Undervalued Small Caps In United Kingdom With Insider Buying For September 2024

The United Kingdom market has shown positive momentum, rising 1.1% over the last week with a notable 4.6% increase in the Materials sector. Over the past year, the market has grown by 6.9%, and earnings are projected to grow by 14% annually. In this context, identifying undervalued small-cap stocks with insider buying can present attractive opportunities for investors looking to capitalize on current market conditions.

Top 10 Undervalued Small Caps With Insider Buying In The United Kingdom

Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

C&C Group | NA | 0.4x | 45.44% | ★★★★★☆ |

Genus | 158.4x | 1.9x | 3.11% | ★★★★★☆ |

GB Group | NA | 2.9x | 35.63% | ★★★★★☆ |

Bytes Technology Group | 26.3x | 6.0x | 6.59% | ★★★★☆☆ |

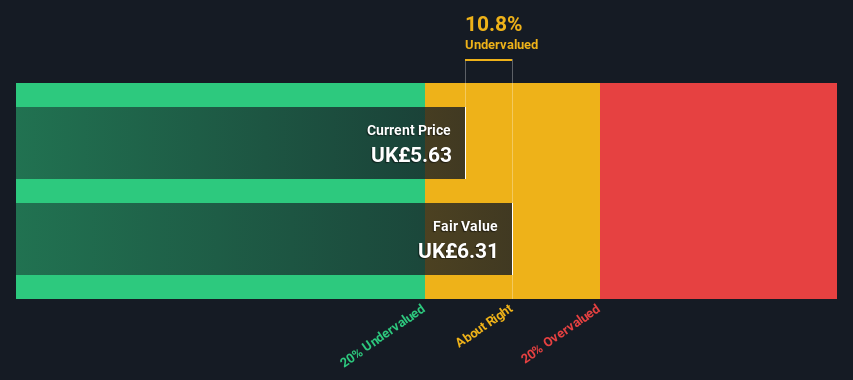

CVS Group | 24.2x | 1.3x | 36.84% | ★★★★☆☆ |

Essentra | 695.2x | 1.3x | 41.51% | ★★★★☆☆ |

NWF Group | 8.8x | 0.1x | 34.76% | ★★★☆☆☆ |

Franchise Brands | 43.0x | 2.2x | 39.02% | ★★★☆☆☆ |

Alpha Group International | 10.2x | 4.7x | -26.26% | ★★★☆☆☆ |

Watkin Jones | NA | 0.2x | -1454.83% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

CVS Group

Simply Wall St Value Rating: ★★★★☆☆

Overview: CVS Group operates veterinary practices, laboratories, a crematorium, and an online retail business with a market cap of approximately £1.32 billion.

Operations: CVS Group generates revenue primarily from Veterinary Practices (£573 million), Online Retail Business (£49.6 million), Laboratories (£31.4 million), and Crematorium services (£11.6 million). The company has seen fluctuations in its gross profit margin, with the most recent figure being 43.11%.

PE: 24.2x

CVS Group, a key player in the veterinary services sector, has shown insider confidence with David Wilton purchasing 2,500 shares worth £26,300 on 20 Sep 2024. Despite carrying high debt levels and relying solely on external borrowing for funding, the company is forecasted to grow earnings by 12.07% annually. This growth potential makes it an intriguing candidate among undervalued UK stocks.

Delve into the full analysis valuation report here for a deeper understanding of CVS Group.

Review our historical performance report to gain insights into CVS Group's's past performance.

Bytes Technology Group

Simply Wall St Value Rating: ★★★★☆☆

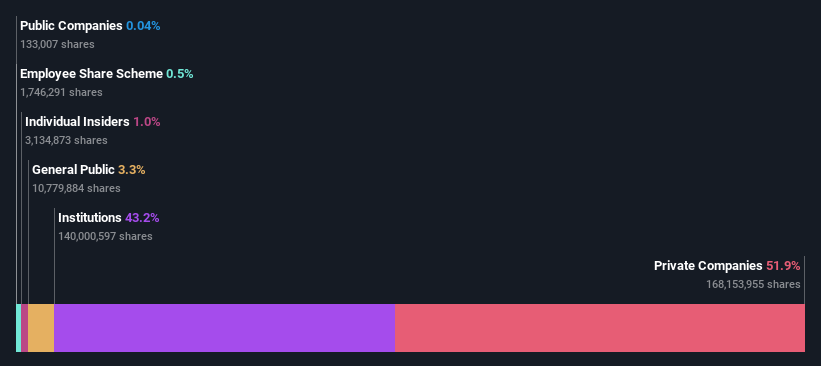

Overview: Bytes Technology Group is an IT solutions provider with a market cap of £1.20 billion.

Operations: The company generated revenue of £207.02 million, with a net income of £46.85 million and a gross profit margin of 70.42%. Operating expenses were £89.07 million, while non-operating expenses amounted to £9.86 million.

PE: 26.3x

Bytes Technology Group, a UK-based small-cap, has recently attracted attention due to insider confidence demonstrated by significant share purchases over the past six months. The company’s earnings are projected to grow at 9.25% annually, indicating strong future prospects. Additionally, Bytes declared both a final and special dividend in July 2024, totaling 14.7 pence per share payable in August. Despite relying solely on external borrowing for funding, Bytes remains focused on growth and shareholder returns through strategic dividends and participation in industry events like Smarter Working Live 2024.

Harworth Group

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Harworth Group is a UK-based land and property regeneration company with a market cap of approximately £0.51 billion, focusing on income generation, capital growth through other property activities, and the sale of development properties.

Operations: The company generates revenue primarily from Income Generation (£19.73 million), Capital Growth - Other Property Activities (£9.05 million), and Capital Growth - Sale of Development Properties (£66.71 million). The net profit margin has shown significant fluctuations, with a recent peak at 1.34% in June 2021 and a low of -0.40% in June 2023, reflecting variability in non-operating expenses and other financial factors over the periods analyzed.

PE: 12.3x

Harworth Group, recently added to multiple FTSE indices on September 17, 2024, showcases its potential as an undervalued small cap with promising growth. The company's H1 2024 earnings report highlights a significant increase in sales to £41.31 million from £18.24 million year-over-year and net income rising to £14.78 million from £2.85 million. Notably, insider confidence is evident with Independent Non-Executive Chairman Alastair Lyons purchasing 50,000 shares for approximately £80,000 in recent months, reflecting strong belief in the company's prospects.

Key Takeaways

Get an in-depth perspective on all 23 Undervalued UK Small Caps With Insider Buying by using our screener here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:CVSG LSE:BYIT and LSE:HWG.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]