Undervalued Small Caps With Insider Activity In Australia For August 2024

The Australian market has shown strong performance recently, climbing 2.1% in the last 7 days and gaining 3.9%, with an impressive 8.3% increase over the past year. In this thriving environment, identifying small-cap stocks with notable insider activity can provide valuable insights for investors seeking opportunities aligned with forecasted annual earnings growth of 13%.

Top 10 Undervalued Small Caps With Insider Buying In Australia

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

Healius | NA | 0.6x | 45.62% | ★★★★★☆ |

Elders | 22.5x | 0.5x | 49.98% | ★★★★☆☆ |

Dicker Data | 22.2x | 0.8x | 10.34% | ★★★★☆☆ |

Eagers Automotive | 9.6x | 0.3x | 41.07% | ★★★★☆☆ |

Codan | 30.6x | 4.5x | 32.08% | ★★★★☆☆ |

Neuren Pharmaceuticals | 12.7x | 8.6x | -50.66% | ★★★★☆☆ |

Coventry Group | 293.5x | 0.4x | 1.09% | ★★★★☆☆ |

RAM Essential Services Property Fund | NA | 6.1x | 43.22% | ★★★★☆☆ |

Deterra Royalties | 11.7x | 7.8x | 13.85% | ★★★☆☆☆ |

FINEOS Corporation Holdings | NA | 2.5x | -738.19% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

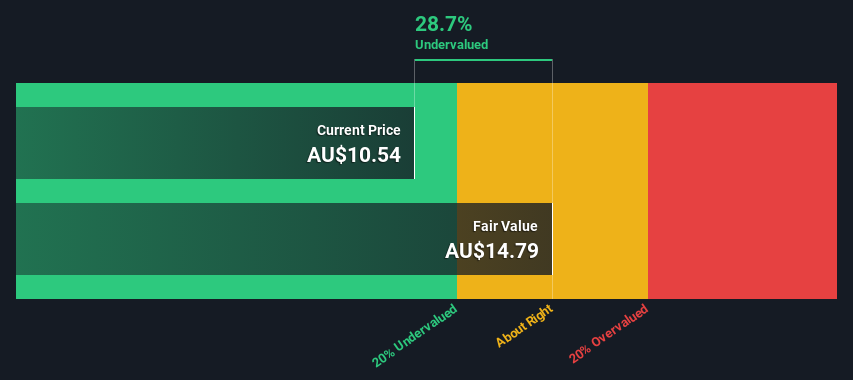

Eagers Automotive

Simply Wall St Value Rating: ★★★★☆☆

Overview: Eagers Automotive is a leading car retailing company with operations primarily in the automotive dealership sector and a market cap of A$3.21 billion.

Operations: Eagers Automotive generates its revenue primarily from car retailing, which contributed A$9.85 billion in the latest period. The company's net income margin has shown fluctuations, most recently at 2.85%, while the gross profit margin was 18.60%. Operating expenses and non-operating expenses are significant cost components, with recent figures being A$1.28 billion and A$270 million respectively.

PE: 9.6x

Eagers Automotive, a small cap in Australia, is currently executing a share repurchase program to buy back up to 25.8 million shares by June 2025, reflecting insider confidence. As of June 11, 2024, the company has issued 258 million shares. The CEO confirmed during the May AGM that they are on track to exceed revenue growth guidance for 2024 and are aggressively pursuing M&A opportunities. Despite high debt levels and reliance on external borrowing, revenue is forecasted to grow annually by 5.52%.

Take a closer look at Eagers Automotive's potential here in our valuation report.

Examine Eagers Automotive's past performance report to understand how it has performed in the past.

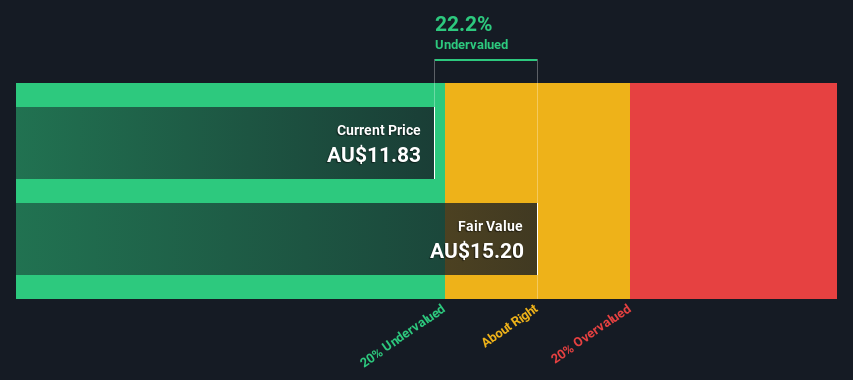

Codan

Simply Wall St Value Rating: ★★★★☆☆

Overview: Codan is a company specializing in communications and metal detection technologies, with a market cap of A$1.62 billion.

Operations: Codan generates revenue primarily from its Communications and Metal Detection segments, with the former contributing A$291.50 million and the latter A$212.20 million. The company has experienced fluctuations in its gross profit margin, which was 54.42% as of December 31, 2023. Operating expenses have been significant, reaching A$174.85 million in the same period, driven by sales & marketing and R&D expenditures totaling A$97.79 million and A$33.31 million respectively.

PE: 30.6x

Codan, a small Australian tech company, has caught attention due to its undervalued stock and insider confidence. Recent insider purchases in the past six months indicate strong belief in the company's future. Codan's earnings are forecasted to grow 16.2% annually, suggesting potential for significant upside. Despite relying solely on external borrowing for funding, the company continues to innovate in metal detection and communications technology sectors, positioning itself well for future growth amidst industry demand.

Delve into the full analysis valuation report here for a deeper understanding of Codan.

Gain insights into Codan's historical performance by reviewing our past performance report.

NRW Holdings

Simply Wall St Value Rating: ★★★★☆☆

Overview: NRW Holdings is an Australian company specializing in civil construction, mining services, and urban infrastructure with a market cap of A$1.34 billion.

Operations: NRW Holdings generates revenue primarily from its Mining, MET, and Civil segments, with the Mining segment contributing the largest share. The company's cost of goods sold (COGS) for the latest period was A$1.45 billion, resulting in a gross profit of A$1.31 billion and a gross profit margin of 47.41%. Operating expenses were A$1.18 billion, leading to a net income of A$88.62 million and a net income margin of 3.22%.

PE: 18.0x

NRW Holdings, a small cap in Australia, reported A$2.91 billion in sales for the fiscal year ending June 30, 2024, up from A$2.67 billion the previous year. Net income rose to A$105.1 million from A$85.64 million. Basic earnings per share increased to A$0.232 from A$0.19 last year, reflecting solid financial performance and potential undervaluation given its market position and growth prospects. Recent insider confidence is evident with purchases made within the past six months.

Get an in-depth perspective on NRW Holdings' performance by reading our valuation report here.

Explore historical data to track NRW Holdings' performance over time in our Past section.

Summing It All Up

Embark on your investment journey to our 14 Undervalued ASX Small Caps With Insider Buying selection here.

Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:APE ASX:CDA and ASX:NWH.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]