UK Dividend Stocks To Watch In September 2024

In the last week, the United Kingdom market has stayed flat, but it is up 7.1% over the past year with earnings expected to grow by 14% per annum over the next few years. In this environment, identifying strong dividend stocks can be a prudent strategy for investors seeking both income and potential growth.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

James Latham (AIM:LTHM) | 5.75% | ★★★★★★ |

Shoe Zone (AIM:SHOE) | 9.94% | ★★★★★☆ |

OSB Group (LSE:OSB) | 8.49% | ★★★★★☆ |

4imprint Group (LSE:FOUR) | 3.09% | ★★★★★☆ |

Impax Asset Management Group (AIM:IPX) | 7.41% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 5.85% | ★★★★★☆ |

Man Group (LSE:EMG) | 5.59% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.59% | ★★★★★☆ |

Dunelm Group (LSE:DNLM) | 6.78% | ★★★★★☆ |

NWF Group (AIM:NWF) | 5.03% | ★★★★★☆ |

Click here to see the full list of 60 stocks from our Top UK Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

Anglo-Eastern Plantations

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Anglo-Eastern Plantations Plc, with a market cap of £241.67 million, owns, operates, and develops agriculture plantations in Indonesia and Malaysia.

Operations: Anglo-Eastern Plantations Plc generates $364.23 million from the cultivation of plantations in Indonesia and Malaysia.

Dividend Yield: 3.7%

Anglo-Eastern Plantations, trading at 41.5% below its estimated fair value, offers a well-covered dividend with a payout ratio of 10.7% and cash payout ratio of 24.4%. However, its dividend yield of 3.65% is lower than the top UK payers and has been volatile over the past decade despite some growth. Recent leadership changes include Marcus Chan's promotion to Executive Director (Corporate Affairs) and Kevin Wong becoming Group CEO, potentially impacting future strategic direction and governance initiatives.

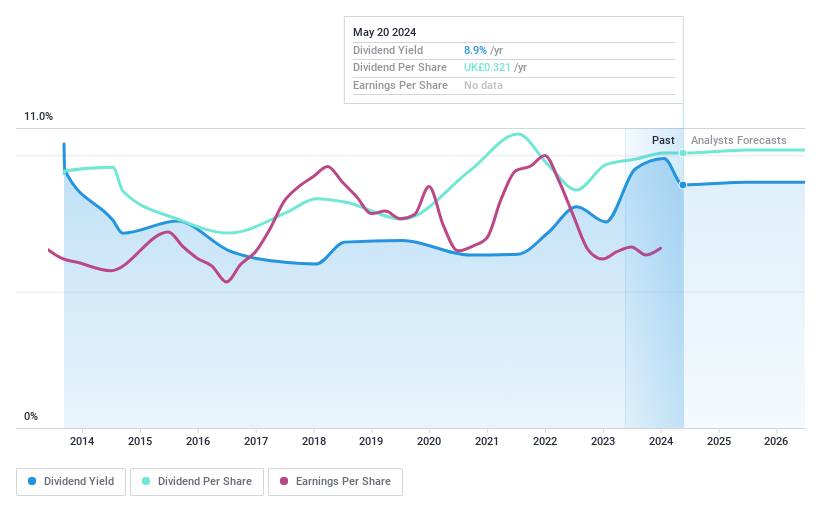

City of London Investment Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: City of London Investment Group PLC is a publicly owned investment manager with a market cap of £184.80 million.

Operations: City of London Investment Group PLC generates revenue from various investment management services, with segments detailed in millions of dollars.

Dividend Yield: 8%

City of London Investment Group reported net income of US$17.12 million for the year ending June 30, 2024, slightly down from US$17.5 million the previous year. While its dividend yield is high at 8.04%, it is not well covered by free cash flows and has been volatile over the past decade despite some growth. Trading at 24.5% below its estimated fair value, CLIG's dividends are considered unreliable due to inconsistent payments and coverage issues.

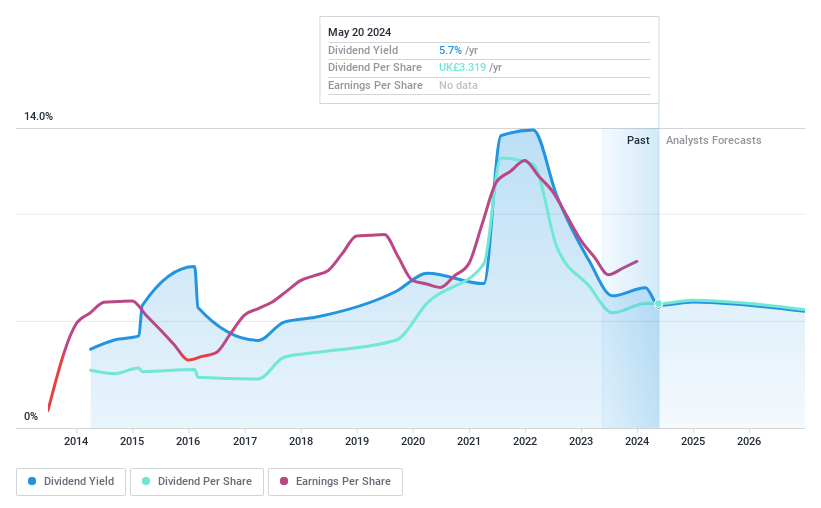

Rio Tinto Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rio Tinto Group engages in exploring, mining, and processing mineral resources worldwide and has a market cap of £85.39 billion.

Operations: Rio Tinto Group generates revenue from several key segments: Copper ($7.60 billion), Iron Ore ($31.86 billion), Minerals ($5.78 billion), and Aluminium ($12.51 billion).

Dividend Yield: 6.4%

Rio Tinto Group's dividend yield of 6.42% places it in the top 25% of UK dividend payers, but its reliability is questionable due to volatility over the past decade. Although dividends are covered by earnings with a payout ratio of 65.6%, they are not well supported by free cash flows, with a high cash payout ratio of 98.9%. Recent M&A rumors involving asset sales and strategic partnerships highlight ongoing restructuring efforts.

Next Steps

Reveal the 60 hidden gems among our Top UK Dividend Stocks screener with a single click here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include LSE:AEP LSE:CLIG and LSE:RIO.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]