Undiscovered Gems In Australia Featuring 3 Promising Small Caps

In recent weeks, the Australian market has faced downward pressure, with the ASX200 closing down 0.87% as concerns over the Chinese economy weigh on investor sentiment. Despite a challenging environment where all sectors finished in the red, small-cap stocks can offer unique opportunities for growth due to their potential for innovation and agility in adapting to market changes. In this context, discovering promising small caps becomes crucial as they often possess untapped potential that can thrive even amidst broader economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Australia

Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

Fiducian Group | NA | 9.94% | 6.48% | ★★★★★★ |

Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

Lycopodium | NA | 17.22% | 33.85% | ★★★★★★ |

Hancock & Gore | NA | -70.20% | 38.14% | ★★★★★★ |

Red Hill Minerals | NA | 75.05% | 36.74% | ★★★★★★ |

Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

AMCIL | NA | 5.16% | 5.31% | ★★★★★☆ |

Hearts and Minds Investments | 1.00% | 18.81% | 20.95% | ★★★★☆☆ |

A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Boart Longyear Group | 71.20% | 9.71% | 39.19% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Catalyst Metals

Simply Wall St Value Rating: ★★★★☆☆

Overview: Catalyst Metals Limited is engaged in the exploration and evaluation of mineral properties in Australia, with a market cap of A$759.30 million.

Operations: Catalyst Metals Limited generates revenue primarily from its operations in Western Australia (A$243.77 million) and Tasmania (A$75.08 million).

Catalyst Metals, a burgeoning player in Australia's mining sector, has recently turned profitable, reporting a net income of A$23.56 million for the fiscal year ending June 2024 compared to a previous loss of A$15.63 million. Their sales skyrocketed to A$317.01 million from A$63.94 million last year, showcasing significant growth potential. The company has been added to the S&P/ASX Emerging Companies Index and forecasts gold production between 105koz and 120koz for FY2025. With high-quality earnings and trading at 87% below its estimated fair value, Catalyst seems poised for further development in its mining ventures like Plutonic East and Trident projects.

Get an in-depth perspective on Catalyst Metals' performance by reading our health report here.

Evaluate Catalyst Metals' historical performance by accessing our past performance report.

Emerald Resources

Simply Wall St Value Rating: ★★★★★☆

Overview: Emerald Resources NL is involved in the exploration and development of mineral reserves in Cambodia and Australia, with a market cap of A$2.76 billion.

Operations: Emerald Resources generates revenue primarily from mine operations, totaling A$366.04 million. The company's market cap is approximately A$2.76 billion.

Emerald Resources, a notable player in the mining sector, has shown impressive financial performance with earnings jumping 41.9% over the past year, outpacing the industry's 1.6% growth. The company reported A$371 million in sales and A$84 million in net income for the year ending June 2024. Despite a debt-to-equity ratio increase to 8.5%, Emerald holds more cash than total debt, ensuring strong financial health. Trading at a significant discount of 69% below its estimated fair value suggests potential upside for investors seeking undervalued opportunities in this space. Notably, high-quality earnings and robust interest coverage (18.6x EBIT) further enhance its appeal as an investment prospect within Australia's mining landscape.

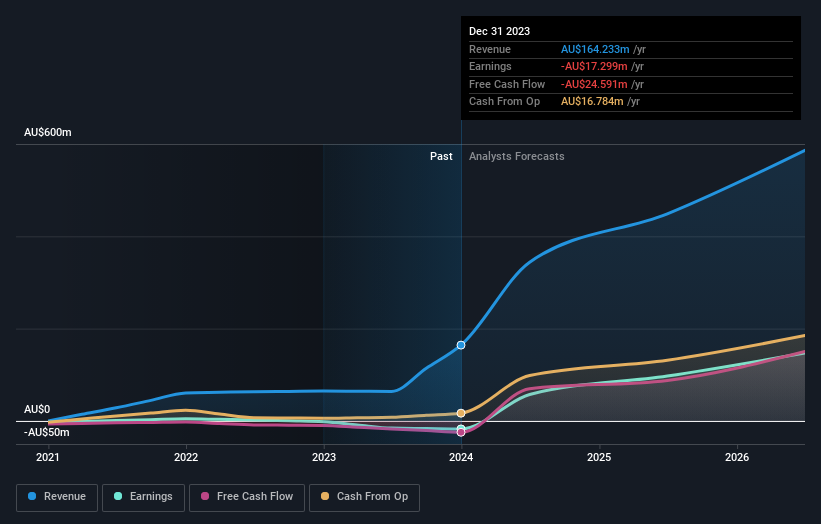

Ora Banda Mining

Simply Wall St Value Rating: ★★★★☆☆

Overview: Ora Banda Mining Limited focuses on the exploration, operation, and development of mineral properties in Australia with a market capitalization of A$1.50 billion.

Operations: Ora Banda Mining generates revenue primarily from gold mining, totaling A$214.24 million. The company's financial performance can be evaluated by examining its net profit margin, which provides insight into profitability after accounting for all expenses.

Ora Banda Mining is making waves with its recent profitability, boasting a net income of A$27.57 million this year compared to a loss of A$44.13 million last year. The company has been added to the S&P Global BMI Index, highlighting its growing market presence despite being dropped from the S&P/ASX Emerging Companies Index. With earnings forecasted to grow 47% annually and trading at 68% below estimated fair value, Ora Banda presents an intriguing opportunity in the mining sector. However, shareholder dilution over the past year and negative free cash flow are areas that require attention moving forward.

Taking Advantage

Investigate our full lineup of 54 ASX Undiscovered Gems With Strong Fundamentals right here.

Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include ASX:CYL ASX:EMR and ASX:OBM.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]