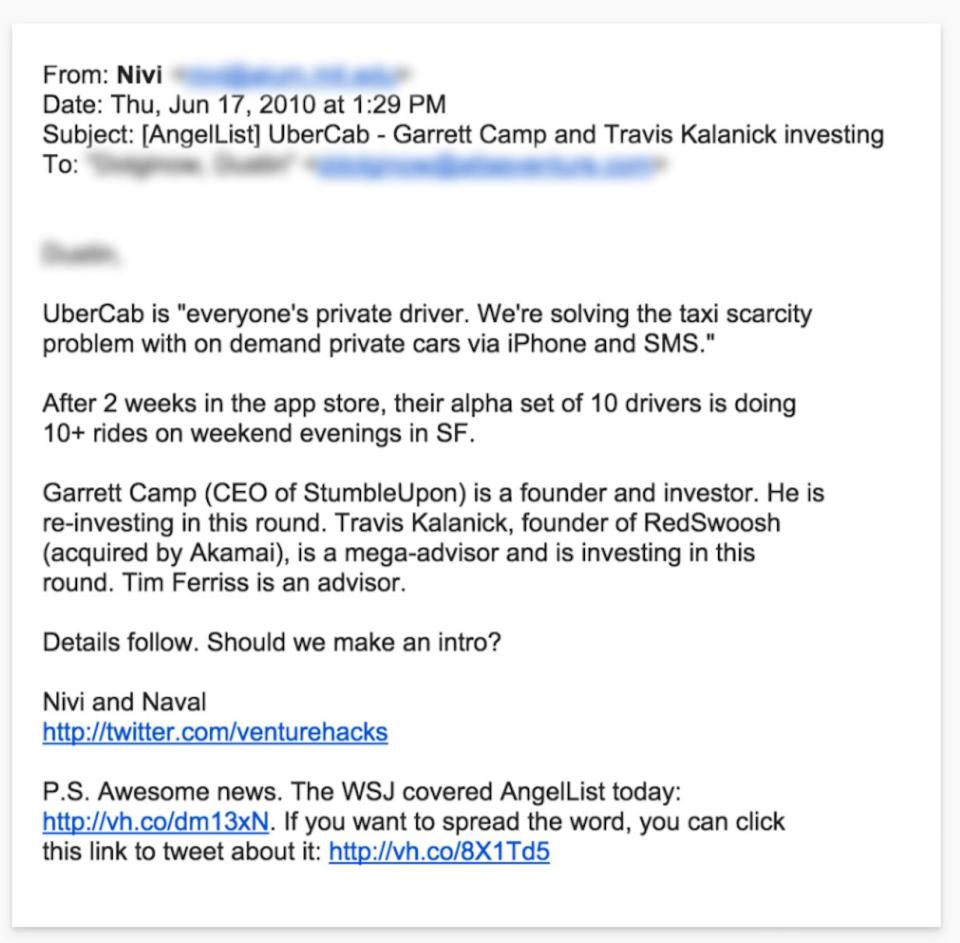

Meanwhile, here is AngelList’s email to investors from 2010, which also helped recruit Uber investors like Shervin Pishevar, then-managing director at Menlo Ventures, which participated in Uber’s Series B.

Once Kalanick became CEO in June 2009, Uber became extremely aggressive in its fundraising, which fueled the company’s rapid global expansion over the next decade across ride-hailing, as well as areas like food delivery with Uber Eats and Uber Freight, an app that matches carriers with shippers. (Uber Eats could reportedly generate at least $1 billion in revenues in 2019, according to Forbes, which performed back-of-the-envelope math based upon Uber’s internal projections.)

“Uber has approached fundraising like it’s approached everything else: an intense desire to do better at everything in order to win,” adds Laws. “Raising more money and doing it so aggressively fits right into Uber's pattern.”

Raising and losing

In more recent years, Uber has gone to great lengths to raise funds even as it incurred big losses: a $3.5 billion Series G closed in June 2016 led by Saudi Arabia’s Public Investment Fund, valuing the company at $59 billion, as well as selling $2 billion of bonds in October 2018 to an undisclosed group of buyers. In comparison, Uber reportedly lost $4.5 billion in 2017, according to data Uber provided to The Information, as well as $1.8 billion in 2018, according to the company’s financial results for the period. Meanwhile, Uber in its updated S-1 filing expected to lose as much as $1.11 billion during first-quarter 2019 ahead of its IPO.

“Uber has gone through more financing rounds than Ali and Frazier in the ‘Thrilla in Manila,’” quips Marty Wolf, president of the Scottsdale, Arizona-based investment bank Martin Wolf, referring to the 14-round third and final boxing match in 1975 between Muhammad Ali and Joe Frazier.

Wolf, who follows the technology sector closely and focuses exclusively on M&A advisory in the IT space, pointed to PayPal’s $500 million investment just this April as clever and strategic.

“They’ve raised more and lost more money than any other IPO company,” he contends, adding that Uber’s pricing at the midpoint of its IPO range is an indication the company is trying to steer clear of Lyft’s (LYFT) recent IPO challenges. (Lyft shares on Thursday afternoon were trading down 28% lower than the stock’s all-time high in late March.)

Given Uber’s more recent moves, Ali Mogharabi, a senior equity analyst with Morningstar, has said Uber still has some financial runway as continues to grow and diversify its business beyond ride-hailing. As such, Mogharabi doesn’t expect Uber to become profitable until 2022 at the earliest.

A version of this story was originally published on May 9, 2019.

More from JP: