Undiscovered Gems In Germany To Watch August 2024

In recent weeks, the German DAX index has shown resilience, gaining 0.35% despite broader market volatility and mixed economic signals across Europe. As industrial output and orders in Germany have exceeded expectations, it presents an opportune moment to explore some lesser-known stocks that could benefit from this positive momentum. A good stock in these conditions often demonstrates strong fundamentals such as robust revenue growth, a solid balance sheet, and the ability to navigate economic fluctuations effectively. With this backdrop in mind, let's take a closer look at three undiscovered gems in Germany that warrant attention this August 2024.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

Mineralbrunnen überkingen-Teinach GmbH KGaA | 19.44% | -1.40% | -8.94% | ★★★★★★ |

EnviTec Biogas | 37.96% | 19.34% | 51.22% | ★★★★★★ |

FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

Mühlbauer Holding | NA | 10.49% | -12.73% | ★★★★★★ |

Südwestdeutsche Salzwerke | 0.66% | 4.03% | 11.36% | ★★★★★☆ |

HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

Baader Bank | 91.28% | 12.42% | -8.00% | ★★★★★☆ |

BAVARIA Industries Group | 3.19% | 0.18% | 28.18% | ★★★★★☆ |

Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

BAUER | 78.29% | 2.30% | -38.28% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Eckert & Ziegler

Simply Wall St Value Rating: ★★★★★★

Overview: Eckert & Ziegler SE manufactures and sells isotope technology components worldwide and has a market cap of €884.27 million.

Operations: Eckert & Ziegler SE generates revenue primarily from the sale of isotope technology components. The company incurs various costs associated with production, distribution, and administrative expenses. Net profit margin trends can be observed to gauge profitability over time.

Eckert & Ziegler, a small cap in the medical equipment sector, has shown impressive financial health and growth. Over the past five years, its debt to equity ratio decreased from 14.7% to 9.5%. Recent earnings reports highlight a net income of €9.54 million for Q2 2024 compared to €6.17 million last year, with sales jumping from €60.03 million to €77.76 million in the same period. Its price-to-earnings ratio stands at 22.9x, below the industry average of 25.6x, indicating good value for investors.

MBB

Simply Wall St Value Rating: ★★★★★★

Overview: MBB SE, with a market cap of €567.64 million, focuses on acquiring and managing medium-sized companies in the technology and engineering sectors both in Germany and internationally.

Operations: MBB SE generates revenue primarily from its Technical Applications (€378.50 million), Service & Infrastructure (€487.10 million), and Consumer Goods (€94.23 million) segments.

MBB SE, a small cap company, shows robust financial health with earnings growing by 63.9% over the past year and forecasted to grow 33.57% annually. The debt to equity ratio improved from 12.6% to 6.9% in five years, indicating strong fiscal management. Recent earnings for Q1 2024 reported sales of €205.47M and net income of €5.77M compared to a net loss last year, highlighting its turnaround performance in the Industrials sector.

Click here and access our complete health analysis report to understand the dynamics of MBB.

Gain insights into MBB's past trends and performance with our Past report.

Mensch und Maschine Software

Simply Wall St Value Rating: ★★★★★★

Overview: Mensch und Maschine Software SE offers CAD/CAM/CAE, product data management, and building information modeling/management solutions in Germany and internationally, with a market cap of €987.29 million.

Operations: Mensch und Maschine Software SE generates revenue primarily from its M+M Software segment (€107.71 million) and M+M Digitization segment (€216.19 million). The company focuses on providing specialized software solutions, contributing to its overall financial performance.

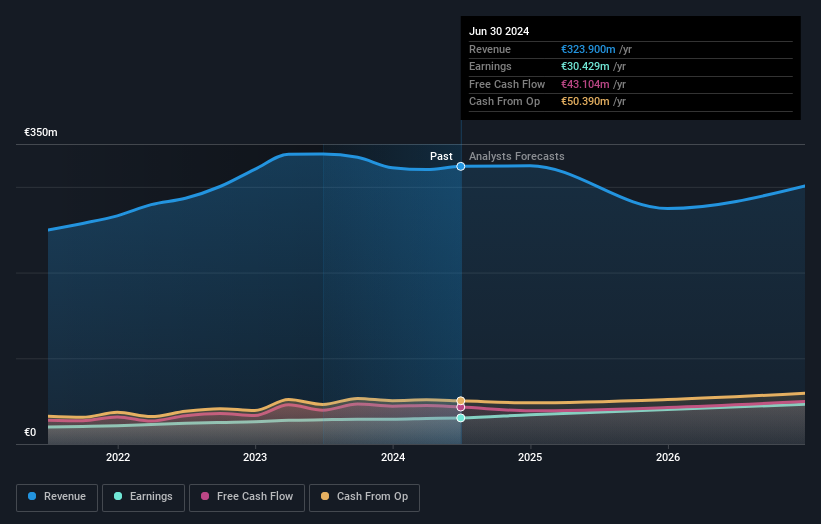

Mensch und Maschine Software (MuM) has shown solid performance, with earnings growing 7.6% last year, outpacing the software industry’s -4.4%. The company’s debt to equity ratio improved significantly from 42.8% to 15.5% over five years, and it trades at 38% below estimated fair value. Recent earnings for Q2 saw sales rise to €75.1 million from €71.32 million, while net income increased to €7.34 million from €6.58 million a year ago.

Next Steps

Gain an insight into the universe of 44 German Undiscovered Gems With Strong Fundamentals by clicking here.

Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include XTRA:EUZ XTRA:MBB and XTRA:MUM.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email [email protected]