The biggest risks to Uber's business as it prepares for its IPO

The ride-hailing giant Uber (UBER) made its stock market debut under the ticker UBER on Friday, with its stock dropping below its $45 initial public offering price.

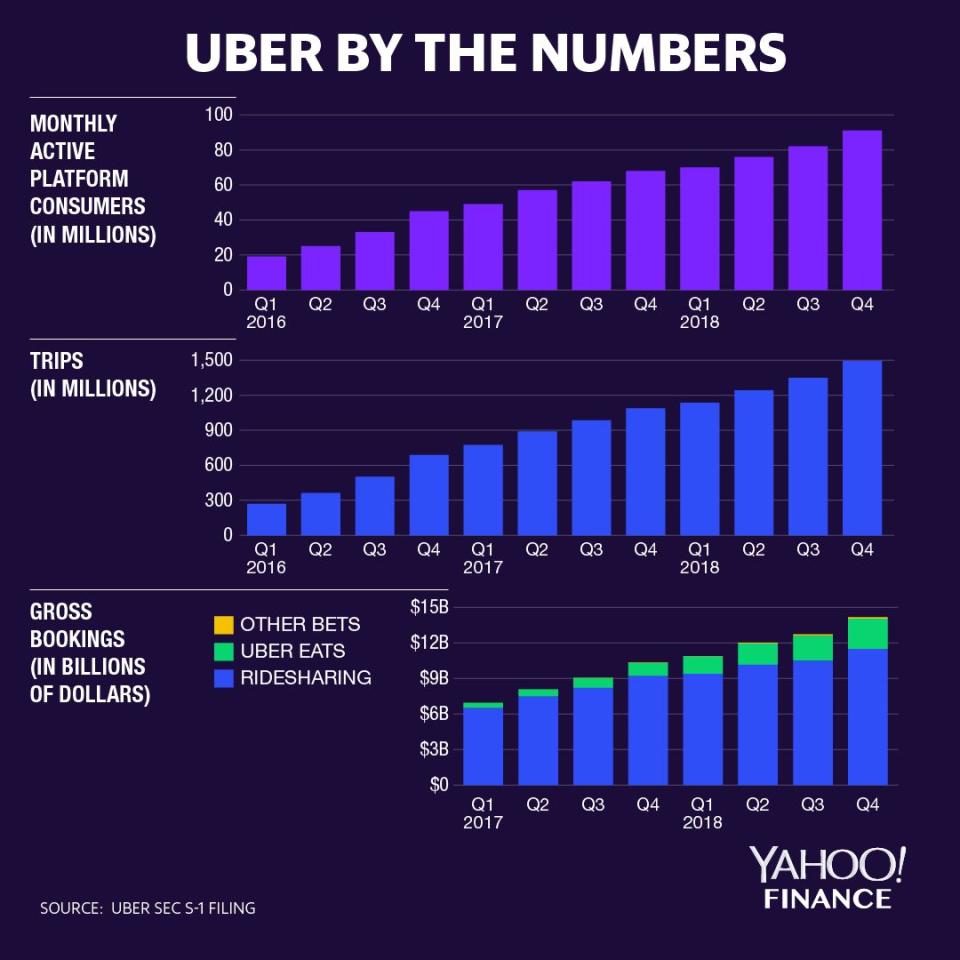

Last month iUber’s S-1 filing gave the curious public a look into its books. Uber took in $11 billion in revenue in 2018, netting a profit of $1 billion, up from a loss of $4 billion in 2017. However, Uber is still operationally unprofitable, with this year’s gains coming from the company selling its businesses in southeast Asia and Russia.

The filing also gave investors a look into Uber’s risk factors, the stuff the company views as the biggest threats to its business.

Competition

On Tuesday, May 7, Uber’s major competitor, Lyft, reported earnings for the first time and exceeded expectations for top-line growth.

Uber recognizes that the competition is fierce, with different competitors in various markets around the world, and while it matters who’s first, price is paramount.

“The cost to switch between products is low,” the filing says. “Consumers have a propensity to shift to the lowest-cost or highest-quality provider; Drivers have a propensity to shift to the platform with the highest earnings potential; restaurants have a propensity to shift to the delivery platform that offers the lowest service fee for their meals and provides the highest volume of orders; and shippers and carriers have a propensity to shift to the platform with the best price and most convenient service for hauling shipments.”

Prices may fall — especially when the company needs to hit the gas

To compete, Uber says that it expects to have to lower prices in the future and offer incentives to drivers.

In this section, the company talked about its very bad 2017 year.

“In 2017, our ridesharing category position in the United States and Canada was significantly impacted by adverse publicity events,” the filing says.

According to the filing, 2018 was also troubling, as Uber’s “ridesharing category position generally declined in 2018,” and the company had to match or exceed the “heavy subsidies and discounts by [its] competitors.”

Big losses

Operationally, Uber lost $4 billion in 2017 and $3 billion in 2018. This may continue to get worse.

“We expect our operating expenses to increase significantly in the foreseeable future, and we may not achieve profitability,” the company wrote. While this is not an uncommon thing for a young company, Uber adds that “many of our efforts to generate revenue are new and unproven, and any failure to adequately increase revenue or contain the related costs could prevent us from attaining or increasing profitability.”

Drivers being classified as employees, not independent contractors

The “gig” or “freelance” economy is why Uber works, and if that changes it would be extremely costly for Uber, which classifies its drivers as independent contractors, meaning the drivers do not receive typical employee benefits like health insurance. The company says it is involved in “numerous” legal proceedings globally about this matter, and more than 60,000 drivers have made arbitration demands against the company about this.

“Any such reclassification would require us to fundamentally change our business model, and consequently have an adverse effect on our business and financial condition,” the company wrote.

Similarly, Uber could lose an entire side of its supply dynamic if drivers are required to get special licenses or be subject to other limitations, like a cap or difficulties insuring cars.

Losing a “critical mass” of drivers, consumers, restaurants, and more

Another potential downside Uber sees is if it loses the supply of drivers it needs — or consumers — to maintain a balanced system of supply and demand.

“Maintaining a balance between supply and demand for rides in any given area at any given time and our ability to execute operationally may be more important to service quality than the absolute size of the network,” the company wrote. “If our service quality diminishes or our competitors’ products achieve greater market adoption, our competitors may be able to grow at a quicker rate than we do and may diminish our network effect.”

Uber acknowledged that people could leave because of the various “negative publicity related to our brand, including as a result of safety incidents and corporate reporting related to safety, perceived political or geopolitical affiliations, treatment of Drivers, perception of a toxic work culture, perception that our culture has not fundamentally changed” among other things.

“As a result of the #DeleteUber campaign, hundreds of thousands of consumers stopped using the Uber platform within days of the campaign,” the company wrote.

Uber understands that brand rehabilitation and having a good reputation are key to long-term success and talent retention.

Airports getting public transportation

Uber noted that 15% of its bookings are to and from airports. This can be a vulnerable part of the business as local laws can set prices, special driver requirements, and more. Furthermore, Uber noted, competition is a big issue, not just from Lyft, but also public transportation, “which typically provides the lowest-cost transportation option in many cities,” the company noted.

Not developing autonomous vehicles fast enough

Much of Uber’s future may rest on whether it succeeds in autonomous vehicle technologies. The company is concerned about the fierce competition from other companies like Waymo.

“Use of autonomous vehicles could substantially reduce the cost of providing ridesharing, meal delivery, or logistics services, which could allow competitors to offer such services at a substantially lower price as compared to the price available to consumers on our platform,” Uber wrote.

Cultural differences

Uber has expanded to over 63 countries, and 74% of all trips are outside the U.S. Uber notes that all of this is new ground for the company.

“We have limited experience operating in many jurisdictions outside of the United States,” the company wrote. “Particularly in countries in which we have limited experience,” the filing continued, there are risks that do not exist in the U.S., like “language and cultural differences,” translation of the app, “exposure to business cultures in which improper business practices may be prevalent,” “societal crime conditions,” “economic instability abroad,” and “terrorist attacks and security concerns.”

Criminals using the platform

Uber has an enormous driver and rider base, and this adds serious risk to its business from a reputational standpoint. Uber says it administers “certain qualification processes for users,” but the process “may not expose all potentially relevant information” — for example, if a background check doesn’t go deep enough. Uber notes the bar for background checks is lower for Uber Eats drivers than for ridesharing. “In addition, we do not independently test Drivers’ driving skills,” Uber notes.

“We are not able to control or predict the actions of platform users and third parties,” Uber wrote. “Such actions may result in injuries, property damage, or loss of life for consumers and third parties, or business interruption, brand and reputational damage, or significant liabilities for us.”

People paying in cash

Though Uber’s whole original idea was to simplify purchase of rides through apps on their phones, Uber actually does a significant amount of business in cash. In 2018, that number was almost 13%.

For the countries in which Uber allows this — India, Brazil, Mexico, and more — this adds many risks. Those include regulatory risk for the company, getting the proper service fee in a paper-trail free environment, and operational concerns like violence and theft.

In Brazil, Uber noted, robberies and “violent, fatal attacks” on drivers have been reported, and Uber’s ability to deal with these risks is important, especially as the amount of cash transactions is likely to increase with Uber’s purchase of Careem, a Middle Eastern ridesharing company Uber acquired for $3.1 billion in March.

Department of Justice investigations

“We are the subject of DOJ criminal inquiries and investigations, as well as related civil enforcement inquiries and investigations by other government agencies in the United States and abroad,” the filing reads. Uber noted that it’s had to deal with lawsuits and issues stemming from its 2015 data breach, and various other investigations by regulators around the world, including the “Greyball” tool Uber used to limit vehicles’ visibility on the platform to government authorities.

Many more

Of course, the risk factors are essentially endless, and Uber identifies many more, from not having good internet, being kicked out of countries, and more. Read the whole thing in the S-1 filing.

This article was originally published on April 12, 2019.

Read more:

How Uber’s largest shareholder is shaping the global ride-sharing market

Early Uber investor sees ‘the same kind of situation’ as Tesla

Why buying Uber or Lyft stock with your mom’s money isn’t a good idea

-

Ethan Wolff-Mann is a writer at Yahoo Finance focusing on consumer issues, personal finance, retail, airlines, and more. Follow him on Twitter @ewolffmann.

Follow Yahoo Finance on Twitter, Facebook, Instagram, Flipboard, SmartNews, LinkedIn,YouTube, and reddit.